- United States

- /

- Capital Markets

- /

- NYSE:WT

Did WisdomTree's (WT) $415 Million Convertible Bond Deal Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- WisdomTree, Inc. recently completed a US$415 million fixed-income offering of 4.625% senior unsecured notes due August 2030, with Oppenheimer & Co. Inc. serving as lead underwriter.

- This convertible bond issuance stands out for its size and callability, highlighting WisdomTree’s focus on flexible capital solutions and future growth capacity.

- With the completion of this significant convertible note offering, we'll examine how increased financial flexibility could affect WisdomTree's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

WisdomTree Investment Narrative Recap

To be a WisdomTree shareholder, you typically need to believe in its ability to deliver consistent growth through innovation in ETFs, digital assets, and private market exposures, while navigating fee compression and competition. The US$415 million convertible bond offering enhances near-term financial flexibility but does not materially change the most important catalyst, product-led AUM growth, or offset the risk from industry-wide margin pressure due to fee compression.

Of recent announcements, the July 17 launch of the WisdomTree Europe Defense Fund stands out. This move into thematic ETFs targeting geopolitical trends is most relevant as it supports AUM growth, a core short-term catalyst, which the new capital could further facilitate if market demand for such differentiated products persists. In contrast, investors should be aware that ...

Read the full narrative on WisdomTree (it's free!)

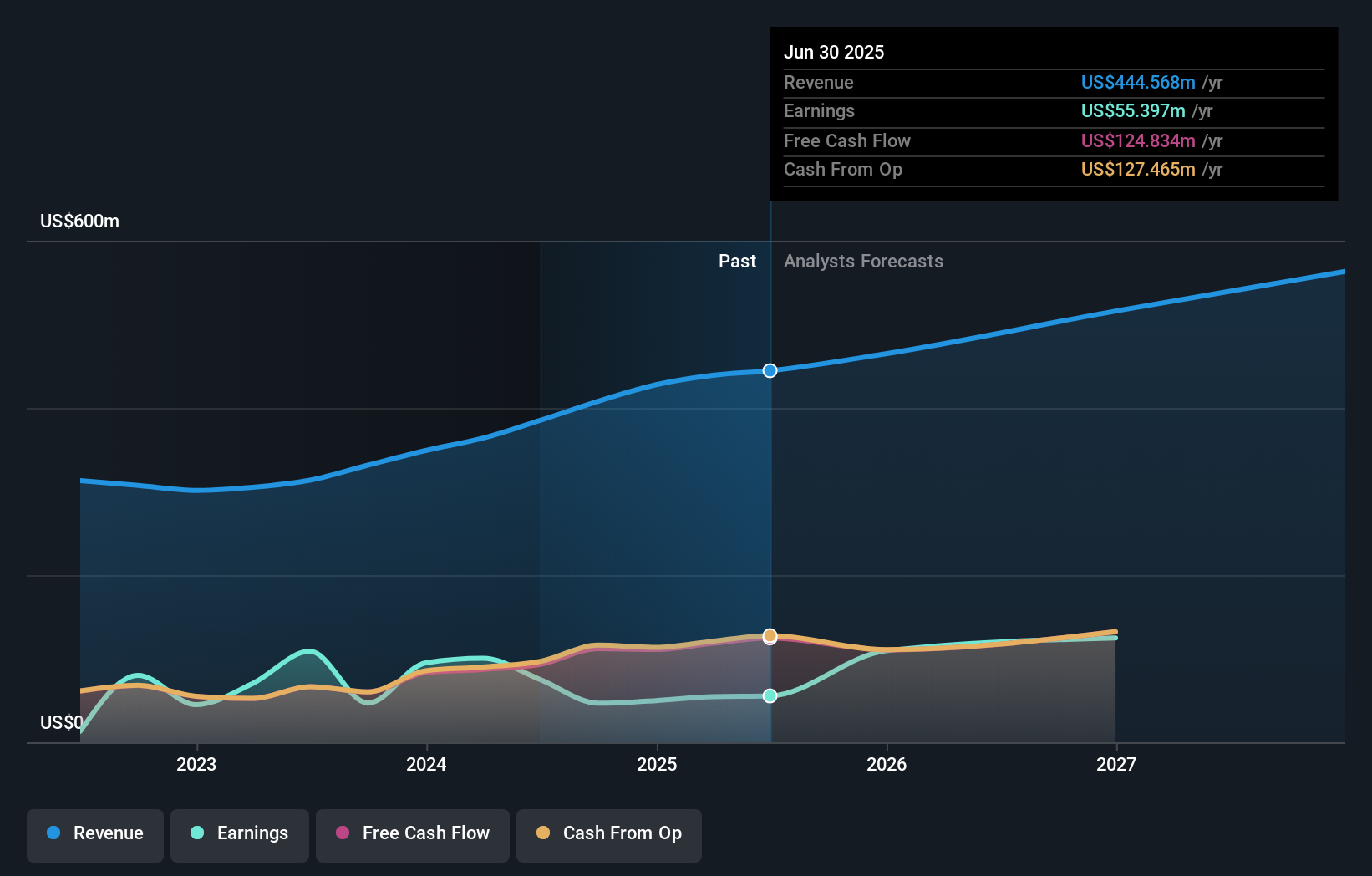

WisdomTree's outlook anticipates $595.5 million in revenue and $235.1 million in earnings by 2028. This scenario requires 10.2% annual revenue growth and a $175.5 million increase in earnings from the current $59.6 million level.

Uncover how WisdomTree's forecasts yield a $14.15 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently set WisdomTree’s fair value in a wide range from US$6.49 to US$14.15, based on two independent analyses. Against this backdrop, the focus on fee compression risk has wider implications for sustaining performance and should encourage you to consider a range of outlooks and insights.

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth as much as 7% more than the current price!

Build Your Own WisdomTree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WisdomTree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WT

WisdomTree

Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives