- United States

- /

- Oil and Gas

- /

- NasdaqCM:CETY

Clean Energy Technologies, Inc. (NASDAQ:CETY) Stocks Pounded By 36% But Not Lagging Industry On Growth Or Pricing

Clean Energy Technologies, Inc. (NASDAQ:CETY) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

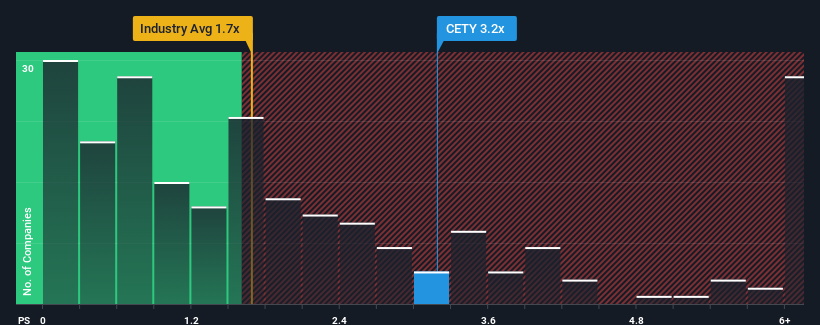

Even after such a large drop in price, you could still be forgiven for thinking Clean Energy Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in the United States' Oil and Gas industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Clean Energy Technologies

How Clean Energy Technologies Has Been Performing

With revenue growth that's exceedingly strong of late, Clean Energy Technologies has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Clean Energy Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Clean Energy Technologies' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.1% shows it's noticeably more attractive.

In light of this, it's understandable that Clean Energy Technologies' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Clean Energy Technologies' P/S Mean For Investors?

There's still some elevation in Clean Energy Technologies' P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Clean Energy Technologies maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Clean Energy Technologies that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CETY

Clean Energy Technologies

Designs, produces, and markets clean energy products and integrated solutions that focuses on energy efficiency and renewable energy in the United States and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives