- United States

- /

- Oil and Gas

- /

- NasdaqCM:LTBR

Lightbridge (LTBR) Advances Fuel Testing at Idaho Lab Is Regulatory Momentum Building?

Reviewed by Sasha Jovanovic

- On October 9, 2025, Lightbridge Corporation announced the successful preparation and loading of enriched uranium-zirconium alloy fuel samples into an experiment assembly at Idaho National Laboratory, paving the way for upcoming irradiation testing in the Advanced Test Reactor.

- This achievement marks a critical step in obtaining performance data that will help guide Lightbridge’s regulatory licensing processes and support its commercialization plans for advanced nuclear fuel technologies.

- We’ll explore how this milestone, which advances Lightbridge’s proprietary fuel technology toward future regulatory and commercial milestones, impacts its overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Lightbridge's Investment Narrative?

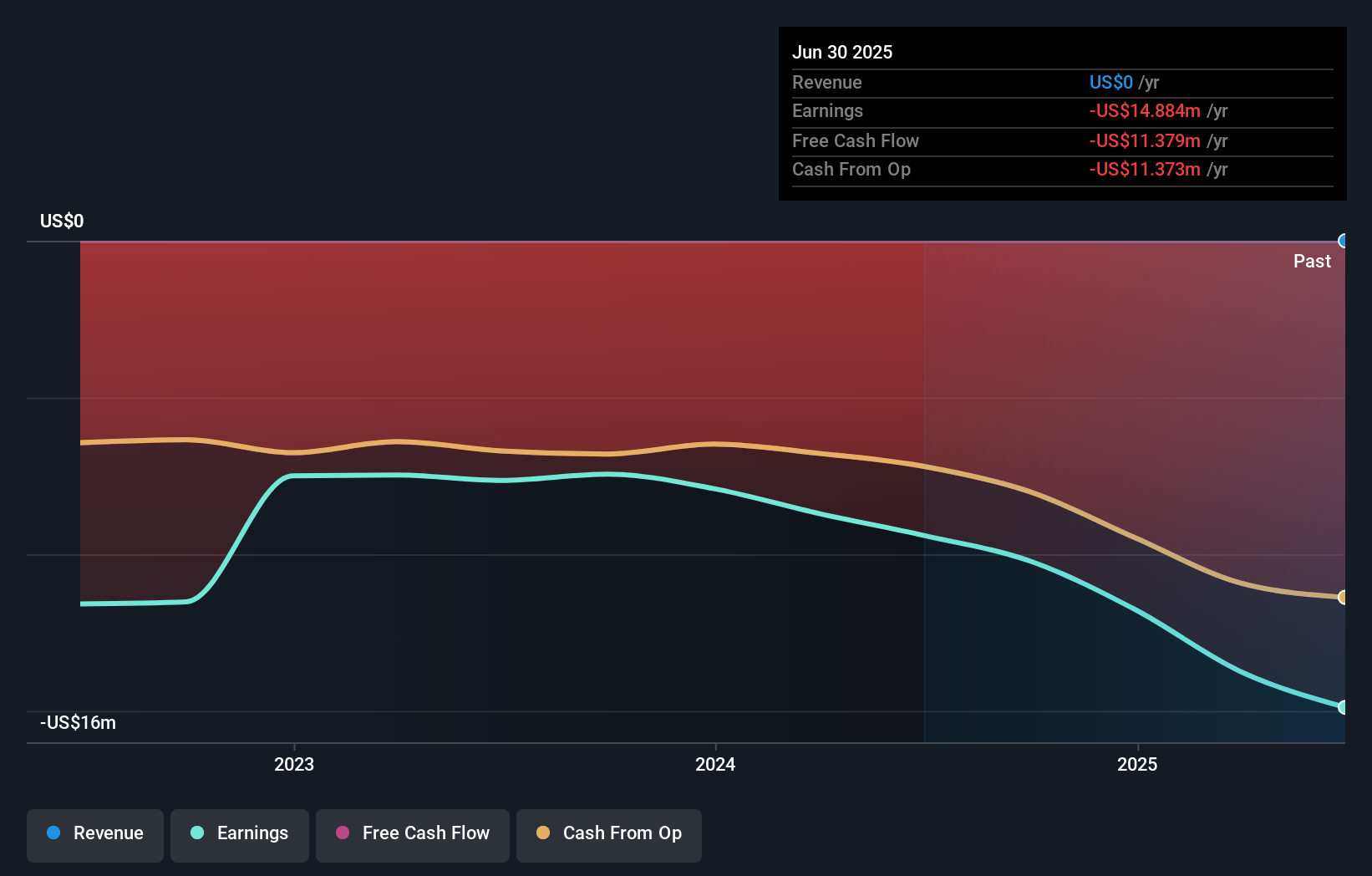

Anyone considering Lightbridge today needs to weigh the long-term potential of its nuclear fuel innovation against the company’s current financial profile and the pace of regulatory hurdles. The recent successful loading of uranium-zirconium alloy fuel samples at Idaho National Laboratory is a concrete technical achievement that brings the company closer to gathering the data required for licensing and commercialization. This milestone moves one of the most important short-term catalysts, proof of performance, towards realization. However, Lightbridge remains pre-revenue and unprofitable, and despite positive momentum in testing, the key risks persist: notably, a lack of revenue, ongoing operating losses, and shareholder dilution. This news could mark progress reinforcing the company’s investment narrative, but whether it materially shifts the near-term risk profile depends on further testing outcomes, the timing and results of regulatory decisions, and the company’s access to future funding. These are still central factors in the investment case.

But despite all this momentum, recent insider selling is a risk that investors should not ignore.

Exploring Other Perspectives

Explore 5 other fair value estimates on Lightbridge - why the stock might be worth as much as $10.00!

Build Your Own Lightbridge Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lightbridge research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Lightbridge research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lightbridge's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LTBR

Lightbridge

Engages in research, developing, and commercializing nuclear fuel.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)