- United States

- /

- Oil and Gas

- /

- NYSE:CQP

Will Weak US Gas Storage and Resilient LNG Demand Shift Cheniere Energy Partners' (CQP) Narrative?

Reviewed by Sasha Jovanovic

- The U.S. Energy Department recently reported that natural gas storage injections came in well below both analyst expectations and the five-year average, which supported natural gas prices even as temperatures remained mild.

- This development, combined with firm global LNG demand and tightening supply balances, has drawn analyst attention to Cheniere Energy Partners for its strong fundamentals and potential within the natural gas market.

- We'll explore how resilient LNG demand and lower-than-expected gas storage levels shape the current investment narrative for Cheniere Energy Partners.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Cheniere Energy Partners' Investment Narrative?

To be an investor in Cheniere Energy Partners right now, you’re essentially buying into the view that robust global demand for LNG and the resilience of US gas exports will continue to underpin the company’s fundamentals despite some softness in recent net income. The unexpected shortfall in US gas storage injections, highlighted by the recent Energy Department report, has given a lift to natural gas prices and may add extra momentum to LNG exporters in the short term. For Cheniere Energy Partners, this could provide a positive tailwind ahead of its Q3 earnings release, potentially offsetting margin pressure and challenges such as slowing profit growth, a volatile dividend track record, and a less-than-ideal debt-to-cash flow position. While the stock looks reasonably valued relative to both peers and earnings projections, the core risks around dividend sustainability and high leverage remain top of mind, especially as interest rates and global competition evolve.

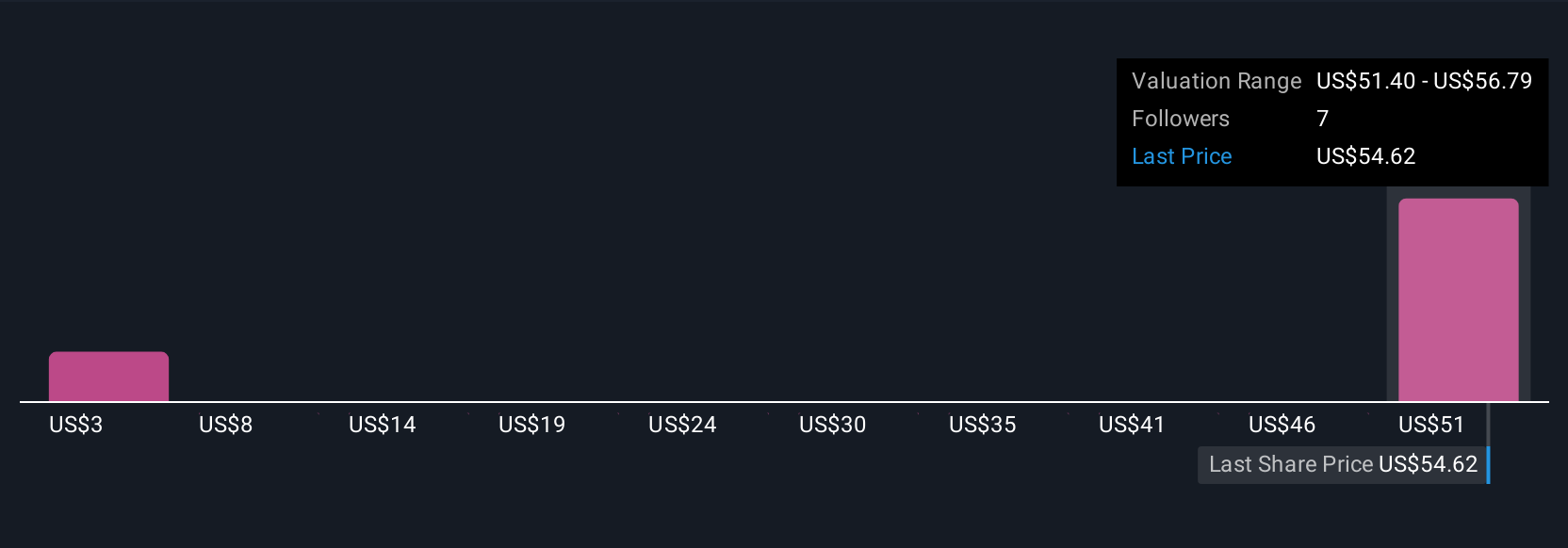

Yet not all LNG players face the same challenges around dividend reliability, here’s what investors need to know. Cheniere Energy Partners' shares are on the way up, but they could be overextended by 17%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth as much as $55.93!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CQP

Cheniere Energy Partners

Through its subsidiaries, provides liquefied natural gas (LNG) to integrated energy companies, utilities, and energy trading companies in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives