- United States

- /

- Oil and Gas

- /

- NasdaqGS:GLNG

Does Gimi Refinancing And New Buyback Change The Bull Case For Golar LNG (GLNG)?

Reviewed by Sasha Jovanovic

- Golar LNG Limited recently closed and drew a new US$1.20 billion asset-backed debt facility to refinance the FLNG Gimi, replacing an existing US$627 million loan, while also reporting mixed third-quarter 2025 results, declaring a dividend, and approving a new US$150 million share buyback program.

- An interesting takeaway is that this refinancing releases about US$400 million in net liquidity to Golar, highlighting how its capital structure decisions may influence future financial flexibility and capital returns.

- We’ll now examine how the US$1.20 billion FLNG Gimi refinancing and released liquidity reshape Golar LNG’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Golar LNG Investment Narrative Recap

To own Golar LNG, you generally need to believe in long duration FLNG cash flows and the value of its contracted backlog, while accepting project, concentration, and balance sheet risk. The US$1.20 billion Gimi refinancing materially improves near term liquidity, which supports the key short term catalyst of funding future FLNG growth, but it also reinforces the main risk around leverage and ongoing access to large, long tenor debt markets.

The newly approved US$150 million share buyback program sits alongside the Gimi refinancing as the most relevant recent announcement, because both hinge on Golar’s financial headroom and cash generation. While the buyback may signal confidence in the business and its cash flows, it also links directly back to the central question of how much capital can prudently be returned to shareholders while still funding capital intensive FLNG expansion and managing a high debt load.

Yet beneath this improved liquidity, investors should still be aware of how Golar’s capital intensive growth plans could...

Read the full narrative on Golar LNG (it's free!)

Golar LNG's narrative projects $434.8 million revenue and $205.2 million earnings by 2028.

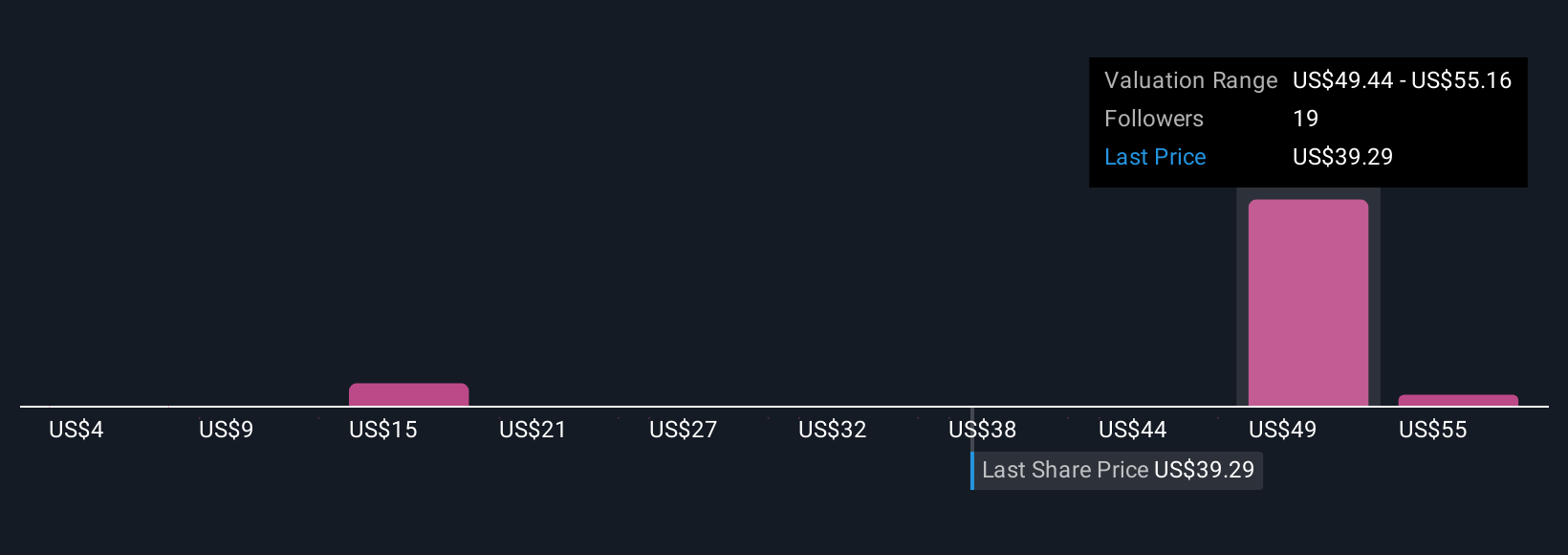

Uncover how Golar LNG's forecasts yield a $51.10 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span a wide US$3.72 to US$60.87 range, showing just how far apart individual views can be. Against that backdrop, the new US$1.20 billion Gimi refinancing and higher leverage profile give you a clear reason to compare multiple perspectives on how financing risk might affect future performance.

Explore 5 other fair value estimates on Golar LNG - why the stock might be worth as much as 59% more than the current price!

Build Your Own Golar LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Golar LNG research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Golar LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Golar LNG's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLNG

Golar LNG

Designs, converts, owns, and operates marine infrastructure for the liquefaction of natural gas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)