- United States

- /

- Oil and Gas

- /

- NasdaqCM:GEVO

Gevo (NasdaqCM:GEVO) Forms Alliance With Axens As Stock Sees 8% Quarterly Dip

Reviewed by Simply Wall St

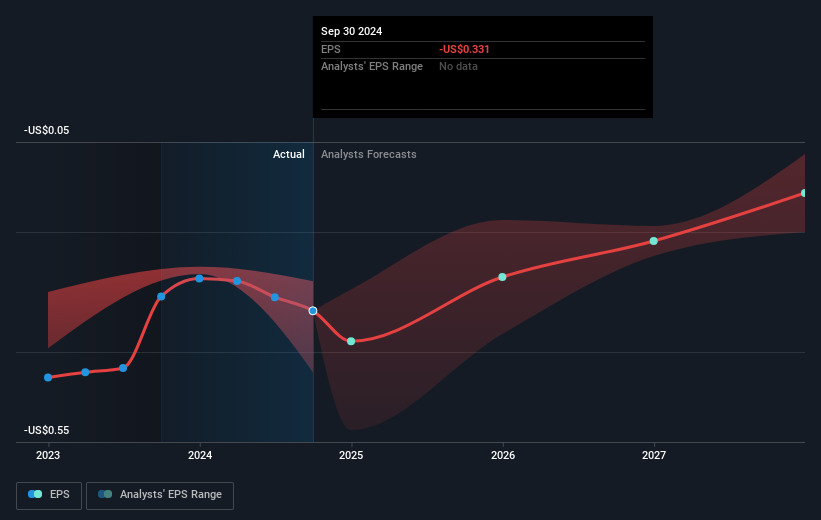

Gevo (NasdaqCM:GEVO) recently formed a strategic alliance with Axens to enhance sustainable aviation fuel development, marking significant progress in its commercialization efforts. Despite these developments, the company's stock saw a price move of 8% decline over the last quarter, potentially influenced by market conditions, including uncertainty due to recent tariff announcements and worries about economic health that have contributed to uneven performance across major U.S. stock indexes. Additionally, the Nasdaq experienced a slight increase of 17% over the past year but also faced a recent drop of 3.6%, impacting various stocks, including Gevo's. In this context, the company's price movement may reflect broader market sentiment rather than solely company-specific news. Overall, these factors underscore the fluid dynamics that can influence stock performance, even amid notable company developments.

Dig deeper into the specifics of Gevo here with our thorough analysis report.

Gevo's total shareholder return (including share price and dividends) reached 68.46% over the past year, significantly outperforming the US Oil and Gas industry, which returned 6.8%, and the broader U.S. market's 16.9%. Several factors contributed to this robust performance. A key development was Gevo's strategic alliance with Axens announced in February 2025 to advance sustainable aviation fuels, leveraging proprietary technologies for low-carbon intensity production. Additionally, Gevo's announcement of extended collaboration with LG Chem in December 2024 for renewable and bioplastic materials further bolstered investor confidence.

Gevo's share buyback program also supported shareholder returns, with a total repurchase of 7,190,006 shares for US$4.71 million by November 2024. However, amidst positive developments, the company faced challenges, such as a compliance extension from Nasdaq in August 2024, highlighting ongoing financial management hurdles. Despite these, Gevo's projected revenue growth of 33% annually suggests a promising trajectory compared to market averages.

- See how Gevo measures up with our analysis of its intrinsic value versus market price.

- Understand the uncertainties surrounding Gevo's market positioning with our detailed risk analysis report.

- Got skin in the game with Gevo? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GEVO

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives