- United States

- /

- Oil and Gas

- /

- NYSE:BSM

Should BSM’s Reduced Q2 2025 Cash Distribution Require Action From Black Stone Minerals (BSM) Investors?

Reviewed by Simply Wall St

- Black Stone Minerals, L.P. recently announced that its board approved a reduced cash distribution of US$0.30 per common unit for the second quarter of 2025, payable on August 14 to unitholders of record as of August 7.

- This reduction in the quarterly cash distribution highlights a recalibration of the company's payout strategy, which may raise questions about its near-term cash flow priorities and signal operational or market-driven pressures affecting distributable income.

- We will explore how this lower payout could influence Black Stone Minerals' investment case given its ongoing acquisition and production strategy.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Black Stone Minerals Investment Narrative Recap

To invest in Black Stone Minerals, you would need to believe in the long-term potential of its mineral and royalty assets, especially in high-interest regions, and the company's ability to capitalize on favorable energy pricing. The recent reduction of the quarterly distribution to US$0.30 per unit signals tighter near-term cash management but does not appear to materially impact the most important short-term catalyst: continued production growth through new drilling activity. The main risk remains persistently weak natural gas prices, as these could compress revenues if the trend continues.

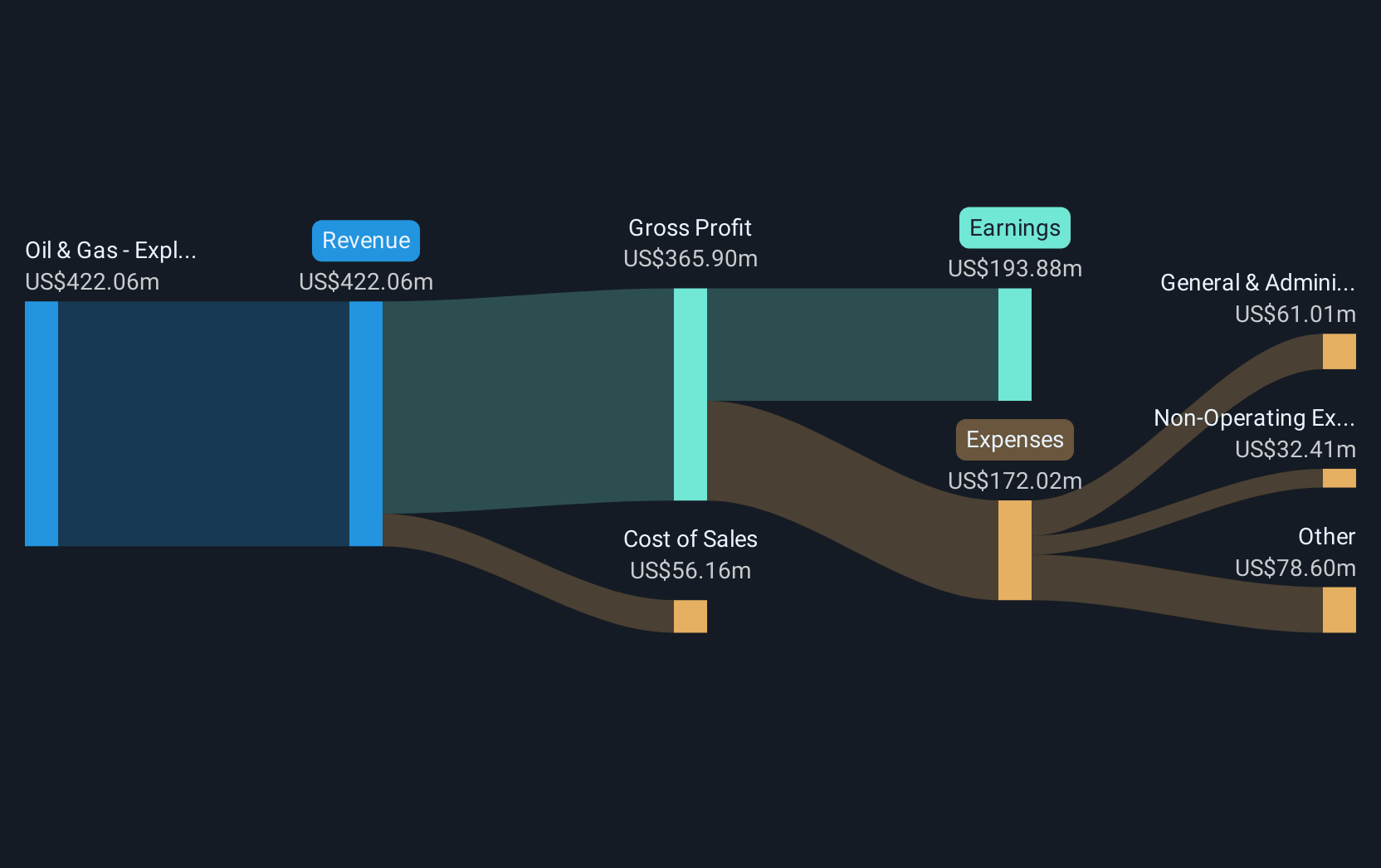

A recent announcement most relevant to the distribution change is the first quarter’s earnings report, which showed a significant year-on-year decline in both revenue and net income. This development shines a light on the pressures bearing down on distributable cash and underscores why short-term cash returns are being reassessed in the face of ongoing market headwinds.

But in contrast to stable payout histories, investors should be aware that cash flows remain sensitive to...

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals' outlook projects $592.3 million in revenue and $375.6 million in earnings by 2028. This scenario assumes a 12.0% annual revenue growth rate and an earnings increase of $181.7 million from the current $193.9 million.

Exploring Other Perspectives

Simply Wall St Community members provided four distinct fair value estimates for Black Stone Minerals, ranging from US$11.29 to US$30.98 per unit. With production volume and energy price volatility still posing short-term risks, you can review these different viewpoints to understand how expectations and priorities can vary across the market.

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives