- United States

- /

- Oil and Gas

- /

- NYSE:CNX

CNX Resources (CNX): Assessing Valuation Following Earnings Estimate Cuts and Zacks Strong Sell Rating

Reviewed by Kshitija Bhandaru

CNX Resources (CNX) was just added to the Zacks Rank #5 (Strong Sell) List after analysts lowered their earnings forecasts for the company. These revised estimates often influence investor sentiment and prompt a closer look at the stock’s outlook.

See our latest analysis for CNX Resources.

Shares of CNX Resources have seen some turbulence lately, with a 1-month share price return of 9.3% giving way to an overall year-to-date decline of 14.3%. This shift in momentum comes alongside recent negative revisions to earnings estimates, which has weighed on sentiment, even though the company’s total shareholder returns reached 84.5% over three years and 215.9% over five years. At the moment, investors appear to be reassessing risk versus reward as the outlook evolves.

If you're looking to broaden your search and spot what's next in the market, now could be a smart time to discover fast growing stocks with high insider ownership

With shares under pressure and analyst estimates trending lower, the key question becomes whether CNX Resources is now trading at a compelling discount, or if the market has already accounted for the company’s future prospects and risks.

Most Popular Narrative: Fairly Valued

Despite a last close price of $32.00, the most widely followed narrative sees CNX Resources as trading right in line with its perceived fair value of $31.57. This signals a market consensus that recent share price moves have kept up with changes to the company's longer-term earnings outlook, setting the stage for a deeper dive into what could drive future gains or losses.

Favorable policy and regulatory shifts towards cleaner-burning natural gas, including programs like 45Z tax credits and renewable energy attribute markets, are creating new, high-margin revenue streams (for example, RMG sales and environmental credits), potentially enhancing both net margins and free cash flow. Ongoing operational improvements, particularly efficiency gains and cost reductions in Utica and Marcellus wells, are lowering capital and operating expenditures per unit. This supports structurally higher margins and improved earnings sustainability over the long term.

Want to know what powers this balanced valuation? There is a bold growth roadmap built on high-margin new revenues and aggressive cost-cutting. Discover which projections analysts are betting on to justify today’s price.

Result: Fair Value of $31.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent natural gas oversupply and regulatory uncertainties could weigh on profits, which may challenge the assumptions behind current earnings and valuation projections.

Find out about the key risks to this CNX Resources narrative.

Another View: Discounted Cash Flow Model

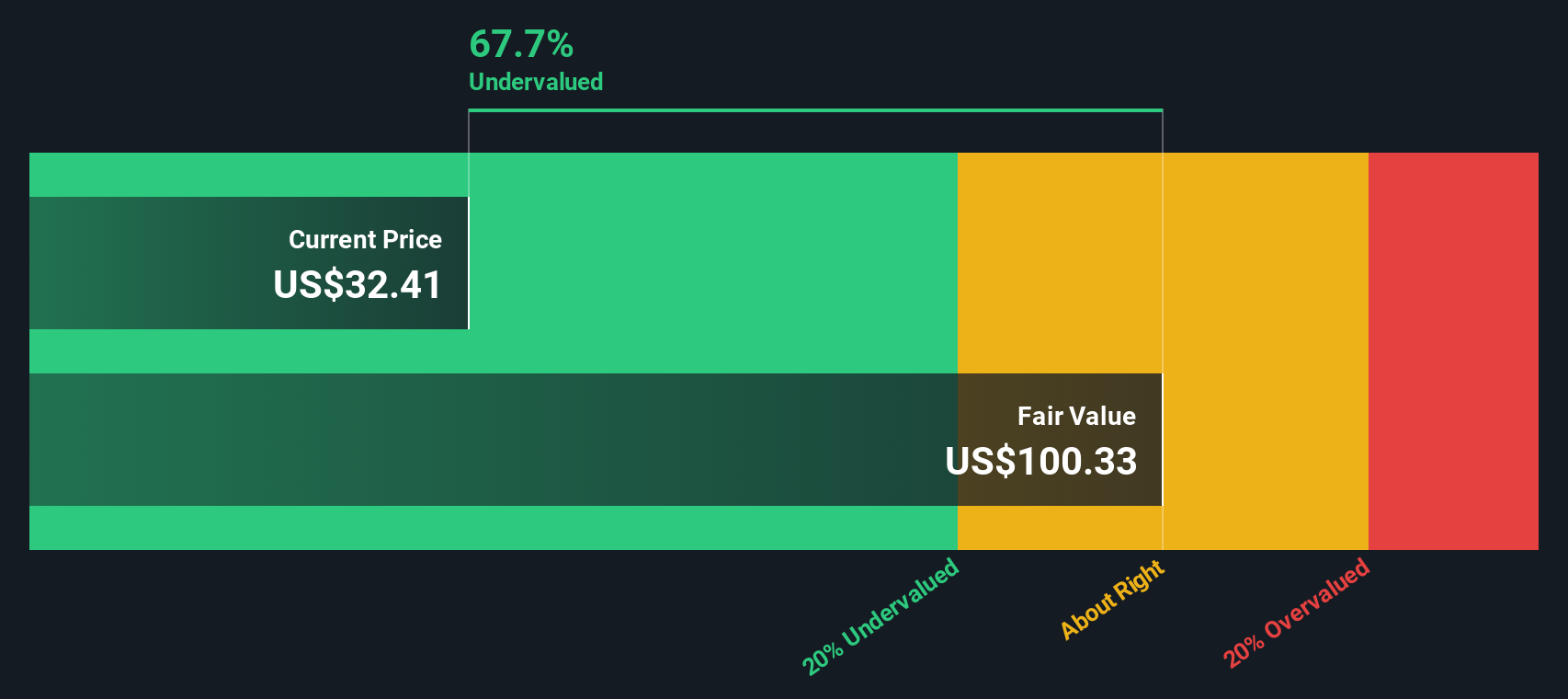

While the analyst consensus sees CNX Resources aligning with its fair value, our DCF model presents a much more optimistic perspective. By estimating future cash flows, this approach calculates a fair value of $108.26 per share, suggesting CNX is deeply undervalued compared to both its current price and traditional multiples. Could the market be missing something, or is the DCF model being too aggressive?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNX Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNX Resources Narrative

If our take doesn't match your perspective, or you'd rather investigate the numbers firsthand, you can craft your own narrative in just a few minutes, and Do it your way

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors are always on the hunt for the next breakout idea. Don’t miss your chance to uncover stocks with game-changing growth potential, hidden value, or the next big technology shift using these handpicked ideas:

- Boost your portfolio with steady income by tapping into these 19 dividend stocks with yields > 3%, which consistently deliver strong yields above 3%.

- Tap into future tech trends by backing innovative leaders among these 24 AI penny stocks, as they reshape industries with artificial intelligence advancements.

- Maximize upside by scanning these 898 undervalued stocks based on cash flows, which are poised to rebound thanks to overlooked fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives