- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (COP): Valuation Check After Q3 2025 Beat and Upgraded Full-Year Guidance

Reviewed by Simply Wall St

ConocoPhillips (COP) just delivered a Q3 2025 beat, lifting full year production guidance while trimming operating cost expectations, even as Wall Street stays cautious about oversupply risks and choppy geopolitics in the oil market.

See our latest analysis for ConocoPhillips.

Despite the Q3 beat and the Marathon Oil integration story, ConocoPhillips’ 1 month share price return of 7.26% sits against a weaker year to date share price return of minus 4.54%, while its 5 year total shareholder return of 179.13% still highlights a strong long term compounding story.

If this kind of cyclical energy setup has you thinking about other opportunities, it could be worth scanning aerospace and defense stocks for differentiated growth and resilience dynamics beyond oil.

With the stock trading below consensus targets despite upgraded guidance and long dated LNG and shale catalysts, is ConocoPhillips quietly undervalued here, or are markets already pricing in every ounce of its future growth?

Most Popular Narrative Narrative: 15% Undervalued

With ConocoPhillips last closing at $95.54 against a narrative fair value of about $112.39, the valuation case leans heavily on future cash flow strength.

The company's expanding LNG portfolio and progress on large scale liquefaction projects (notably in Qatar, Port Arthur, and Willow) are set to capture significant market share from robust global gas demand, especially as natural gas solidifies its role as a transition fuel. These projects are expected to drive a substantial free cash flow inflection and topline revenue expansion through 2029.

Curious how modest top line assumptions still justify a richer earnings multiple? The narrative leans on rising margins and a powerful free cash flow reset. Want to see the exact roadmap behind that jump in valuation?

Result: Fair Value of $112.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk on capital intensive LNG and Willow projects, alongside weaker-for-longer commodity prices, could easily derail that optimistic free cash flow reset.

Find out about the key risks to this ConocoPhillips narrative.

Another Angle on Valuation

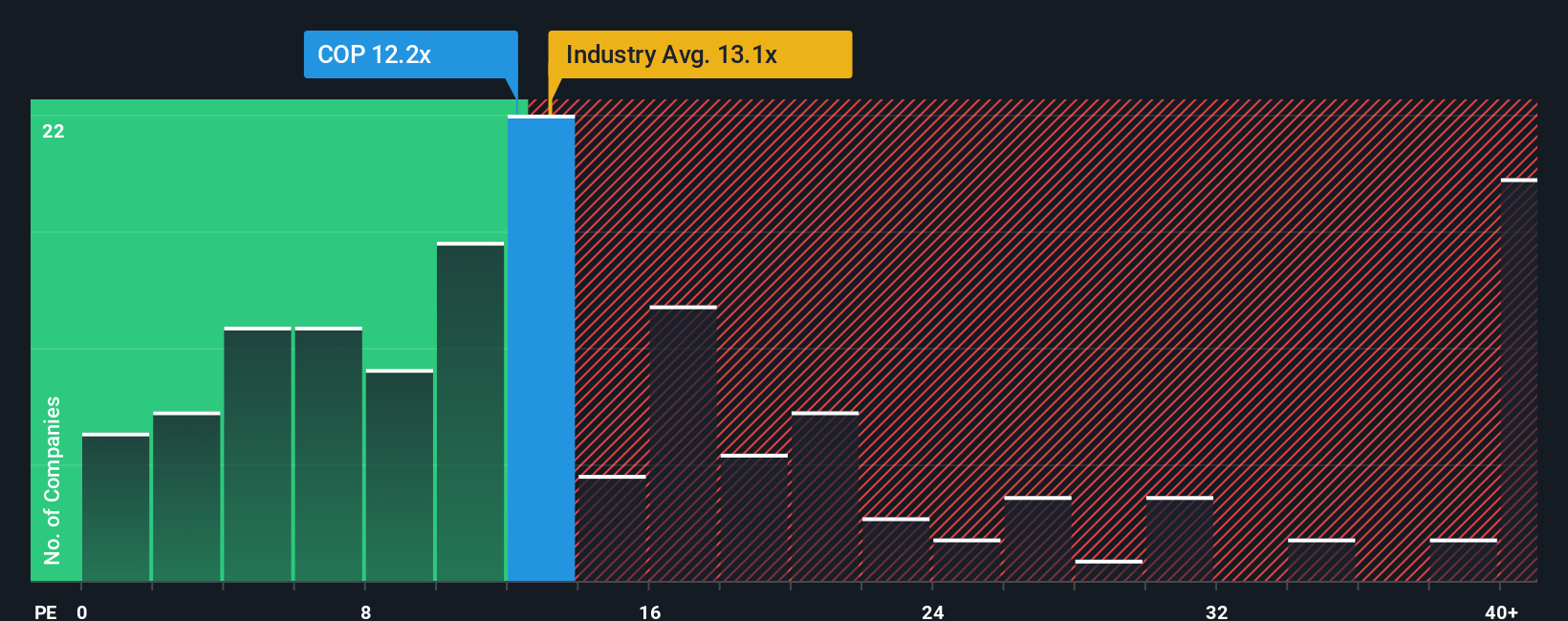

On earnings, ConocoPhillips looks less of a bargain. It trades on about 13.4 times earnings, slightly richer than both the US Oil and Gas industry at 13.3 times and its peer group at 12.4 times. This suggests less potential for multiple expansion if sentiment or growth expectations soften.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ConocoPhillips Narrative

If you see the setup differently or simply prefer digging into the numbers yourself, you can spin up a custom view in under three minutes: Do it your way.

A great starting point for your ConocoPhillips research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to scan fresh opportunities on Simply Wall Street that match your style, goals, and risk appetite.

- Explore companies trading below estimated intrinsic value through these 907 undervalued stocks based on cash flows tailored to forward cash flows.

- Focus on early stage disruptors using these 26 AI penny stocks with growth stories in artificial intelligence.

- Look for companies that pay dividends via these 13 dividend stocks with yields > 3% that meet specific yield and sustainability checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)