- United States

- /

- Oil and Gas

- /

- NasdaqGS:CHRD

Will Chord Energy's (CHRD) Bold Debt Move Reshape Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Chord Energy finalized its offering of US$750 million in 6.000% senior unsecured notes due 2030 to fund its Williston Basin acquisition from XTO Energy and support debt repayment and general corporate purposes.

- A unique feature of this debt raise is the special mandatory redemption clause, providing protection to noteholders if the targeted asset acquisition is not completed by September 2026.

- We'll explore how this significant debt financing and pending asset acquisition may influence Chord Energy's capital allocation strategy and long-term outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Chord Energy Investment Narrative Recap

To be a Chord Energy shareholder, you need conviction in the company's ability to drive sustainable free cash flow and margin improvement from its concentrated Williston Basin operations. The recent US$750 million bond offering and pending XTO asset acquisition could accelerate growth if integration succeeds, but dependence on a single region remains the biggest short-term risk, especially with near-term regulatory and operational pressures. For now, this debt financing materially reinforces the importance of executing the XTO transaction on schedule.

Of the recent announcements, the upsized US$1 billion share buyback plan, authorized in early August 2025, stands out. It signals management's emphasis on capital returns alongside the acquisition, but effective buyback deployment may ultimately hinge on the added scale and cash flow stability that comes from closing and integrating the new Williston Basin assets.

By contrast, investors should be aware that concentrated regional exposure means even a single unexpected regulatory development could quickly alter the risk profile...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's narrative projects $4.4 billion in revenue and $1.0 billion in earnings by 2028. This requires a 4.3% yearly revenue decline and a $734.3 million increase in earnings from $265.7 million today.

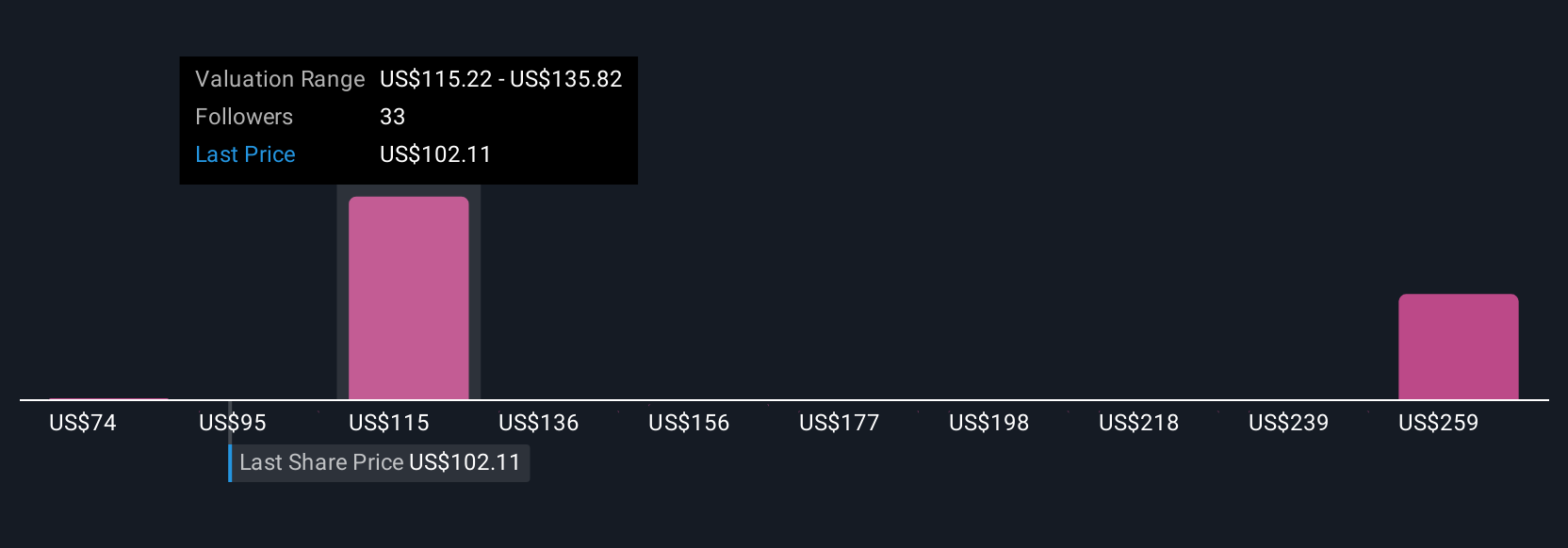

Uncover how Chord Energy's forecasts yield a $135.07 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Five private members of the Simply Wall St Community estimate fair values for Chord Energy ranging from US$74 to US$426.59 per share. As you compare these diverse outlooks, keep in mind that successful execution of the Williston Basin acquisition remains central to potential long-term performance.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRD

Chord Energy

Operates as an independent exploration and production company in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives