- United States

- /

- Diversified Financial

- /

- NYSE:WEX

WEX (WEX) Valuation in Focus After Trucker Path Partnership Expands Fleet Solutions

Reviewed by Kshitija Bhandaru

WEX (WEX) just unveiled a partnership with Trucker Path to bring advanced navigation and fleet management tools to its commercial EFS customers. The joint initiative aims to support trucking operations with features tailored for real-world industry challenges.

See our latest analysis for WEX.

WEX’s latest partnership arrives against a backdrop of weak share price momentum. After a tough stretch this year, with a year-to-date share price return of -13.06%, news like the Trucker Path collaboration could lift sentiment by highlighting WEX’s focus on practical solutions. Longer-term total shareholder returns, at 8.4% over three years, remind investors that the bigger picture can evolve as new services take hold.

Curious where innovation meets growth outside the usual picks? Consider broadening your watchlist and discover fast growing stocks with high insider ownership

With the stock still trading at a notable discount to analyst price targets despite recent strategic moves, the key question is whether WEX is undervalued at current levels or if the market is accurately factoring in its future growth prospects.

Most Popular Narrative: 17.5% Undervalued

The most widely followed narrative prices WEX well above its latest close, hinting at sizable upside if key assumptions hold true in the years ahead.

The recent signing of a long-term agreement with BP, including both new card sales and the future conversion of BP's existing commercial fleet portfolio, will expand WEX's reach across core fueling segments and is expected to add 0.5% to 1% to company revenue in the first full year post-conversion. This is set to catalyze revenue acceleration in 2026 and beyond, as digital and card-based payments adoption grows across fleet operations.

Curious how rapid market adoption, product innovation, and bold expansion targets combine to support this bullish price? One ambitious revenue projection and game-changing profit margin goal could be behind the narrative’s optimistic valuation. Discover which future milestones analysts believe will redefine WEX’s true value.

Result: Fair Value of $184.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from fintech challengers and the risk of regulatory or technology shifts could quickly test the durability of WEX’s bullish outlook.

Find out about the key risks to this WEX narrative.

Another View: Looking at Market Comparisons

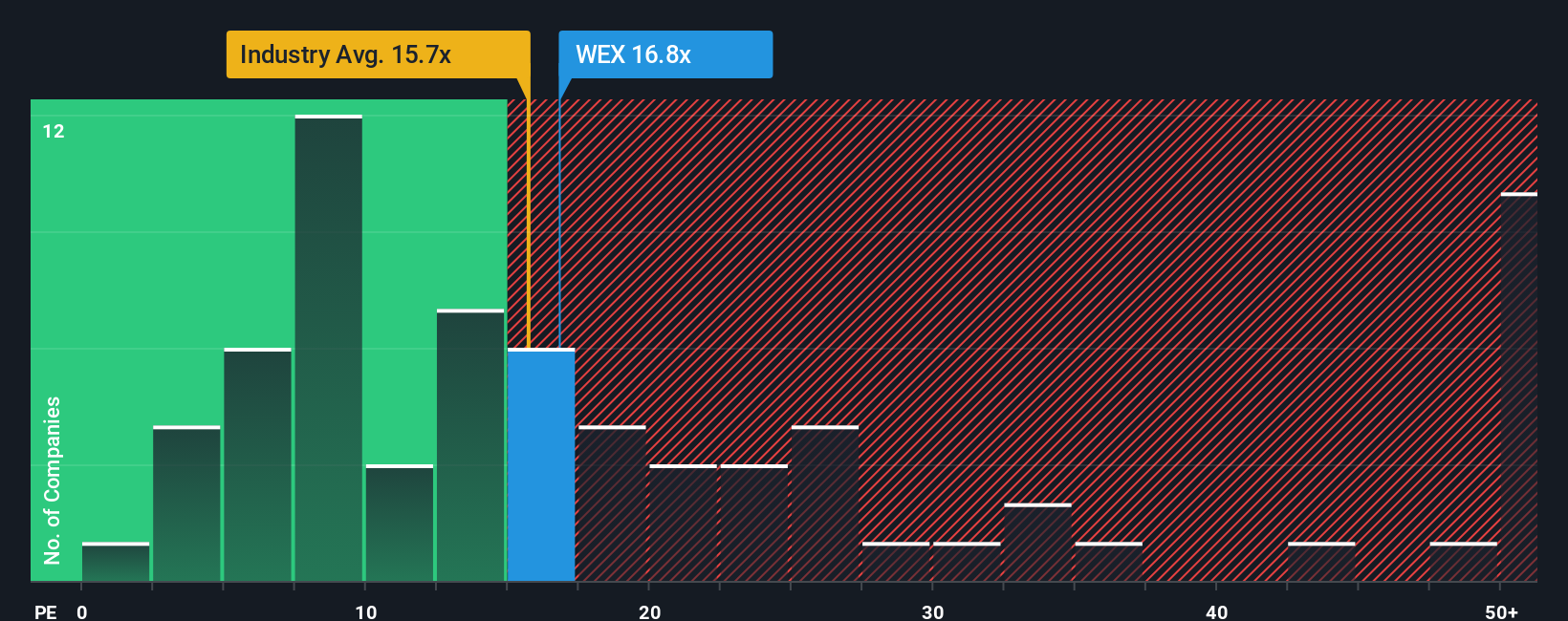

While analysts forecast WEX as undervalued, the market’s favored price-to-earnings ratio tells a more cautious story. At 17x, WEX is more expensive than the industry average (15.6x) and its own fair ratio (16.8x), but cheaper than peers (20.6x). Does this create extra risk or hidden potential for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEX Narrative

If the story here doesn’t fully match your view or you’d rather dig into the numbers yourself, crafting a custom narrative takes less than three minutes. Why not Do it your way?

A great starting point for your WEX research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock unique opportunities that others might miss by acting now. These focused stock picks could jump-start your next big win.

- Tap into tomorrow’s big payouts with these 18 dividend stocks with yields > 3% that have strong yields and proven track records.

- Gain an edge with these 24 AI penny stocks reshaping entire industries through breakthrough artificial intelligence innovations.

- Catch early-stage growth with these 3559 penny stocks with strong financials poised for major upside and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives