- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

Here's Why We Think HighPeak Energy (NASDAQ:HPK) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like HighPeak Energy (NASDAQ:HPK). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for HighPeak Energy

HighPeak Energy's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is awe-striking that HighPeak Energy's EPS went from US$0.13 to US$1.65 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

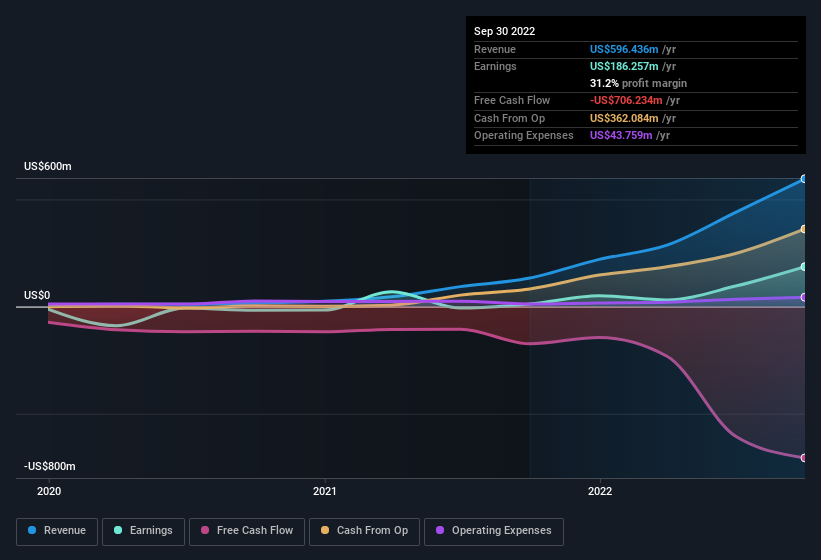

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that HighPeak Energy is growing revenues, and EBIT margins improved by 26.8 percentage points to 58%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of HighPeak Energy's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are HighPeak Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth US$181k) this was overshadowed by a mountain of buying, totalling US$64m in just one year. This adds to the interest in HighPeak Energy because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was company insider John DeJoria who made the biggest single purchase, worth US$50m, paying US$21.61 per share.

On top of the insider buying, it's good to see that HighPeak Energy insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$244m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Should You Add HighPeak Energy To Your Watchlist?

HighPeak Energy's earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest HighPeak Energy belongs near the top of your watchlist. Even so, be aware that HighPeak Energy is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Keen growth investors love to see insider buying. Thankfully, HighPeak Energy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HPK

HighPeak Energy

Operates as an independent crude oil and natural gas exploration and production company.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives