- United States

- /

- Energy Services

- /

- NasdaqCM:MIND

While shareholders of MIND Technology (NASDAQ:MIND) are in the black over 3 years, those who bought a week ago aren't so fortunate

The MIND Technology, Inc. (NASDAQ:MIND) share price is down a rather concerning 41% in the last month. In contrast the stock is up over the last three years. However, it's unlikely many shareholders are elated with the share price gain of 81% over that time, given the rising market.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

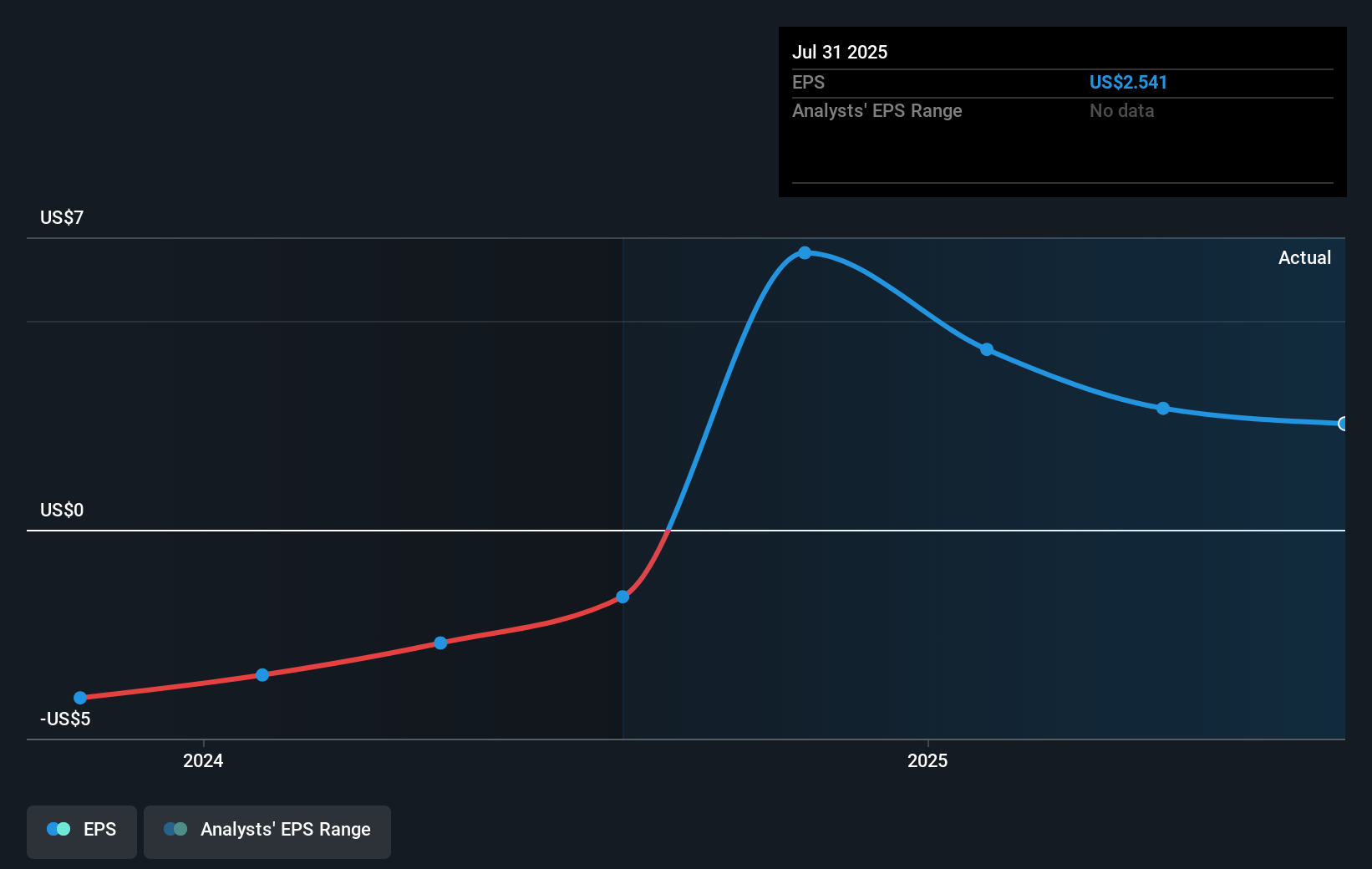

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

MIND Technology became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how MIND Technology has grown profits over the years, but the future is more important for shareholders. This free interactive report on MIND Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that MIND Technology shareholders have received a total shareholder return of 34% over one year. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand MIND Technology better, we need to consider many other factors. For example, we've discovered 3 warning signs for MIND Technology (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MIND

MIND Technology

Provides technology to the oceanographic, hydrographic, defense, seismic, and maritime security industries in the United States, China, Norway, Turkey, Singapore, Canada, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion