- United States

- /

- Energy Services

- /

- NasdaqGS:PTEN

How PTEN’s Shift to a Q2 Net Loss Has Changed Its Investment Story

Reviewed by Simply Wall St

- Patterson-UTI Energy, Inc. reported second quarter 2025 earnings with sales of US$1,219.32 million and a net loss of US$49.14 million, both down versus the previous year’s results.

- This marks a shift from profitability to a net loss, reflecting ongoing financial pressures as the company’s revenue and margins continue to contract.

- We'll examine how the move from net income to net loss may reshape Patterson-UTI Energy's investment narrative going forward.

Patterson-UTI Energy Investment Narrative Recap

As a potential Patterson-UTI Energy shareholder, you likely need confidence in the company's ability to leverage integrated service offerings and technological assets to capture industry upturns and secure large contracts. The recent shift from net income to a net loss underscores persistent financial pressures, meaning any rebound in activity, especially from stable operators or technology-driven services, becomes even more important in the short term. The most significant risk remains the sensitivity of Patterson-UTI’s revenue and margins to commodity price volatility, which appears more pressing after this quarter’s results. Among recent announcements, the maintenance of dividend payments stands out as particularly relevant. Despite unprofitability, continuing quarterly dividends at US$0.08 per share suggests management’s emphasis on rewarding shareholders, but there are questions about the sustainability of these payouts if losses persist. This action sits squarely at the intersection of ongoing financial strain and the company’s commitment to maintaining investor returns. On the other hand, investors should be aware that when oil prices dip and activity slows, the knock-on effects on contract pricing and rig demand can be both rapid and severe...

Read the full narrative on Patterson-UTI Energy (it's free!)

Patterson-UTI Energy's outlook anticipates $4.9 billion in revenue and $351.5 million in earnings by 2028. This projection implies a 1.7% annual revenue decline and a $1.35 billion increase in earnings from current earnings of -$1.0 billion.

Exploring Other Perspectives

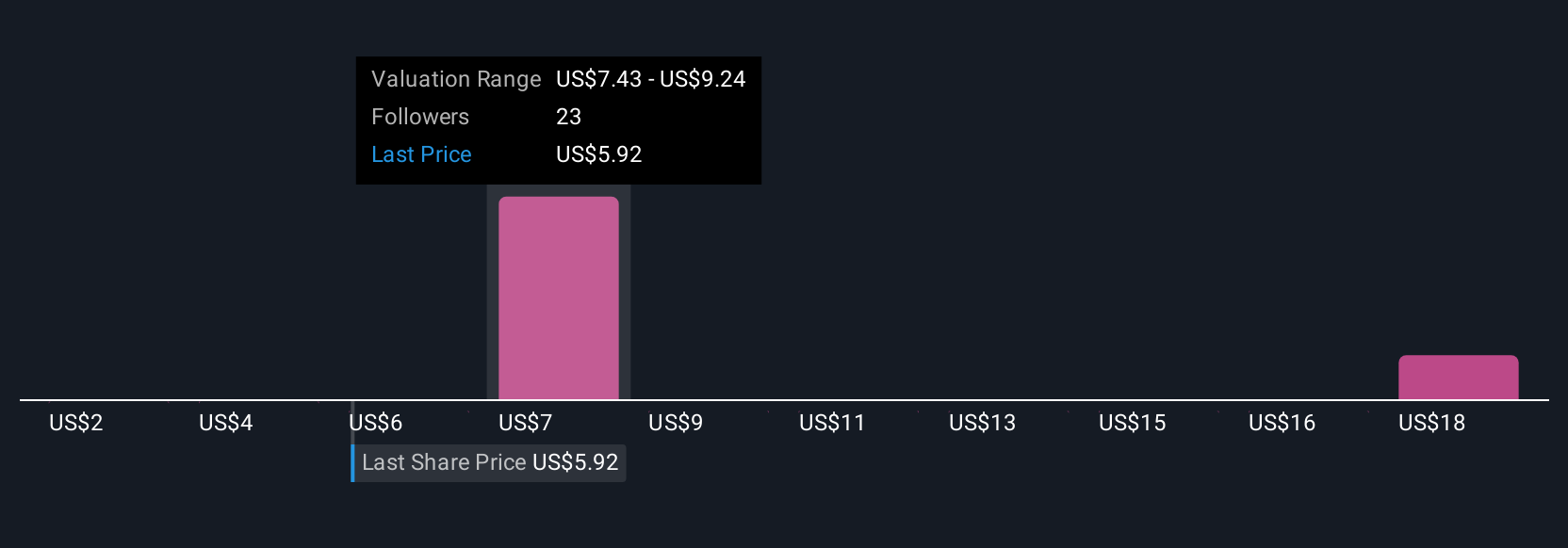

Four fair value opinions from the Simply Wall St Community range from as low as US$2 to as high as US$18.05 per share. Given Patterson-UTI's reliance on stable rig demand, these diverse estimates reflect widespread uncertainty about how prolonged oil price weakness could affect future performance.

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTEN

Patterson-UTI Energy

Through its subsidiaries, provides drilling and completion services to oil and natural gas exploration and production companies in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives