- United States

- /

- Energy Services

- /

- NasdaqGS:CHX

ChampionX's (NASDAQ:CHX) Upcoming Dividend Will Be Larger Than Last Year's

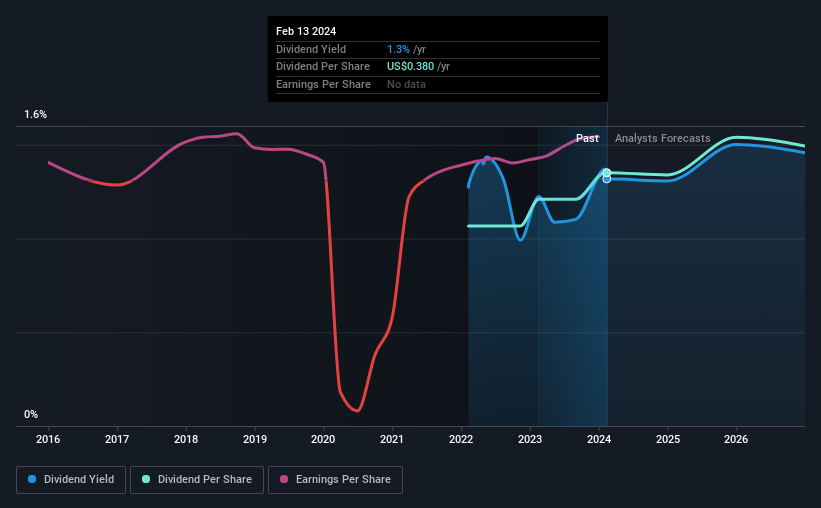

ChampionX Corporation's (NASDAQ:CHX) dividend will be increasing from last year's payment of the same period to $0.095 on 26th of April. Although the dividend is now higher, the yield is only 1.3%, which is below the industry average.

See our latest analysis for ChampionX

ChampionX's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. However, prior to this announcement, ChampionX's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 52.9%. Assuming the dividend continues along recent trends, we think the payout ratio could be 14% by next year, which is in a pretty sustainable range.

ChampionX Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2022, the annual payment back then was $0.30, compared to the most recent full-year payment of $0.38. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Has Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. ChampionX has seen EPS rising for the last five years, at 6.5% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Our Thoughts On ChampionX's Dividend

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Earnings growth generally bodes well for the future value of company dividend payments. See if the 9 ChampionX analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHX

ChampionX

Provides chemistry solutions, artificial lift systems, and engineered equipment and technologies to oil and gas companies worldwide.

Flawless balance sheet and good value.