- United States

- /

- Oil and Gas

- /

- NYSE:CQP

Did Rising Gas Costs And LNG Competition Just Shift Cheniere Energy Partners' (CQP) Margin Story?

Reviewed by Sasha Jovanovic

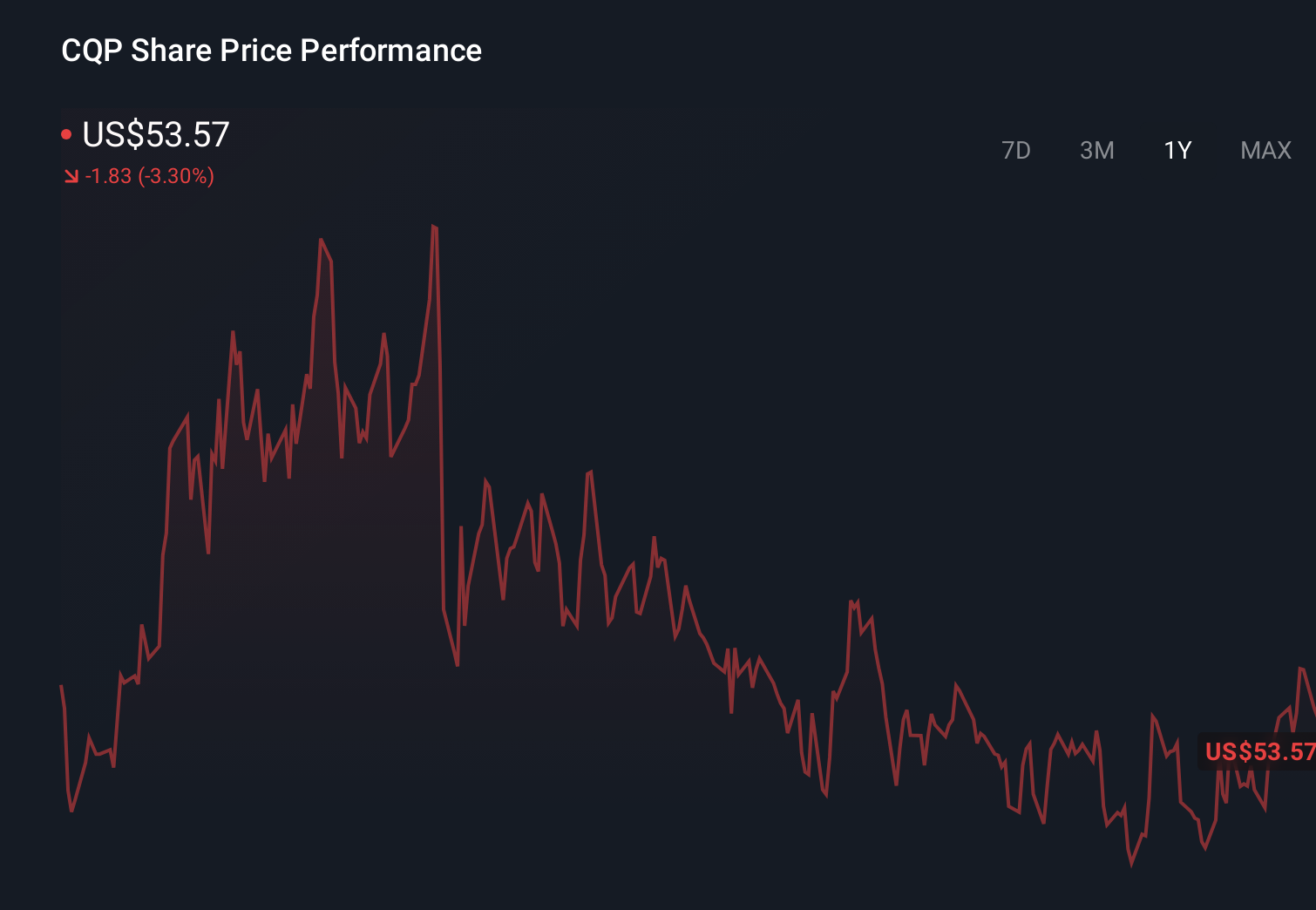

- In the past week, Cheniere Energy Partners faced renewed scrutiny as rising natural gas prices raised concerns about profit margins across the US liquefied natural gas sector.

- Investors are increasingly focused on how the company’s existing and future LNG infrastructure will cope with higher feedstock costs and intensifying industry competition.

- We’ll now examine how these margin pressures from climbing natural gas prices shape Cheniere Energy Partners’ broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cheniere Energy Partners' Investment Narrative?

To own Cheniere Energy Partners, you really have to believe in the long-term role of US LNG exports and the resilience of its contracted, infrastructure-heavy model, even when margins wobble. Recent pressure on LNG stocks from higher natural gas prices directly touches one of CQP’s key short term catalysts: how much cash is left after feedstock costs to fund distributions and manage its sizeable debt stack. With revenue up but net income and margins down over the last year, the latest gas price spike and resulting share price pullback make margin pressure a more immediate risk than earlier analysis suggested. That said, reaffirmed 2025 distribution guidance and long-term contracts may blunt some of the impact, unless elevated gas prices persist and new US capacity intensifies competition faster than expected.

However, CQP’s high leverage and negative equity position are critical details investors should not overlook. Cheniere Energy Partners' share price has been on the slide but might be up to 7% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth as much as $55.33!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

No Opportunity In Cheniere Energy Partners?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CQP

Cheniere Energy Partners

Through its subsidiaries, provides liquefied natural gas (LNG) to integrated energy companies, utilities, and energy trading companies in the United States and internationally.

Established dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion