- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

What Do Recent Pipeline Expansions Mean for Plains GP Holdings Share Price in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Plains GP Holdings and trying to size up your next move, you are in good company. The stock closed recently at $17.63, and its journey has been anything but dull. After a slip of 6.9% over the past month, Plains found a bit of pep with a 4.4% move up just this week. Look a little further back and the story gets even more compelling. Over the long haul, Plains is up nearly 74% in three years and an eye-catching 290% in the last five. So, what is driving the action?

Much of the recent momentum appears tied to industry updates around pipeline expansion projects and favorable policy developments, which have fueled a broad sense that midstream companies are on a steadier footing than they were during the last cycle. Investors seem to be recalibrating risk and opportunity here, especially as Plains has proven nimble at adapting to volatility. That helps explain why you are seeing renewed optimism around the stock, even though this year-to-date return is still under water at -4.8%.

But numbers only tell part of the story. When we run Plains GP Holdings through the valuation gauntlet, a series of six key checks, the company comes through as undervalued in five of them, giving it an impressive valuation score of 5. That is worth a closer look.

Let us break down those valuation approaches, and later, I will share a perspective on valuation that is even more illuminating than the classic metrics alone.

Why Plains GP Holdings is lagging behind its peers

Approach 1: Plains GP Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and discounting those sums back to their value in today's dollars. This helps investors gauge whether a stock price reflects the company's actual ability to generate cash over time.

For Plains GP Holdings, the most recent reported Free Cash Flow stands at $2.15 Billion. Analyst forecasts cover the next five years and suggest continued growth, with Simply Wall St extrapolating cash flows beyond that horizon. The projections point to Free Cash Flow reaching $1.72 Billion by 2029, with anticipated annual figures showing steady increases over the next decade.

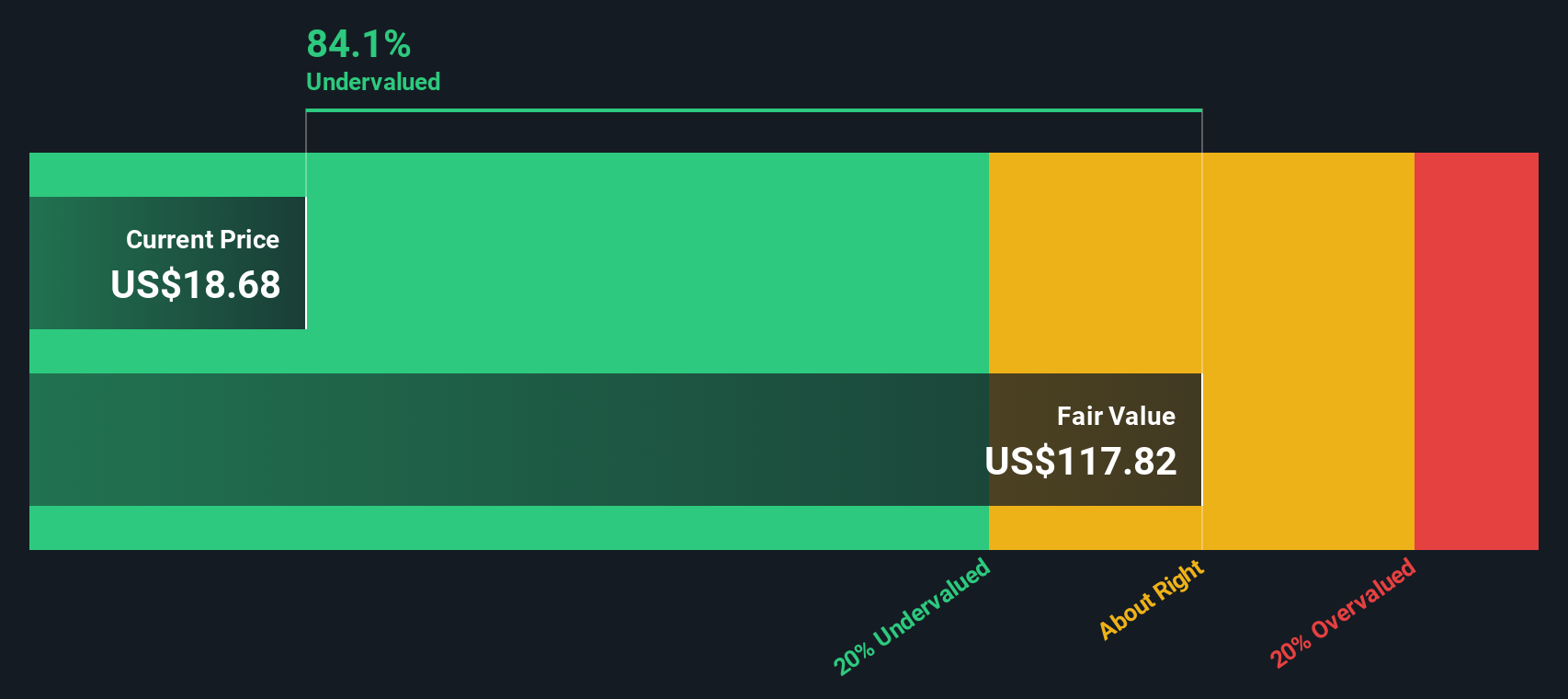

According to this DCF approach, the intrinsic value per share is estimated at $96.51. With the stock currently trading at $17.63, this implies an 81.7% discount, indicating the shares are significantly undervalued based on these cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plains GP Holdings is undervalued by 81.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Plains GP Holdings Price vs Sales

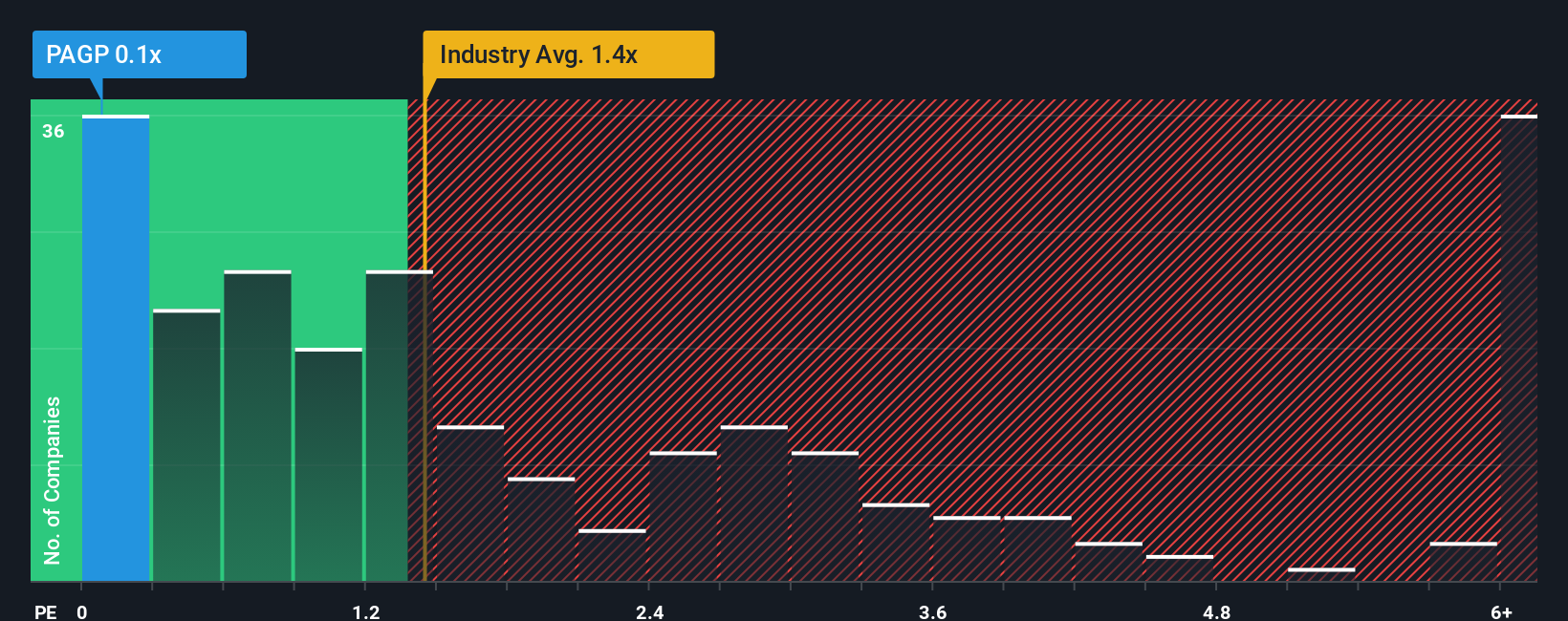

For companies like Plains GP Holdings, the Price-to-Sales (P/S) ratio is a helpful valuation tool, especially when profits fluctuate or when comparing businesses in capital-intensive sectors like oil and gas. The P/S metric looks at how much investors are willing to pay for each dollar of sales, making it a consistent yardstick for evaluating the underlying scale and revenue strength of a business where profit margins can swing from year to year.

Growth expectations and company-specific risks play an important role in what investors consider a “normal” or “fair” multiple. A higher growth rate or lower risk profile usually justifies a higher multiple, while mature companies in more volatile industries tend to trade at lower ones. For Plains GP Holdings, the current P/S ratio stands at 0.07x. This means the stock is currently being valued at just seven cents for every dollar of sales.

To put things in perspective, the average P/S ratio for peers sits at 5.76x, and the oil and gas industry average clocks in at 1.54x. Enter Simply Wall St’s proprietary “Fair Ratio,” which in this case is 0.52x. This number is tailored to Plains GP Holdings’ specific business profile, considering its growth outlook, risk, profit margin, industry, and market capitalization. The Fair Ratio offers a more accurate benchmark than simply comparing to peers or sector averages, as it factors in nuances that standard multiples can overlook.

Comparing Plains GP Holdings’ current P/S multiple of 0.07x to its Fair Ratio of 0.52x, the stock looks meaningfully undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plains GP Holdings Narrative

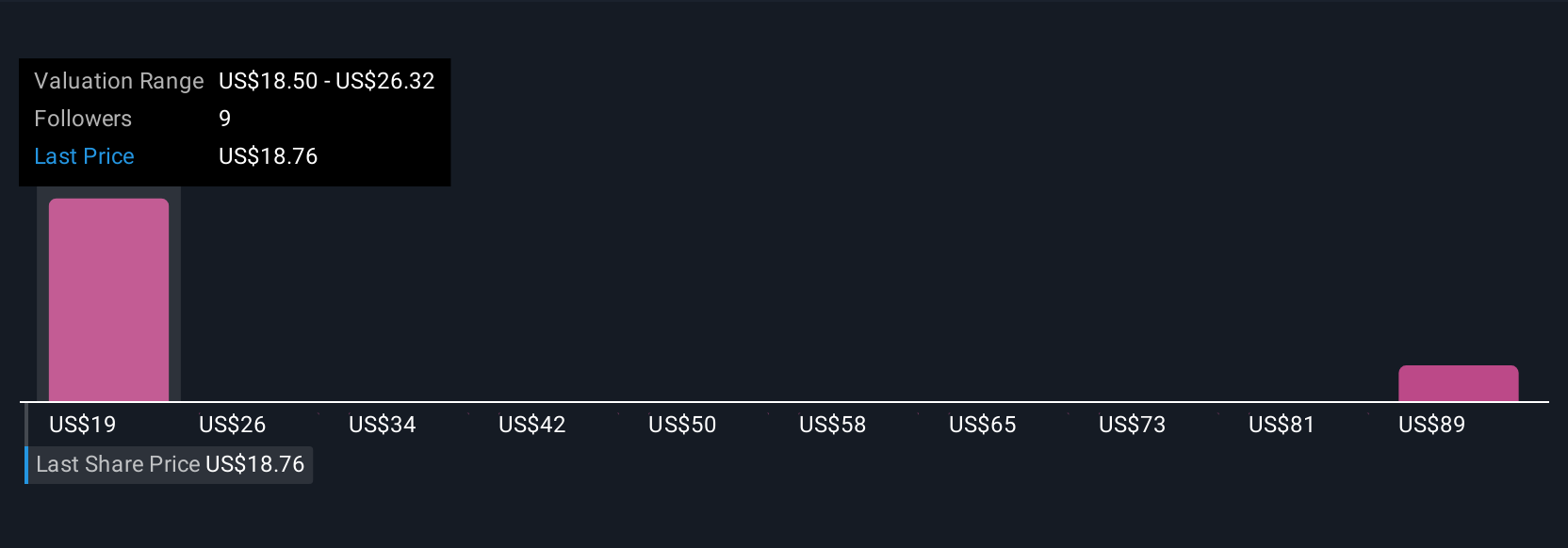

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative goes beyond traditional financial ratios by letting you combine your unique perspective, the “story” you see for a company, with data-driven forecasts of future revenue, margins, and fair value. In other words, a Narrative connects how you think the business will evolve with concrete financial outcomes, then links this story to a valuation you can act on.

Narratives are an accessible tool available right within Simply Wall St’s Community page, used by millions of investors to share and refine their outlooks. With Narratives, you can visualize how new news or earnings instantly change a company’s fair value, giving you a living, breathing decision aid. This helps you see, at a glance, whether it might be time to buy, hold, or sell by comparing your fair value to the current price and tracking changes as new events unfold.

For instance, on Plains GP Holdings, one investor might craft a bullish Narrative based on aggressive Permian expansion and estimate a fair value above $26 per share, while another, weighing margin risks from sector headwinds, could land at a much more conservative $17.5, putting the power of context and conviction in your hands.

Do you think there's more to the story for Plains GP Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)