- United States

- /

- Energy Services

- /

- NYSE:AROC

A Fresh Look at Archrock (AROC) Valuation Following Analyst Upgrade and Positive Earnings Momentum

Reviewed by Kshitija Bhandaru

Archrock (AROC) was recently upgraded to a Zacks Rank #2 (Buy), highlighting growing confidence among analysts regarding its upcoming earnings. This change underscores a trend of positive surprises in previous quarters.

See our latest analysis for Archrock.

Archrock’s latest analyst upgrade comes on the heels of steady performance, with a 3.38% share price gain in the last 90 days and a total shareholder return of nearly 17% over the past year. The company’s long-term momentum is hard to ignore as well, with total returns of over 450% for shareholders over five years. This signals durable growth potential that continues to attract attention.

If you’re looking to expand your investing playbook, now’s a great moment to see what opportunities await with fast growing stocks with high insider ownership

With Archrock’s recent upgrade and notable track record, the big question remains: is the market underestimating its future potential, or has all of that growth already been priced into the stock, leaving less room for upside?

Most Popular Narrative: 21.8% Undervalued

With Archrock trading at $24.14 and the most widely followed narrative pointing to a fair value of $30.89, expectations for future upside are clearly strong. Here is what is driving that optimism right now.

The company's ongoing transformation to a modern, high-horsepower fleet and longer customer commitments (average contract duration now exceeding six years) is translating to higher margins, enhanced operational stability, and increased earnings visibility.

Want to know what powers this valuation? The best-kept secret is the combination of accelerating margins and remarkably optimistic profit forecasts. The calculation behind this price target is not just about short-term growth, but a full business transformation that could change the company’s earnings profile. Find out the bold analyst projections that might surprise even seasoned investors.

Result: Fair Value of $30.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in U.S. natural gas demand or disruptive regulatory changes could quickly challenge Archrock’s growth outlook and earnings potential.

Find out about the key risks to this Archrock narrative.

Another View: What Do Earnings Ratios Say?

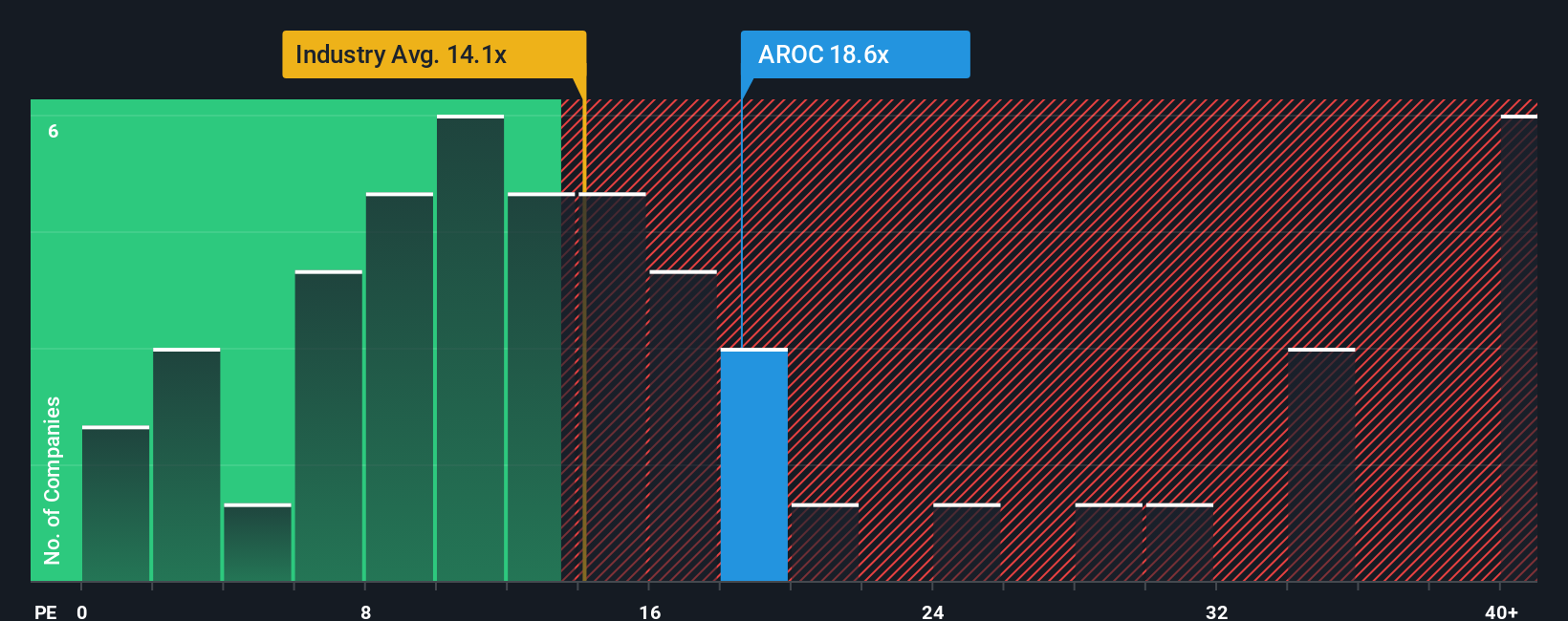

While the narrative suggests Archrock’s shares are undervalued, looking at its price-to-earnings ratio paints a more complicated picture. At 18.6x, Archrock trades higher than the US Energy Services industry average of 14x and even above its estimated fair ratio of 17.6x. This could signal less upside, or highlight a market willing to pay a premium for expected growth. Does this make the risk of future disappointment greater, or simply show market conviction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Archrock Narrative

If you want to dig into the numbers yourself and develop a different perspective, it only takes a few minutes to craft your own view, so why not Do it your way

A great starting point for your Archrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Use the power of the Simply Wall Street Screener to find standout companies with advantages you might not have considered yet.

- Tap into future tech by checking out these 25 AI penny stocks and uncover which businesses are fueling the AI race right now.

- Supercharge your search for sustainable returns by scanning these 18 dividend stocks with yields > 3% with yields higher than 3%. This is perfect for those who want income and growth.

- Capitalize on pricing opportunities by hunting for value among these 893 undervalued stocks based on cash flows and spot stocks that the market might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AROC

Archrock

Operates as an energy infrastructure company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives