- United States

- /

- Oil and Gas

- /

- NasdaqCM:LTBR

Here's Why We're Not Too Worried About Lightbridge's (NASDAQ:LTBR) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Lightbridge (NASDAQ:LTBR) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Lightbridge

When Might Lightbridge Run Out Of Money?

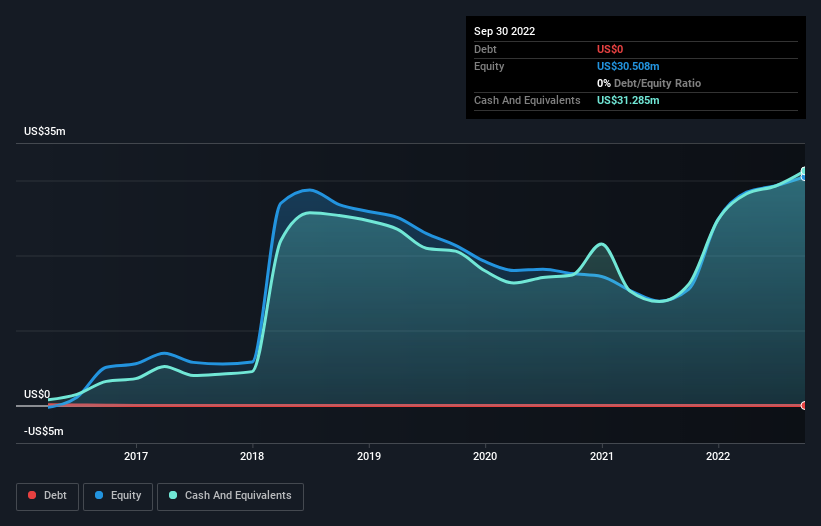

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Lightbridge last reported its balance sheet in September 2022, it had zero debt and cash worth US$31m. In the last year, its cash burn was US$6.4m. So it had a cash runway of about 4.9 years from September 2022. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Is Lightbridge's Cash Burn Changing Over Time?

Because Lightbridge isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 47% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Lightbridge makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Lightbridge Raise Cash?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Lightbridge to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$52m, Lightbridge's US$6.4m in cash burn equates to about 12% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Lightbridge's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Lightbridge is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its cash burn relative to its market cap wasn't quite as good, but was still rather encouraging! After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Lightbridge has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LTBR

Lightbridge

Engages in research, developing, and commercializing nuclear fuel.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives