- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (BKR): Rethinking Valuation as US Rig Count and Oil Prices Surge

Reviewed by Kshitija Bhandaru

If you’ve been eyeing Baker Hughes (BKR) lately, this past week’s headlines probably haven’t gone unnoticed. Recent data shows a solid jump in the US oil rig count and a meaningful climb in crude prices, both factors that can move the needle for companies like Baker Hughes. These shifts may feel technical, but for anyone deciding what to do with this stock, they set the stage for a fresh look at what’s actually priced in and where things could go from here.

This renewed activity comes as Baker Hughes tacks on a 43% gain over the past year, riding momentum built on top of industry tailwinds and several new agreements, such as the extension with Petrobras in Brazil. Short-term gains recently accelerated, coinciding with a supportive oil market backdrop. While year-to-date growth has been steady, the recent spike suggests that investors are recalibrating their risk and return expectations on the back of these sector-wide catalysts.

With this kind of run and an energized market, the key question is whether Baker Hughes shares are now trading at a premium or if there is still room left for upside as investors weigh the company’s true growth potential.

Most Popular Narrative: 10% Undervalued

The most widely followed narrative currently sees Baker Hughes as undervalued by approximately 10%. This perspective is grounded in the company's diversified strategy and forward revenue outlook, using a 7.73% discount rate to estimate fair value.

Baker Hughes is actively expanding into fast-growing markets like distributed power solutions for data centers and new energy infrastructure (hydrogen, CCS, geothermal). The company is capitalizing on the robust increase in global energy demand, especially from digital infrastructure and emerging markets, which positions it for long-term recurring revenue growth and higher-margin opportunities.

How does Baker Hughes' valuation stand up to analyst optimism? The real story is in the numbers fueling this price target. The most popular narrative relies on ambitious financial forecasts and assumes industry-leading profit multiples typically reserved for faster-growing companies. Want to uncover the surprising expectations keeping analysts bullish even when growth projections cool? The answer lies in these assumptions, waiting for you to explore.

Result: Fair Value of $50.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost pressures and Baker Hughes' ongoing exposure to oil and gas volatility could present hurdles to the bullish long-term narrative in the future.

Find out about the key risks to this Baker Hughes narrative.Another View: Valuation by Industry Comparison

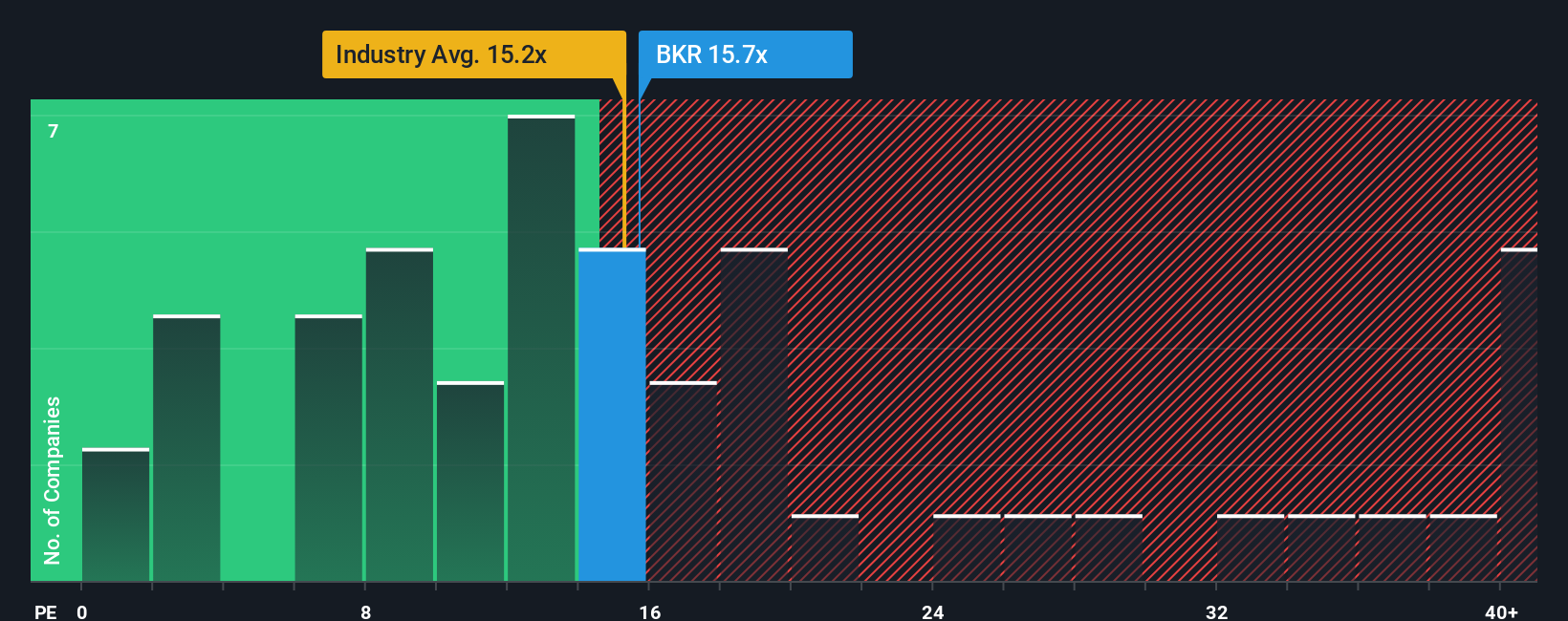

Looking from a different angle, Baker Hughes actually trades at a higher price-to-earnings ratio compared to the US Energy Services industry average. This perspective suggests the stock may not be as undervalued as initially believed. Are the market’s expectations justified, or is something being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Baker Hughes to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Baker Hughes Narrative

If you see things differently, or want to dig into the details yourself, shaping your own take on Baker Hughes is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Baker Hughes.

Looking for more investment ideas?

Don’t settle for the usual stocks when there’s a world of opportunity waiting. Focus on unique sectors and emerging leaders with these smart shortcuts:

- Catch opportunities in tomorrow's technology breakthroughs by scanning AI disruptors using the AI penny stocks link.

- Target hidden value with stocks trading below their true worth by accessing our screen for undervalued stocks based on cash flows potential.

- Tap into cash-flowing winners by finding shares with attractive income, highlighted in our search for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives