- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

Assessing National Energy Services Reunited's (NasdaqCM:NESR) Valuation After Joining the S&P Global BMI Index

Reviewed by Kshitija Bhandaru

National Energy Services Reunited (NasdaqCM:NESR) just landed a spot in the S&P Global BMI Index, a milestone that puts the company on the radar of index funds and benchmark-following investors. For shareholders and prospective buyers alike, this development could be more than a headline; it might be the start of fresh flows of capital into the stock. Whether you already hold NESR or are simply tracking it, this kind of index inclusion has a habit of shaking things up for both liquidity and long-term visibility.

The timing for NESR is interesting, given the backdrop of its performance this year. While shares have climbed close to 8% over the past three months and are up nearly 19% since January, momentum has been especially strong recently, pointing toward possible renewed interest since the announcement. Over the past year, NESR has returned close to 10%, and its three-year gain exceeds 80%, suggesting longer-term confidence is not in short supply. The inclusion in the S&P Global BMI Index adds another layer to a story already marked by steady growth and building optimism.

But is this surge in attention and price action all about future promise, or is the market already pricing in the next chapter for NESR? Let’s dig deeper into the valuation to find out.

Most Popular Narrative: 21% Undervalued

According to the most widely followed narrative, National Energy Services Reunited is trading well below its estimated fair value, driven by expectations of continued growth and operational resilience even as sector challenges remain.

“NESR is poised to benefit from robust long-term global energy demand growth, particularly in emerging markets and the Global South. This is evidenced by expanding rig counts and project backlogs across Kuwait, Saudi Arabia, North Africa, and Iraq. These trends are likely to drive sustained revenue growth and backlog visibility. Activity in unconventional resource development, especially gas, across the Middle East is accelerating. NESR's established position in Saudi's Jafurah project and expanding contracts in Kuwait and North Africa provide strong exposure to secular increases in service intensity per well, which supports both top-line expansion and higher per-unit margins.”

Curious how analysts arrived at such a strong upside? They are betting on a smart mix of international expansion, operational efficiency, and rising margins. There is a surprising combination of bullish assumptions in play here. Does the company really have the firepower to hit these ambitious targets? The full narrative lays out the catalyst mix behind this call and reveals exactly what needs to happen for the valuation to hold up.

Result: Fair Value of $13.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, NESR's heavy reliance on long-term oil contracts in the MENA region and rising capital needs could quickly challenge these bullish projections if conditions shift.

Find out about the key risks to this National Energy Services Reunited narrative.Another View: What Does the SWS DCF Model Say?

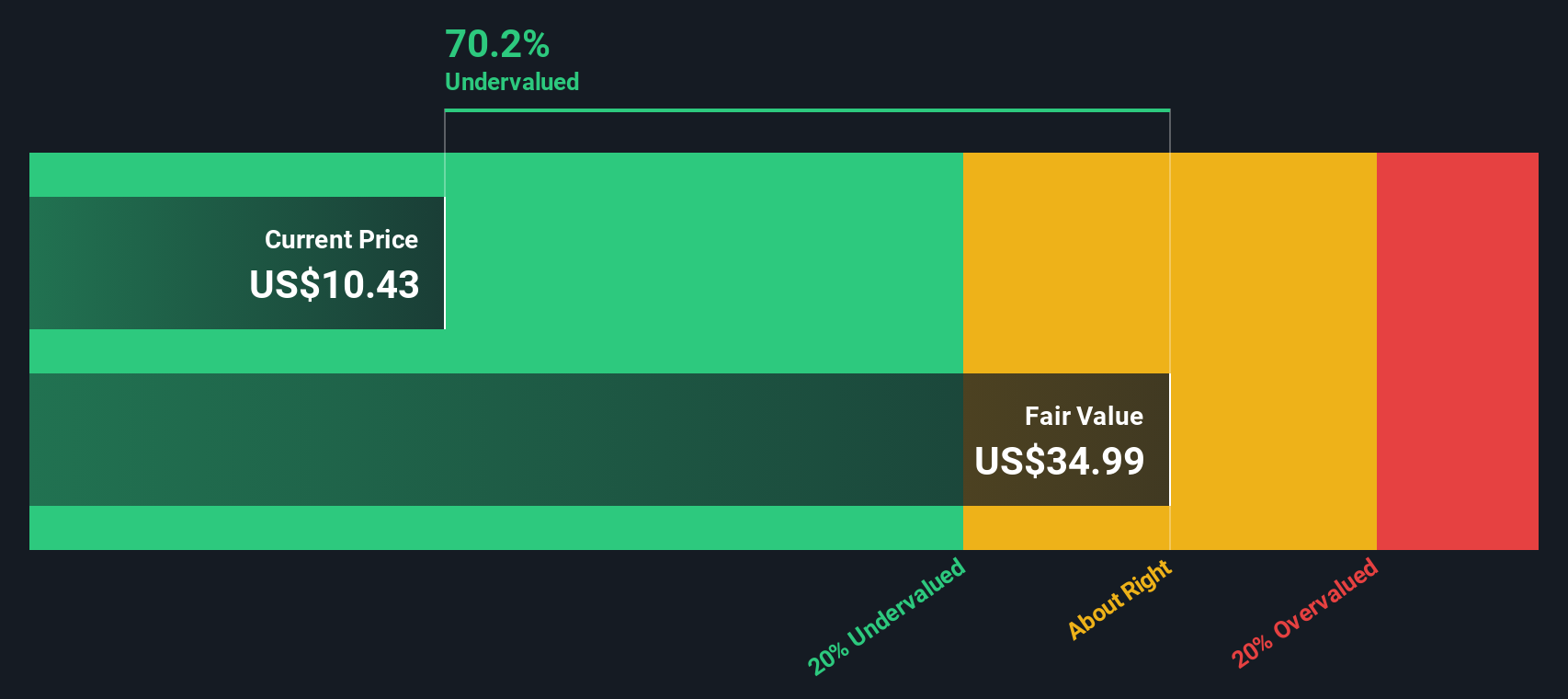

Taking a step back from analyst price targets, our DCF model also sees National Energy Services Reunited as undervalued at current prices. However, do both methods capture all the real-world risks and opportunities ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Energy Services Reunited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Energy Services Reunited Narrative

If you want to test your own assumptions or approach the numbers from a different angle, assembling a personal narrative takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding National Energy Services Reunited.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when you can capitalize on others across the market. Missing these could mean missing out on tomorrow’s standout performers.

- Spot hidden potential by targeting penny stocks with strong financials. Use the penny stocks with strong financials to find those resilient up-and-comers before the crowd.

- Get ahead of the curve in the artificial intelligence revolution by checking out AI penny stocks and see which cutting-edge companies are poised for explosive growth.

- Secure more value for your money by uncovering undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives