- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (NasdaqGS:BKR) Joins Frontier For Carbon Capture And Power Solutions Expansion

Reviewed by Simply Wall St

Baker Hughes (NasdaqGS:BKR) recently announced a partnership with Frontier Infrastructure to advance carbon capture and storage solutions in the U.S., a significant step given the increasing focus on sustainable energy practices. This announcement comes during a quarter where the company's stock price saw a minimal decrease of 0.16%, amid a broad market downturn with a 2.5% drop. Despite the challenging market conditions, Baker Hughes reported impressive financial results, with Q4 sales increasing to $7.364 billion from the previous year. Key executive changes, including the appointment of a new CFO, and expanded client agreements, such as contracts with ExxonMobil and Argent LNG, highlight the company's growth trajectory. However, external factors like the recently imposed tariffs causing market volatility may have influenced investor sentiment. Overall, Baker Hughes continues to focus on strategic initiatives, indicating resilience amid broader economic pressures.

Click to explore a detailed breakdown of our findings on Baker Hughes.

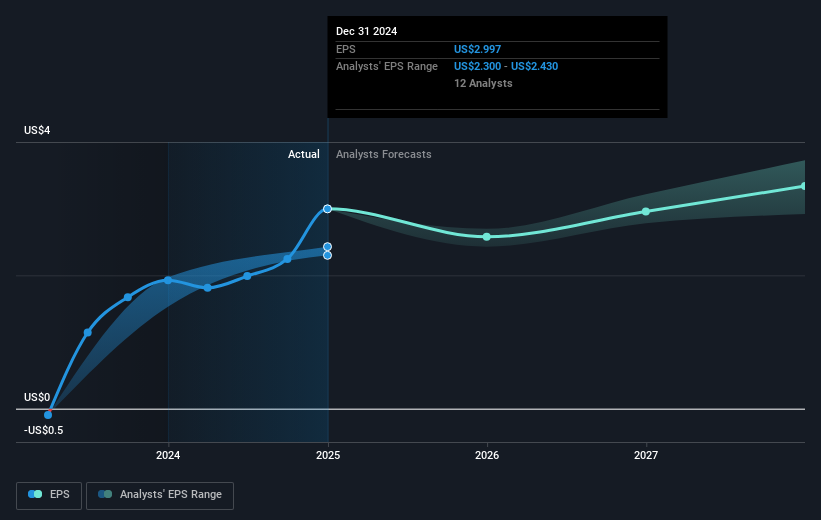

Over the past five years, Baker Hughes has delivered total shareholder returns of 303.45%, showcasing a significant upsurge in value for investors. This remarkable performance can be attributed to several key developments within the company. Successful financial results, such as 2024's full-year sales hitting US$27.83 billion and net income of US$2.98 billion, underscored a solid financial health. A substantial earnings growth of 77.5% annually over the period has also played a pivotal role in driving long-term returns, highlighting the company's focus on profitability.

Baker Hughes has strategically expanded its operations through significant client engagements and contracts. Recent major awards, such as the one from Tecnicas Reunidas for Saudi Arabia's Jafurah gas field, and collaborations with industry giants like ExxonMobil Guyana, have bolstered its market positioning. Additionally, partnerships in emerging technologies, including the joint development agreement with Hanwha for ammonia applications, have reinforced its commitment to innovation, contributing to the company outperforming the US Energy Services industry over one year.

- Discover whether Baker Hughes is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Baker Hughes' growth trajectory—explore our risk evaluation report.

- Is Baker Hughes part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives