- United States

- /

- Capital Markets

- /

- NYSE:VRTS

Virtus Investment Partners (VRTS): Evaluating a Low P/E and DCF Discount After This Year’s Share Price Slide

Reviewed by Simply Wall St

Virtus Investment Partners (VRTS) has been drifting lower this year, and that slide is starting to invite closer scrutiny from value focused investors watching the asset management space.

See our latest analysis for Virtus Investment Partners.

The 1 year to date share price return of negative 24.32 percent and 1 year total shareholder return of negative 25.21 percent suggest momentum has clearly faded, even though the recent 30 day share price gain hints that some investors are starting to reassess the risk reward profile at around 165.90 dollars a share.

If you are weighing whether Virtus still fits your strategy, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With the shares trading below analyst targets and at a meaningful intrinsic discount, the market seems cautious about Virtu’s growth prospects. Is this a mispriced value opportunity, or is Wall Street correctly discounting weaker years ahead?

Price-to-Earnings of 8.2x: Is it justified?

On a price to earnings basis, Virtus Investment Partners looks inexpensive at 165.90 dollars per share compared to both peers and the wider Capital Markets industry.

The price to earnings ratio compares the current share price to the company’s earnings per share, making it a simple gauge of how much investors are paying for each dollar of current profit. For an asset manager like Virtus, where earnings quality is considered high and profitability has recently improved, this lens is particularly useful.

Statements indicate that VRTS is trading at a price to earnings multiple of 8.2 times, which is noted as good value both versus a peer average of 24.6 times and the broader US Capital Markets industry on 25 times. That discount suggests the market is heavily discounting the durability of current earnings or future growth, despite net profit margins rising from 13.4 percent to 15.5 percent and a forecast return on equity stepping up to 21.6 percent in three years time.

Relative to the sector, the gap is stark, with Virtus changing hands at roughly a third of the typical price to earnings multiple seen across its closest competitors and the industry as a whole. If profitability holds anywhere near current levels, that spread may indicate scope for the valuation to move closer to peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.2x

However, slower revenue growth and lingering share price weakness could signal that clients are reallocating capital and limiting Virtus’s ability to sustain recent profitability improvements.

Find out about the key risks to this Virtus Investment Partners narrative.

Another View: Discounted Cash Flow

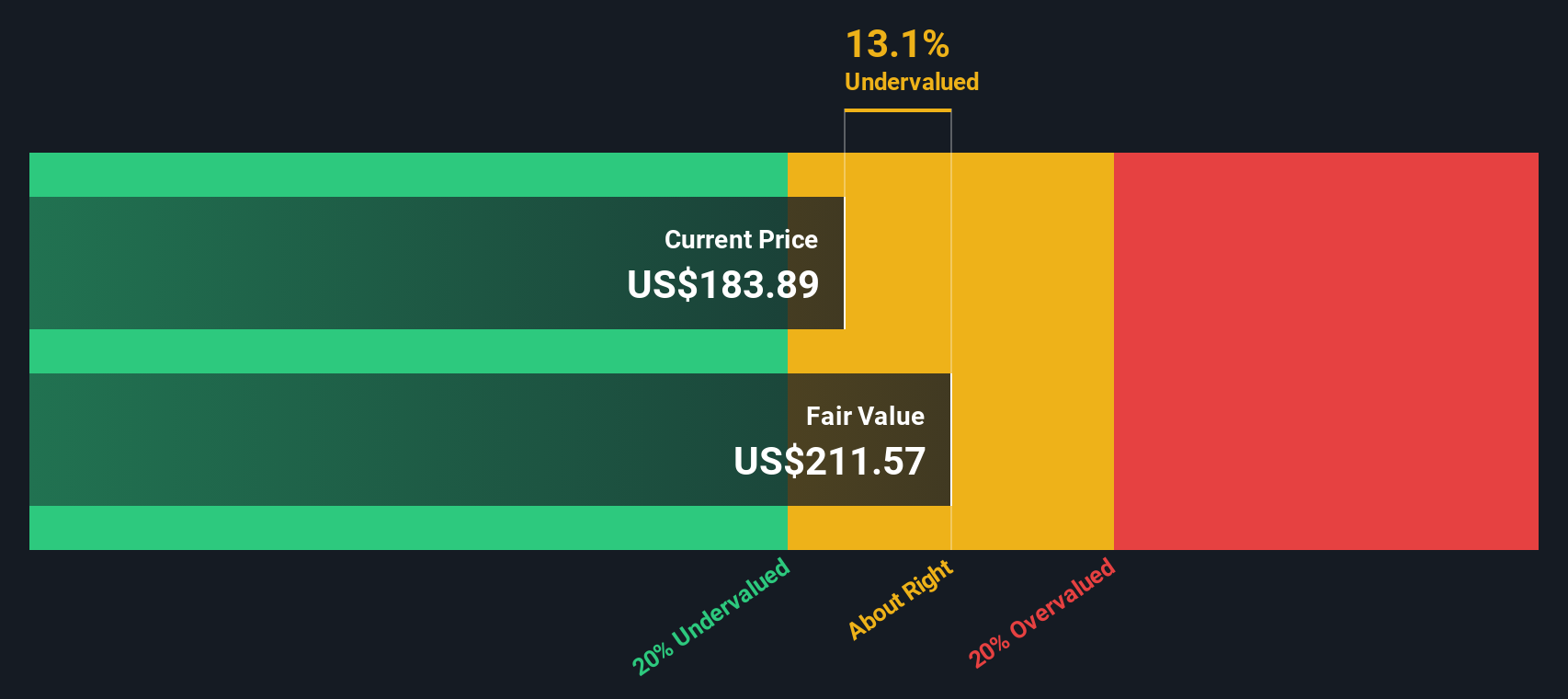

Our DCF model paints an even cheaper picture, suggesting Virtus is trading about 20 percent below an estimated fair value of roughly 207.95 dollars per share. If earnings are volatile and assets can walk out the door, how much weight should investors really give this gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virtus Investment Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virtus Investment Partners Narrative

If this perspective does not fully align with your own outlook, you can quickly dive into the numbers, shape your thesis, and Do it your way in under three minutes.

A great starting point for your Virtus Investment Partners research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh opportunities on their radar, so do not stop at Virtus when you can tap curated ideas built from powerful data screens.

- Tap into income potential by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with cash returns.

- Ride the next wave of innovation by targeting these 26 AI penny stocks that may benefit from advances in artificial intelligence.

- Strengthen your margin of safety by focusing on these 906 undervalued stocks based on cash flows where pessimism may have pushed prices below their underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)