- United States

- /

- Capital Markets

- /

- NYSEAM:CET

Undiscovered Gems in the United States to Explore February 2025

Reviewed by Simply Wall St

The United States market has seen a significant upswing over the past year, with a 23% increase despite remaining flat in the last week, and earnings are forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are poised for growth yet remain under the radar can provide unique opportunities for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Target Hospitality (NasdaqCM:TH)

Simply Wall St Value Rating: ★★★★★★

Overview: Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America, with a market cap of approximately $939.45 million.

Operations: Target Hospitality generates revenue primarily from its Government segment, contributing $268.45 million, and the Hospitality & Facilities Services - South segment, adding $149.42 million.

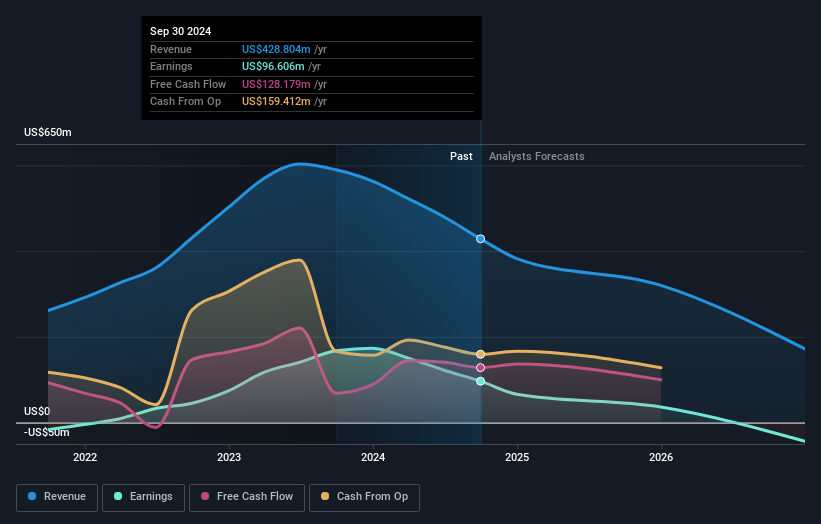

Target Hospitality, a niche player in the rental and hospitality services sector, is navigating both growth opportunities and challenges. The firm's debt to equity ratio has impressively decreased from 279.4% to 43% over five years, reflecting improved financial health. However, earnings are expected to drop by an average of 89.3% annually over the next three years due to political uncertainties and reliance on government contracts. Despite this forecasted decline, Target Hospitality's recent share repurchase of 1.53 million shares for US$12.11 million indicates confidence in its value proposition amidst efforts for strategic diversification and enhanced shareholder returns.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated offers management services to cosmetic treatment centers across Japan, Vietnam, the United States, and internationally with a market capitalization of approximately $498.34 million.

Operations: SBC generates revenue primarily from healthcare facilities and services, amounting to $223.34 million.

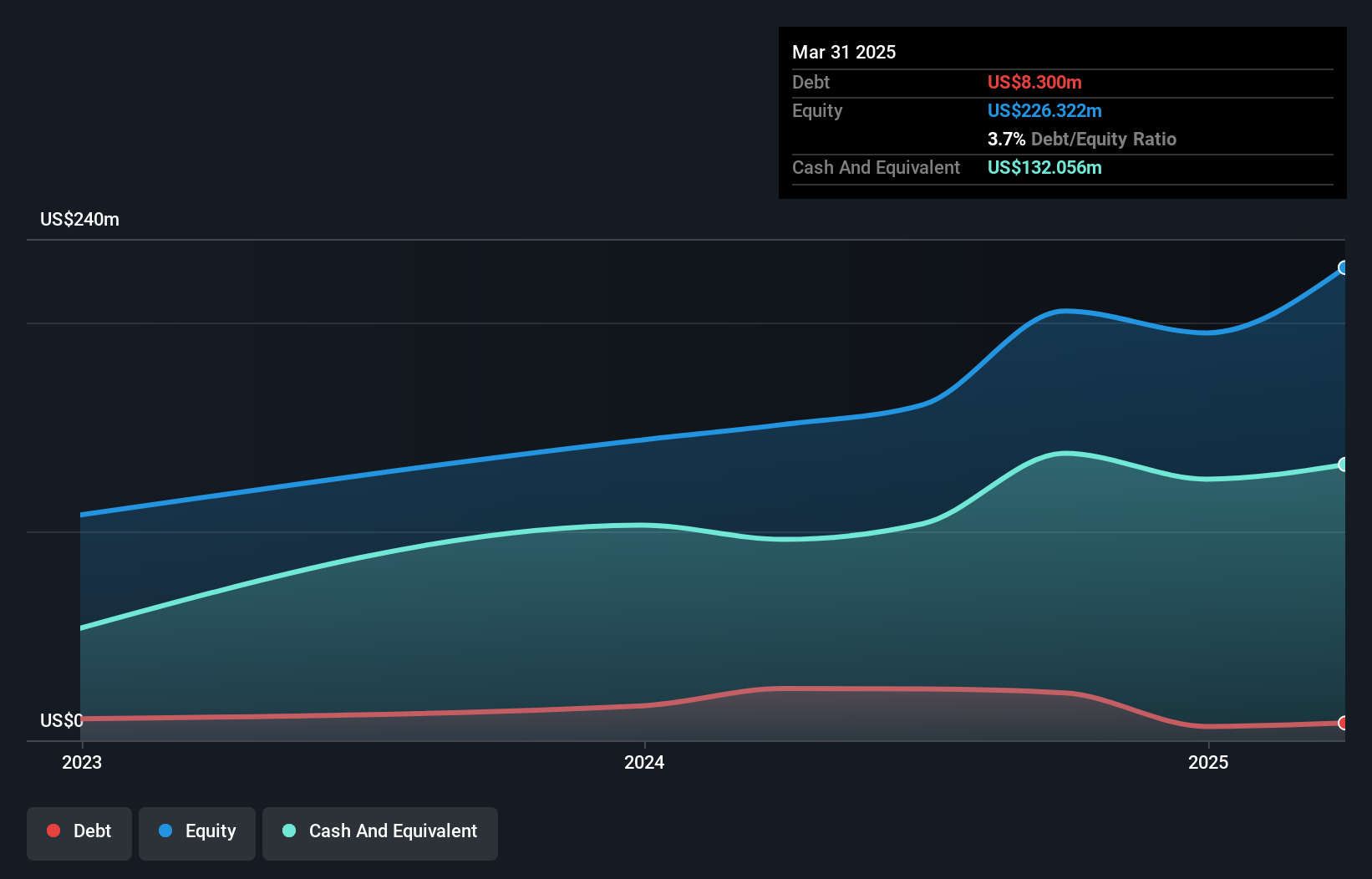

SBC Medical Group Holdings has been on a remarkable trajectory, with earnings surging by 75% over the past year, outpacing the Healthcare industry's growth of 10%. The company trades at a significant discount, approximately 84% below its estimated fair value. SBC's financial health is robust, as it holds more cash than total debt and maintains positive free cash flow. Recent initiatives like launching a translation app for medical aesthetics and expanding its Inbound-Focused Clinics indicate strategic moves to boost medical tourism. Additionally, SBC Wellness aims to enhance corporate wellness offerings, potentially driving further growth in Japan's evolving market.

Central Securities (NYSEAM:CET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of $1.35 billion.

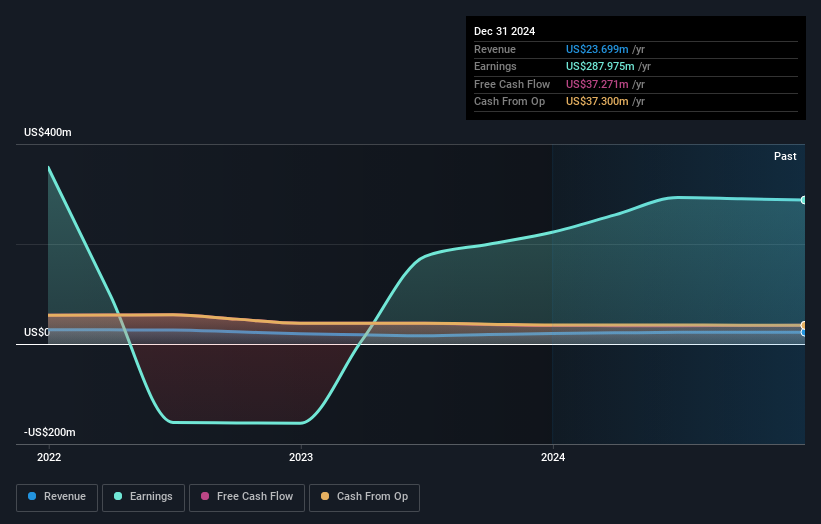

Operations: Central Securities Corp. generates revenue primarily from its financial services segment, specifically through closed-end funds, amounting to $23.37 million.

Central Securities stands out with its robust financial health, having experienced a remarkable 67% earnings growth over the past year, surpassing the Capital Markets industry's 16.5%. The company benefits from being debt-free for five years, eliminating concerns about interest payments. A significant one-off gain of US$277 million has impacted recent results, highlighting its ability to capitalize on unique opportunities. Trading at 54.7% below estimated fair value suggests potential upside for investors. Additionally, Central Securities declared a dividend of US$2.05 per share payable in December 2024, reinforcing shareholder returns and confidence in its financial stability.

Next Steps

- Explore the 279 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Good value with proven track record.

Market Insights

Community Narratives