- United States

- /

- Energy Services

- /

- NasdaqGS:CHX

Do ChampionX's (NASDAQ:CHX) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like ChampionX (NASDAQ:CHX). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for ChampionX

ChampionX's Improving Profits

Over the last three years, ChampionX has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, ChampionX's EPS soared from US$0.71 to US$0.92, over the last year. That's a impressive gain of 29%.

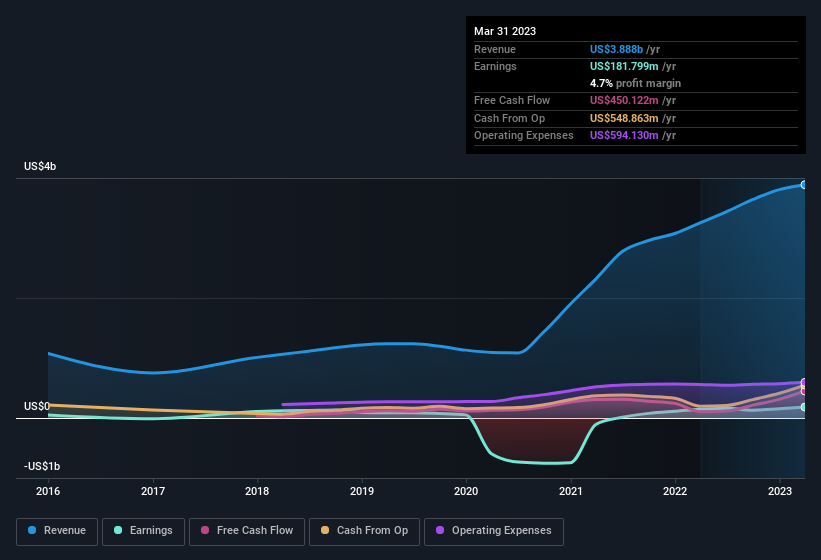

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of ChampionX shareholders is that EBIT margins have grown from 7.0% to 11% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of ChampionX's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ChampionX Insiders Aligned With All Shareholders?

Since ChampionX has a market capitalisation of US$5.7b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they hold US$43m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to ChampionX, with market caps between US$4.0b and US$12b, is around US$8.2m.

The ChampionX CEO received US$7.2m in compensation for the year ending December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is ChampionX Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into ChampionX's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that ChampionX has underlying strengths that make it worth a look at. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with ChampionX , and understanding it should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHX

ChampionX

Provides chemistry solutions, artificial lift systems, and engineered equipment and technologies to oil and gas companies worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives