- United States

- /

- Energy Services

- /

- NYSE:AROC

Assessing Archrock (AROC) Valuation After a Steady Week of Trading

Reviewed by Kshitija Bhandaru

See our latest analysis for Archrock.

Archrock’s share price has held steady lately, but the bigger story is its solid momentum. The stock boasts a 1-year total shareholder return of just over 20%, reflecting growing optimism about its long-term prospects despite quieter trading sessions.

If you’re interested in spotting the next growth play, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Given Archrock’s strong shareholder returns and notable discount to analyst price targets, the question remains: does the current share price underestimate future growth, or has the market already factored in the company’s potential?

Most Popular Narrative: 18.7% Undervalued

Compared to its last close at $25.11, the most followed narrative sets Archrock’s fair value at $30.89. This suggests notable potential grounded in expectations for robust earnings and margin gains ahead.

Sustained investments in domestic energy production and infrastructure, supported by energy security priorities and manufacturing onshoring, are generating broad-based demand across major shale basins. This environment allows Archrock to expand geographically and diversify its customer base, which reduces revenue volatility and supports stable earnings.

Can Archrock’s expansion and contract growth continue to drive its margins? The narrative’s fair value points to significant profit increases and earnings potential. What is the factor that truly impacts performance? Unlock the full breakdown behind this price target and discover which financial lever is most influential.

Result: Fair Value of $30.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. energy policy or rapid advances in renewables could quickly change demand and potentially undermine Archrock’s stable outlook.

Find out about the key risks to this Archrock narrative.

Another View: A Look at Valuation Ratios

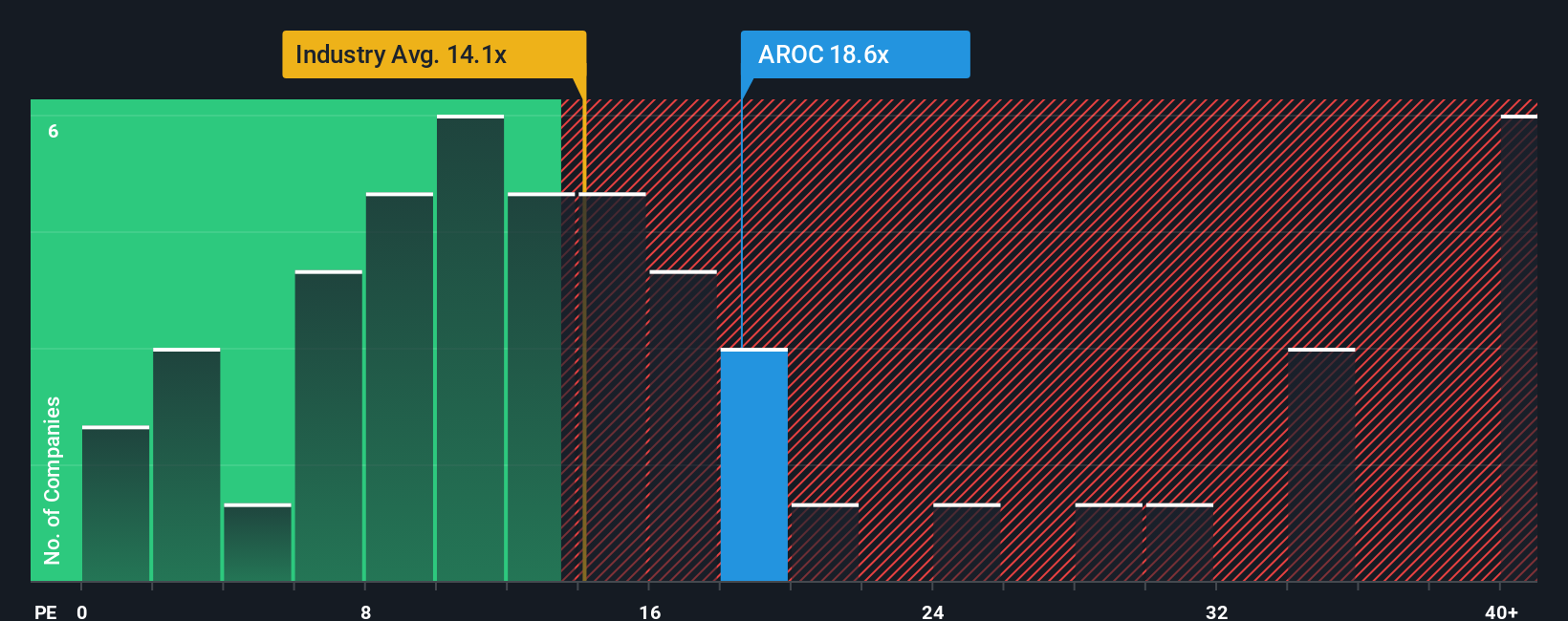

While the current narrative suggests Archrock is undervalued, a closer look at its price-to-earnings ratio tells a different story. The company currently trades at 19.3x earnings, making it more expensive than both its industry peers (17.8x) and the fair ratio of 17.7x. This higher valuation indicates investors are paying a premium, which could leave less room for upside if expectations fall short. Does this gap mean more risk than opportunity ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Archrock Narrative

If you want to dig deeper, check the numbers for yourself and build a personalized story. Craft your own Archrock view in just a few minutes with Do it your way.

A great starting point for your Archrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next breakout stock get away from you. Use the Simply Wall Street screener to unlock investment opportunities you won’t want to miss.

- Maximize your portfolio’s growth by uncovering these 885 undervalued stocks based on cash flows that are trading well below fair value thanks to strong cash flow potential and market mispricing.

- Boost your long-term returns by finding these 19 dividend stocks with yields > 3% that are delivering reliable income with yields exceeding 3% and robust fundamentals.

- Stay ahead of trends by targeting these 24 AI penny stocks that are positioned at the forefront of artificial intelligence and next-generation automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AROC

Archrock

Operates as an energy infrastructure company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives