Key Takeaways

- Rising competition from low-cost investment options and large asset managers is constraining WisdomTree's revenue growth and capacity to maintain premium pricing.

- Expansion into digital assets and niche acquisitions adds significant risk and volatility to earnings, especially under tightening regulatory conditions.

- Strategic acquisitions, digital asset momentum, product innovation, and diverse distribution are driving robust growth, margin improvement, and reduced reliance on any single market or asset class.

Catalysts

About WisdomTree- Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

- Fee revenue growth is likely to be structurally limited by the accelerating dominance of low-cost passive investing and the proliferation of direct indexing and robo-advisor platforms, which erode product differentiation and pressure WisdomTree's ability to command premium pricing, thereby constraining both revenue and long-term earnings growth.

- The high capital outlays for expansion into digital assets, blockchain solutions, and tokenization initiatives introduce substantial execution and regulatory risk; any delay in industry-wide adoption or unforeseen compliance challenges could turn these costs into long-duration drags on net income and operational margins.

- WisdomTree's acquisition of Ceres Partners raises overall exposure to niche and illiquid assets, and the heavy reliance on performance fees tied to farmland appreciation and optional solar/data center windfalls creates heightened earnings volatility; if the private markets stall or farmland returns normalize, revenue and net margins could decline significantly.

- Industry consolidation and price wars, particularly from mega-issuers like BlackRock, Vanguard, and Schwab expanding in-house low-fee ETFs, threaten WisdomTree's market share and distribution reach, leading to sustained pressure on fee capture rates and top-line revenue growth over the next decade.

- Increasing regulatory scrutiny and the mounting cost of cross-border compliance, especially in the US and Europe, are likely to escalate operational expenses and erode profitability at a time when the asset management industry is already facing narrowed margins from commoditization.

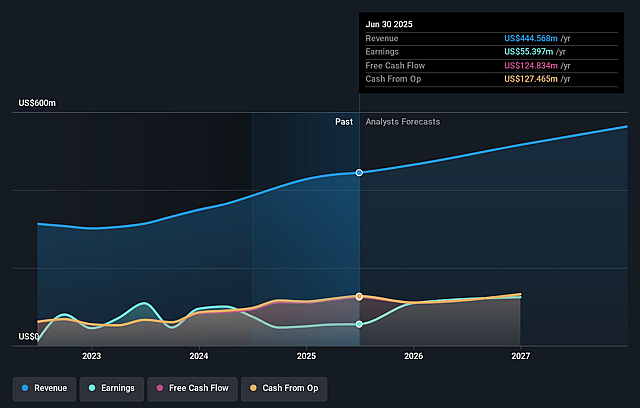

WisdomTree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on WisdomTree compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming WisdomTree's revenue will grow by 9.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.4% today to 35.5% in 3 years time.

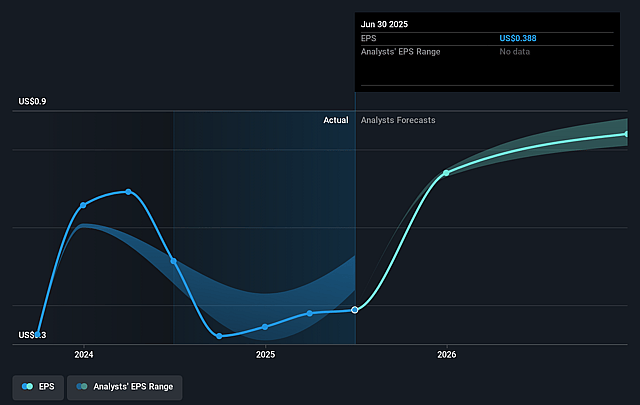

- The bearish analysts expect earnings to reach $209.7 million (and earnings per share of $1.4) by about September 2028, up from $59.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 33.0x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 1.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.74%, as per the Simply Wall St company report.

WisdomTree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of Ceres Partners provides WisdomTree with exposure to U.S. farmland, an underpenetrated $3.5 trillion asset class with stable historical returns averaging 10 percent per year and strong diversification benefits, which could drive both revenue and margin expansion in the long term.

- WisdomTree is demonstrating significant momentum in digital assets and stablecoins, with AUM in this segment growing from $350 million to $500 million in a single quarter and the stablecoin ecosystem projected to exceed $3.5 trillion by 2030, suggesting substantial future top-line and fee revenue growth.

- Record net inflows and all-time high assets under management across U.S., Europe, and digital assets, coupled with strength in broad, diverse product lines such as the European Defense Fund and model portfolios, point to robust organic growth and support continued improvement in revenue and adjusted net income.

- The company is leveraging its differentiated technology-driven platform, with successful early investments in digital asset infrastructure and regulated tokenized products, which position it as a leader in the rapidly expanding tokenization and on-chain finance industries, a trend that can improve future margins and operating leverage.

- WisdomTree's cross-channel distribution and product innovation capabilities, including penetration into international markets and new thematic products, are widening its addressable market and reducing reliance on any single geography or asset class, helping to sustain and diversify its revenue base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for WisdomTree is $12.25, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of WisdomTree's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $12.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $590.0 million, earnings will come to $209.7 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $13.71, the bearish analyst price target of $12.25 is 11.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on WisdomTree?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.