- United States

- /

- Energy Services

- /

- NYSE:AESI

Atlas Energy Solutions (AESI) Is Down 9.4% After Analyst Downgrade and Q2 2025 EPS Miss – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, RBC Capital downgraded Atlas Energy Solutions following its Q2 2025 earnings, which included an earnings per share miss but higher-than-expected revenue.

- The combination of a subdued sales volume outlook and cautious analyst sentiment could leave Atlas facing greater uncertainty as it works through industry changes.

- Given the recent analyst downgrade over Permian sand market challenges, we'll examine how this impacts Atlas Energy Solutions' investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Atlas Energy Solutions Investment Narrative Recap

To own Atlas Energy Solutions stock, investors need to believe in a recovery for Permian Basin sand demand, where Atlas’s integrated operations and logistics assets could support margin expansion as weaker competitors exit. The recent downgrade by RBC Capital, following a disappointing Q2 2025 earnings miss and a subdued sand sales outlook, puts extra pressure on a near-term catalyst: a rebound in industry demand. At the same time, ongoing weak completion activity and soft sand pricing remain the key risks to watch, these headwinds are material and present ongoing uncertainty.

Among the company’s recent developments, Q2 2025 earnings are most relevant. Revenue slightly exceeded expectations at US$288.68 million, but the net loss of US$5.56 million and a significant miss on earnings per share reflect continued margin and demand pressure. This result is especially relevant against the backdrop of cautious near-term analyst sentiment and adds further weight to the focus on operational execution and demand stabilization in the coming quarters.

Yet while some see opportunity in Atlas’s position, the potential for continued weak sand demand is a risk that investors should keep on their radar...

Read the full narrative on Atlas Energy Solutions (it's free!)

Atlas Energy Solutions is projected to reach $1.2 billion in revenue and $148.5 million in earnings by 2028. This outlook assumes annual revenue growth of 2.2% and represents an increase in earnings of $134.5 million from the current $14.0 million.

Uncover how Atlas Energy Solutions' forecasts yield a $14.18 fair value, a 34% upside to its current price.

Exploring Other Perspectives

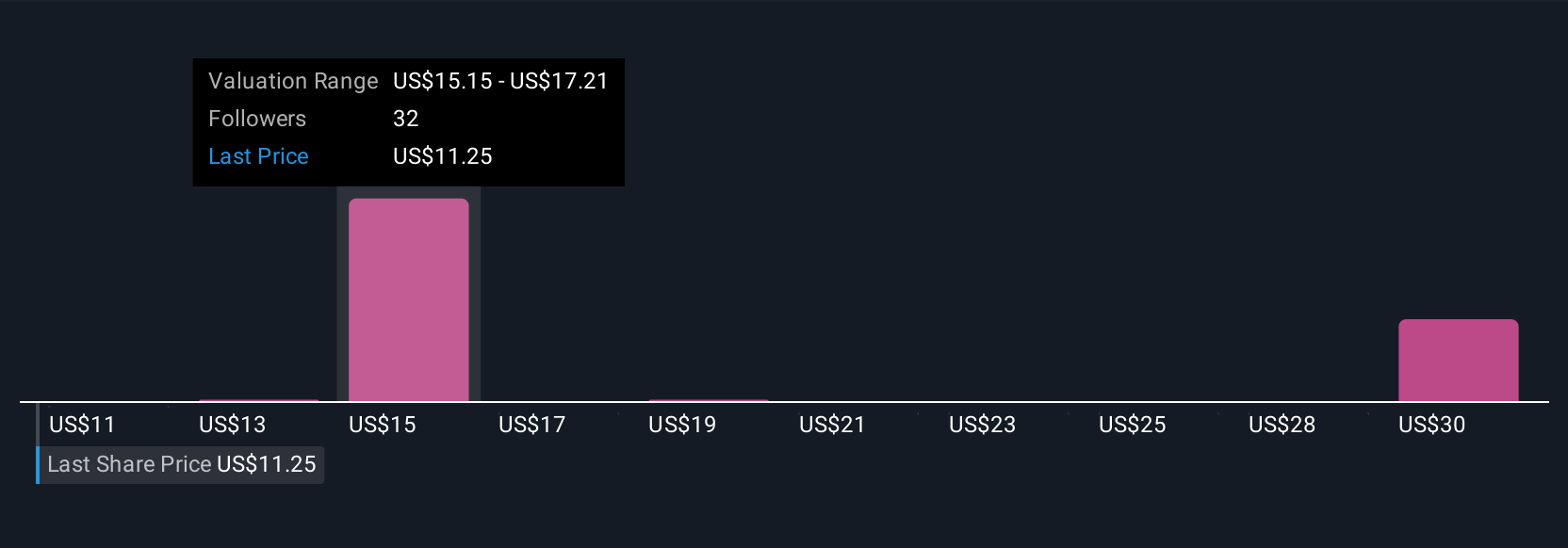

Simply Wall St Community members provide eight unique fair value estimates for Atlas Energy Solutions, ranging from US$10.50 to US$40.21 per share. As participants weigh these valuations, many remain focused on the current risk of structurally lower demand for Atlas’s core sand and logistics business.

Explore 8 other fair value estimates on Atlas Energy Solutions - why the stock might be worth over 3x more than the current price!

Build Your Own Atlas Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Atlas Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Energy Solutions' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AESI

Atlas Energy Solutions

Engages in the production, processing, and sale of mesh and sand used as a proppant during the well completion process in the Permian Basin of West Texas and New Mexico.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives