- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

With EPS Growth And More, HighPeak Energy (NASDAQ:HPK) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like HighPeak Energy (NASDAQ:HPK), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for HighPeak Energy

How Fast Is HighPeak Energy Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. It is awe-striking that HighPeak Energy's EPS went from US$0.55 to US$1.89 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. HighPeak Energy shareholders can take confidence from the fact that EBIT margins are up from 46% to 56%, and revenue is growing. Both of which are great metrics to check off for potential growth.

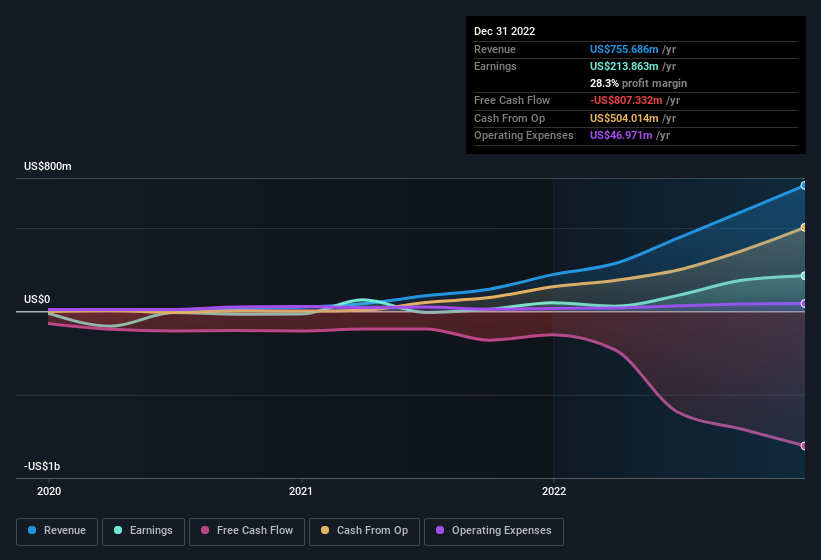

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of HighPeak Energy's forecast profits?

Are HighPeak Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that HighPeak Energy insiders spent a staggering US$68m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the company insider, John DeJoria, who made the biggest single acquisition, paying US$50m for shares at about US$21.61 each.

Along with the insider buying, another encouraging sign for HighPeak Energy is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$258m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does HighPeak Energy Deserve A Spot On Your Watchlist?

HighPeak Energy's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe HighPeak Energy deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with HighPeak Energy (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

The good news is that HighPeak Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HPK

HighPeak Energy

Operates as an independent crude oil and natural gas exploration and production company.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives