Last Update03 Oct 25Fair value Increased 3.08%

Analysts have raised their price target for WisdomTree from $14.35 to $14.79, citing updated assessments of revenue growth, profit margins, and future valuation multiples.

What's in the News

- Launched the WisdomTree Private Credit and Alternative Income Digital Fund, which provides access to private credit markets through blockchain-based, tokenized fund shares (Key Developments).

- Introduced the WisdomTree Europe Defense Fund (WDEF), offering targeted exposure to European defense industry leaders as geopolitical tensions rise (Key Developments).

- Added Oppenheimer & Co. Inc. as Lead Underwriter for a $415 million Fixed-Income Offering (Key Developments).

- Launched the WisdomTree GeoAlpha Opportunities Fund (GEOA) to provide exposure to global companies that may benefit from geopolitical and policy shifts (Key Developments).

- Completed the repurchase of over 29 million shares, representing nearly 20 percent of total shares outstanding, under the ongoing buyback program (Key Developments).

Valuation Changes

- Consensus Analyst Price Target increased from $14.35 to $14.79, indicating a modest upward adjustment in fair value estimates.

- Discount Rate edged up slightly from 8.73% to 8.75%, reflecting a minor increase in the required rate of return.

- Revenue Growth projection decreased marginally from 10.56% to 10.50%.

- Net Profit Margin dropped significantly from 37.92% to 27.53%, suggesting a more conservative outlook on profitability.

- Future P/E Ratio rose from 12.0x to 17.1x, indicating higher expected valuation multiples.

Key Takeaways

- Growth is driven by expansion into private assets, international markets, digital finance, and alternative investment products, supporting revenue diversification and margin improvement.

- Innovative offerings in blockchain, tokenized assets, and wealth management position the company to capture emerging opportunities and deepen distribution channels.

- Rising competition, fee compression, and regulatory risks threaten WisdomTree's growth, revenue predictability, and profitability across both traditional and digital asset segments.

Catalysts

About WisdomTree- Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

- The acquisition of Ceres Partners positions WisdomTree to capitalize on growing investor demand for private market and alternative asset exposures, particularly in underpenetrated, income-generating sectors like U.S. farmland, supporting future AUM and fee revenue growth.

- WisdomTree's early investments in blockchain, tokenization, and stablecoin-powered digital asset infrastructure are enabling new product and revenue streams (such as tokenized funds and scalable net interest income), aligning them with the expanding adoption of digital finance, which is likely to boost both top line and margin expansion.

- The continued global shift from active to passive investing remains a powerful driver for WisdomTree's core ETF business, as evidenced by broad-based net inflows, growing international scale, and record AUM, which should translate to higher revenue and improved operating leverage.

- Successful international expansion, particularly in Europe, is driving strong organic growth via differentiated products (like the European Defense Fund), boosting cross-regional flows and deepening the company's distribution reach, supporting sustained earnings growth and improvement in net margins.

- Robust model portfolio and direct indexing initiatives (including the Quorus partnership) demonstrate the firm's capacity to capture new wealth management trends and distribution channels, likely further diversifying revenue streams and stabilizing or expanding net margins.

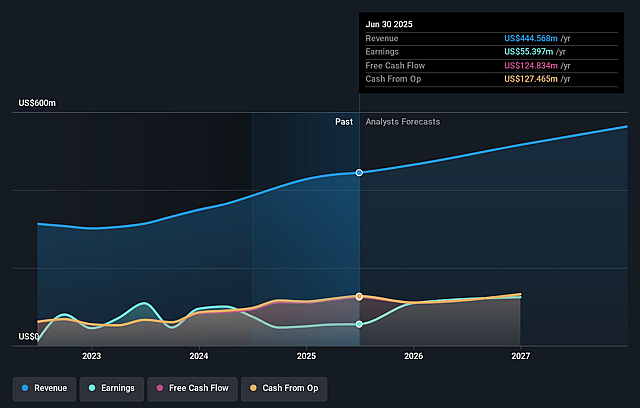

WisdomTree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming WisdomTree's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.4% today to 37.9% in 3 years time.

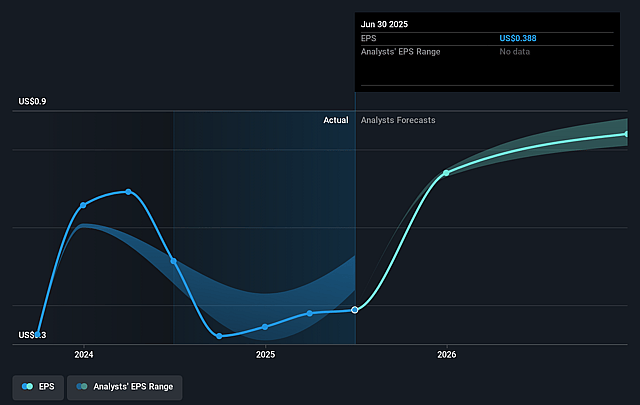

- Analysts expect earnings to reach $227.8 million (and earnings per share of $1.51) by about September 2028, up from $59.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 32.8x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 1.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.73%, as per the Simply Wall St company report.

WisdomTree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Farmland as an asset class may face long-term headwinds from rising investor preference for more liquid or scalable private market alternatives (such as private credit or infrastructure) and increasing competition as other asset managers enter the space, potentially slowing WisdomTree's AUM growth and diversification benefits, which could limit future revenue and fee expansion.

- Heavy reliance on performance fees from the farmland fund exposes WisdomTree to volatility in agricultural land pricing, unpredictable mark-to-market events, and macroeconomic risks (such as changing commodity prices, climate impact, or interest rate changes), which could negatively impact the predictability of future revenues and net earnings.

- Ongoing industry-wide fee compression, driven by the proliferation of ultra low-cost or zero-fee investment products and increasing transparency around investment costs, threatens WisdomTree's revenue per asset managed and long-term net margins-especially as ETF and model portfolio markets become more commoditized.

- Significant investment and optimism around digital assets and stablecoin initiatives may carry execution and regulatory risk; if demand for tokenized assets or stablecoins fails to scale, or if tough new regulations emerge, WisdomTree could face subpar returns on invested capital and lower or negative contribution to earnings from these segments.

- Potential for industry consolidation or increased competition from larger global asset managers-who may eventually enter or scale-up in both farmland and digital asset markets-threatens WisdomTree's market share, pricing power, and ability to maintain above-average revenue growth, putting longer-term pressure on both top-line and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.35 for WisdomTree based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $12.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $600.8 million, earnings will come to $227.8 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 8.7%.

- Given the current share price of $13.65, the analyst price target of $14.35 is 4.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.