- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

The National Energy Services Reunited (NASDAQ:NESR) Share Price Is Up 40% And Shareholders Are Holding On

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the National Energy Services Reunited Corp. (NASDAQ:NESR) share price is 40% higher than it was a year ago, much better than the market return of around 26% (not including dividends) in the same period. So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 1.4% in the last three years.

See our latest analysis for National Energy Services Reunited

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, National Energy Services Reunited actually saw its earnings per share drop 56%.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

National Energy Services Reunited's revenue actually dropped 8.2% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

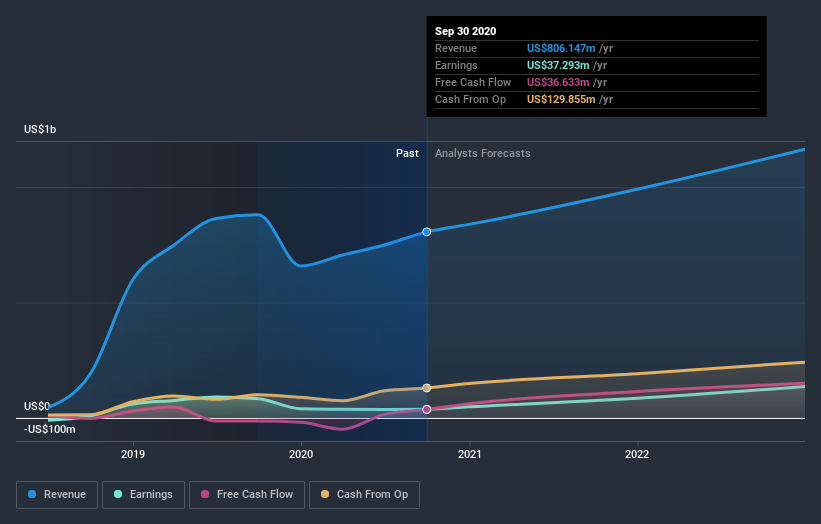

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for National Energy Services Reunited in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that National Energy Services Reunited rewarded shareholders with a total shareholder return of 40% over the last year. That gain actually surpasses the 0.5% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting National Energy Services Reunited on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with National Energy Services Reunited , and understanding them should be part of your investment process.

National Energy Services Reunited is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade National Energy Services Reunited, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade National Energy Services Reunited, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives