- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Plains All American Pipeline (PAA): Revisiting Valuation After Recent Outperformance and Long‑Term Total Return

Reviewed by Simply Wall St

Plains All American Pipeline (PAA) has quietly outperformed the broader energy space over the past month, with shares edging higher as investors revisit midstream names for income, cash flow stability, and measured growth.

See our latest analysis for Plains All American Pipeline.

Zooming out, that steady climb to a share price of $17.87 sits on top of a roughly 5.5 percent 1 month share price return and a near 200 percent 5 year total shareholder return, which together signal that momentum in this income focused midstream name is still very much alive.

If PAA has you rethinking what steady compounding can look like, it might be worth broadening your search and discovering fast growing stocks with high insider ownership.

With double digit trailing returns, modest reported growth, and a meaningful discount to analyst targets, investors now face a key question: is Plains All American still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 12.7% Undervalued

With the narrative fair value sitting around $20.47 against a last close of $17.87, the valuation case leans in favor of more upside if assumptions hold.

The fair value estimate has risen slightly, moving from approximately $20.35 to $20.47 per unit, reflecting a modestly more optimistic intrinsic valuation. The discount rate has fallen slightly, from about 7.49 percent to 7.46 percent, signaling a marginal reduction in the perceived riskiness of future cash flows.

Curious what kind of slow and steady revenue path, rising margins, and future earnings multiple are stitched together to justify that higher intrinsic value? The full narrative reveals the precise growth assumptions and profitability shifts that support this valuation view, as well as how a lower risk lens reshapes the long term payoff profile.

Result: Fair Value of $20.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on Plains navigating energy transition headwinds and avoiding missteps in capital deployment that could blunt long term earnings power.

Find out about the key risks to this Plains All American Pipeline narrative.

Another Angle on Valuation

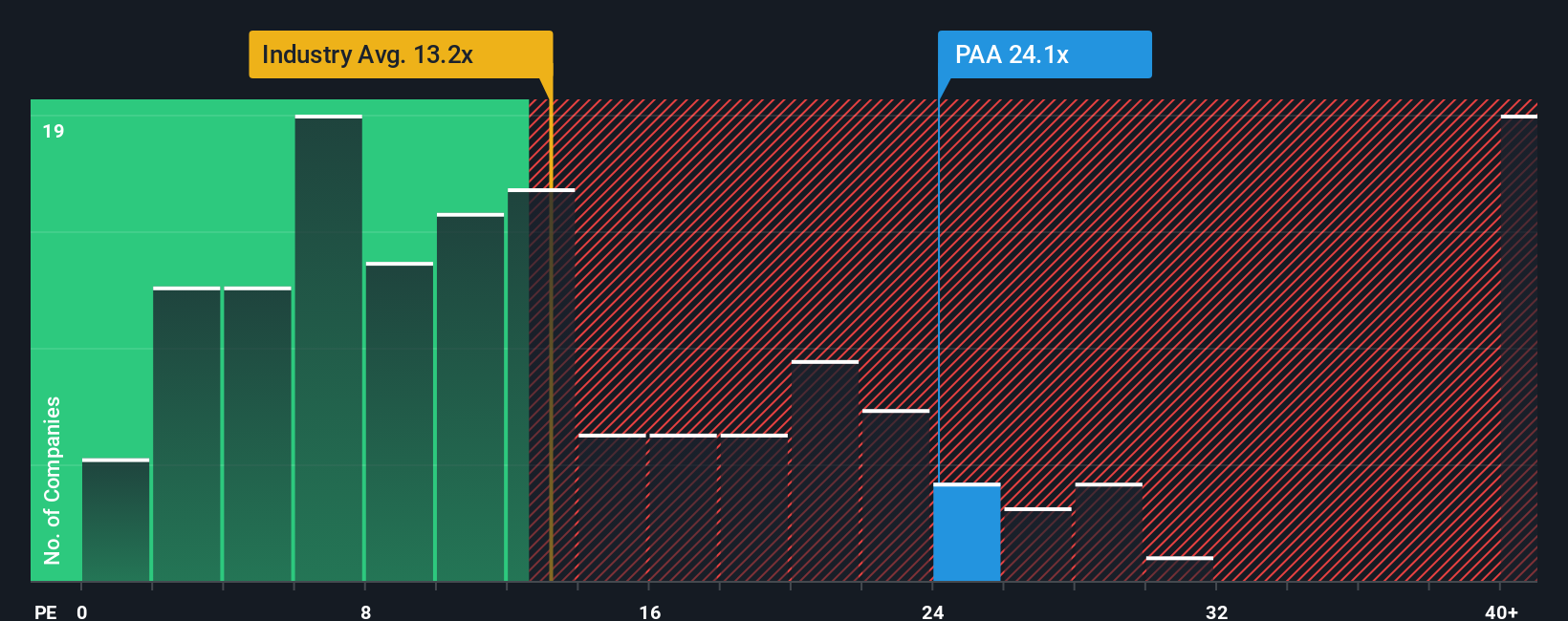

While the narrative fair value suggests moderate upside, our earnings based yardsticks send a mixed message. PAA trades on a 17.3 times price to earnings ratio, richer than the US Oil and Gas average of 13.2 times, but cheaper than peers at 18.6 times and below its 20.4 times fair ratio. This leaves investors to decide whether that gap is a margin of safety or a warning sign.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains All American Pipeline Narrative

If this perspective does not quite align with your own view, you can dig into the numbers yourself, shape a custom story, and Do it your way in just a few minutes.

A great starting point for your Plains All American Pipeline research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work and use the Simply Wall St Screener to uncover focused opportunities that match your strategy before the next leg of this market unfolds.

- Capture potential mispricings by scanning these 906 undervalued stocks based on cash flows that may offer strong upside based on their cash flow profiles and fundamentals.

- Position yourself at the frontier of innovation by targeting these 26 AI penny stocks poised to benefit from accelerating demand for intelligent automation and data driven solutions.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can help anchor your portfolio with dependable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)