- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (COP): Exploring Current Valuation After Recent Period of Share Price Stability

Reviewed by Simply Wall St

If you’re tracking ConocoPhillips (COP), its latest price movements might have caught your eye and left you wondering what comes next. With no dramatic event altering the story this week, the relative stability draws attention to the fundamental drivers behind COP stock. For investors weighing a new position or looking to fine-tune their exposure, it is a natural moment to pause and consider whether recent shifts signal opportunity or caution.

This quiet period follows a year where momentum has gradually faded. Over the past twelve months, ConocoPhillips’ shares have declined by 9%, despite some modest gains in the past three months. These moves come against a backdrop of slow annual revenue growth and more meaningful net income improvement, as the company navigates a constantly changing energy sector landscape. Long-term returns remain positive, while short-term pressures persist for oil and gas stocks broadly.

With ConocoPhillips trading below levels seen in recent years, some may ask whether the market is overlooking its value or if this steady performance simply reflects realistic expectations for future growth.

Most Popular Narrative: 20.3% Undervalued

According to the most widely referenced narrative, ConocoPhillips shares appear notably undervalued compared to analyst projections, with a consensus view that the stock price is lagging fair value by a healthy margin.

The company's expanding LNG portfolio and progress on large-scale liquefaction projects (notably in Qatar, Port Arthur, and Willow) are set to capture significant market share from robust global gas demand, especially as natural gas solidifies its role as a "transition fuel." These projects are expected to drive a substantial free cash flow inflection and topline revenue expansion through 2029.

Curious how analysts arrive at such a bullish fair value? There's a hidden formula at play here: think ambitious financial forecasts, higher projected profit margins, and a price multiple that might surprise you. Want the details on just how aggressive these assumptions are and what’s driving the future growth story? The numbers behind the narrative are not what you’d expect for an energy giant. Ready to unravel the math powering this undervalued call?

Result: Fair Value of $116.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sharp swings in energy prices or delays in major projects could quickly challenge the optimistic outlook and shift expectations in a new direction.

Find out about the key risks to this ConocoPhillips narrative.Another View: Industry Comparison Tells a Different Story

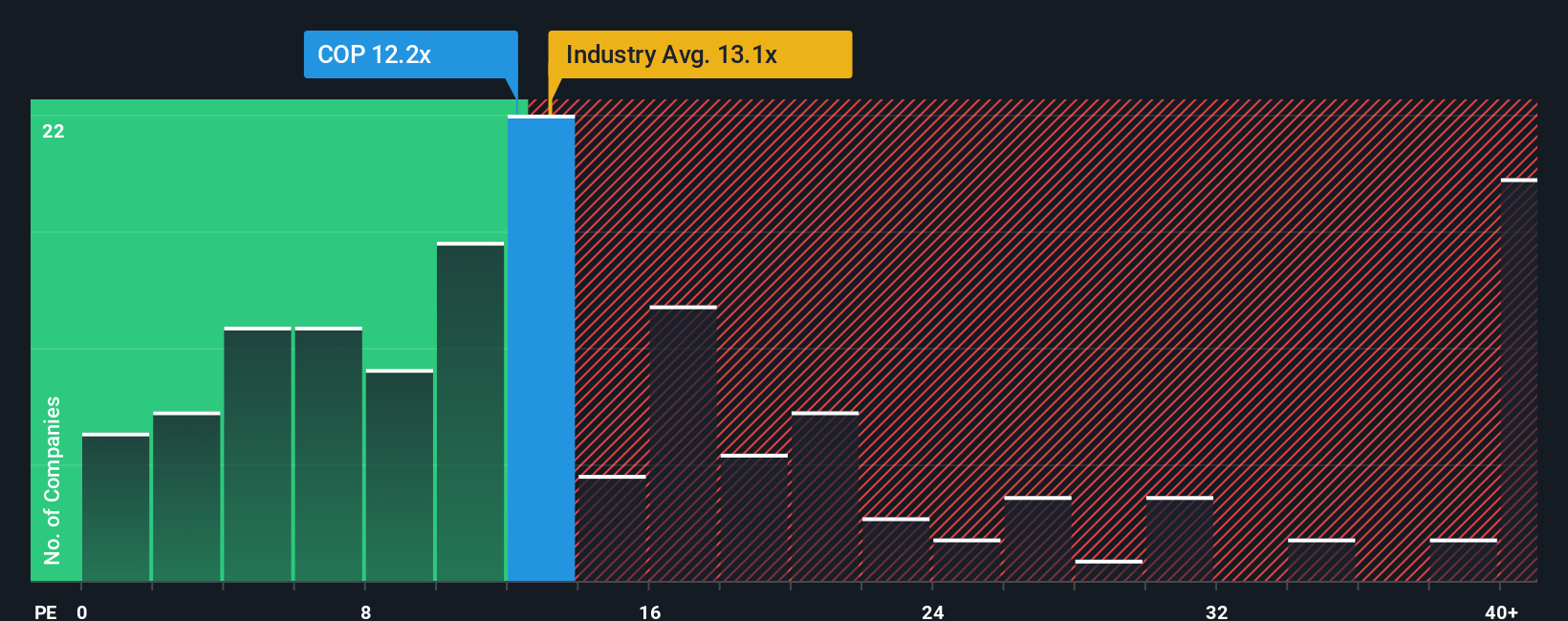

While the analyst-based valuation sees ConocoPhillips as undervalued, looking at the company’s current market pricing against the broader US industry average presents a more muted picture. This suggests shares may not be as cheap as they seem. Could the market be pricing in realities that analysts miss, or is there hidden value being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding ConocoPhillips to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own ConocoPhillips Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can shape your own take in just a few minutes. Do it your way.

A great starting point for your ConocoPhillips research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for one opportunity when the market is packed with inventive ways to grow your portfolio? Let Simply Wall Street’s powerful Screener uncover hidden gems and help you seize your next advantage. Don’t let valuable trends slip by while others get ahead.

- Spot the latest market disruptors and fuel your watchlist with AI penny stocks shaping the AI-powered future of business and automation.

- Capture above-average yields when you research dividend stocks with yields > 3% and find strong companies rewarding shareholders with robust, consistent dividends.

- Zero in on real value plays with undervalued stocks based on cash flows that highlight stocks trading at attractive prices based on fundamental cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)