- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy Company (NYSE:CRGY) Surges 27% Yet Its Low P/S Is No Reason For Excitement

Crescent Energy Company (NYSE:CRGY) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

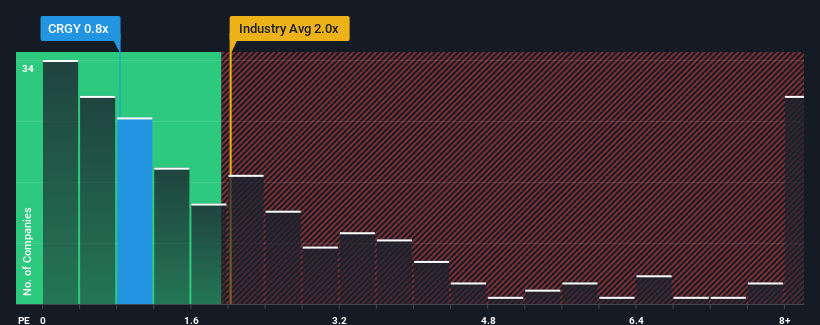

Even after such a large jump in price, when close to half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") above 2x, you may still consider Crescent Energy as an enticing stock to check out with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Crescent Energy

What Does Crescent Energy's Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, Crescent Energy has been doing relatively well. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on Crescent Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crescent Energy's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 139% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 38% per year, which is noticeably more attractive.

In light of this, it's understandable that Crescent Energy's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Crescent Energy's P/S Mean For Investors?

Despite Crescent Energy's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Crescent Energy's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 5 warning signs for Crescent Energy (2 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Crescent Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Crescent Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives