- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC): Valuation Analysis as Legal Risks Remain After Partial Lawsuit Dismissal

Reviewed by Kshitija Bhandaru

UWM Holdings (UWMC) shares have now fallen for a third straight day as investors digest mixed news from an ongoing class action lawsuit surrounding alleged mortgage lending practices. The latest court decision dismissed most claims but left key legal risks unresolved.

See our latest analysis for UWM Holdings.

Despite recent volatility and legal uncertainty, UWM Holdings’ share price has bounced around this year. A 90-day share price return of nearly 29% shows that short-term momentum was once building, even as the 1-year total shareholder return remains well in negative territory. It appears that sentiment is fluctuating between hope for a rebound and wariness over the persistent legal risks looming in the background.

If the shifts in UWM Holdings’ outlook have you wondering where to look next, now is an ideal moment to discover fast growing stocks with high insider ownership

Given these mixed signals and the ongoing legal cloud, the core question is whether UWM Holdings is trading at a meaningful discount or if markets have already accounted for any possible upside from future growth. Could this be a real buying opportunity, or is optimism already priced in?

Most Popular Narrative: 11% Undervalued

With UWM Holdings closing at $5.35, the most followed market narrative suggests fair value is higher. This gap hints at further upside if the narrative’s assumptions prove out.

Bringing servicing in-house is anticipated to generate cost efficiencies and enhance customer lifetime value by improving borrower loyalty and repeat/referral business for brokers. This is expected to benefit both net margins and revenues beginning in 2026 and beyond.

Ready for the full inside story? The catalyst behind this bullish fair value projection includes a dramatic increase in future company earnings and a profit margin boost. Want to see the bold assumptions that underpin analysts’ optimism? The key details behind this valuation might surprise you.

Result: Fair Value of $6.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or weaker mortgage demand could quickly undermine these optimistic forecasts. This could put both future earnings and valuation at risk.

Find out about the key risks to this UWM Holdings narrative.

Another View: Multiples Paint a Different Picture

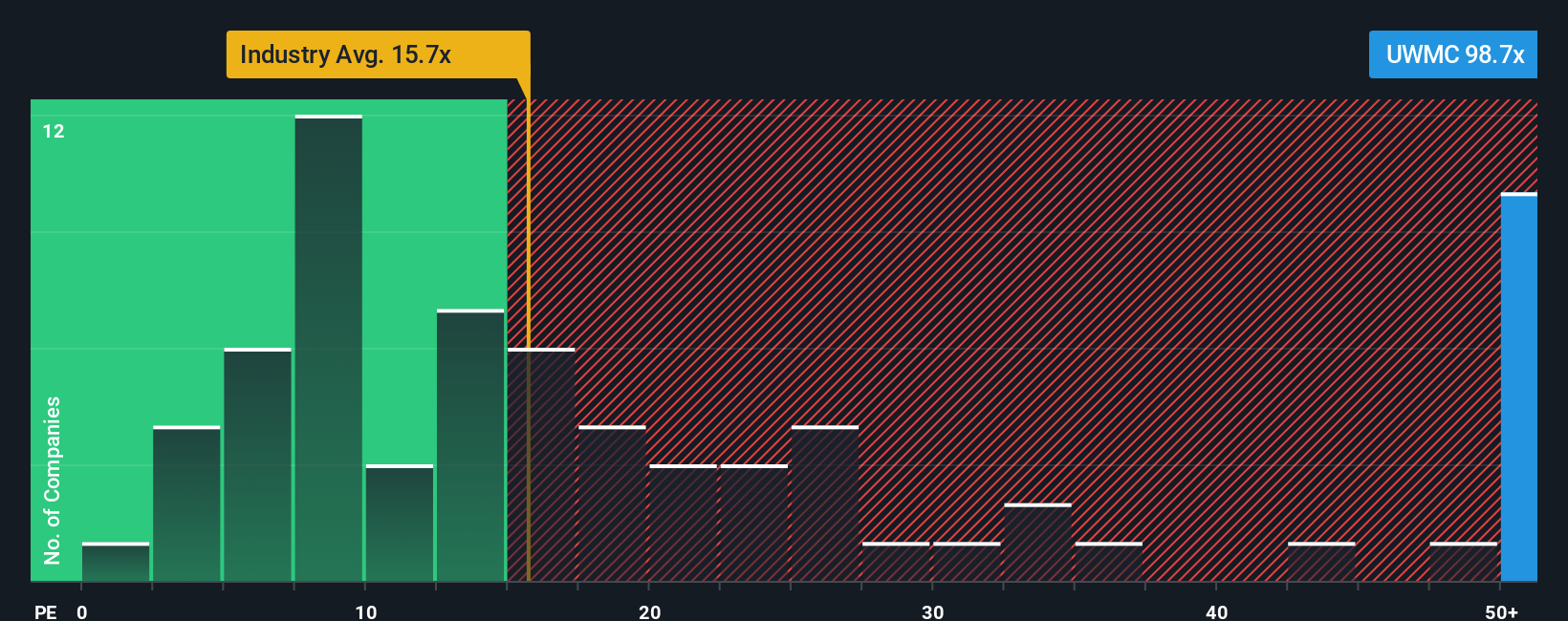

However, looking at the price-to-earnings ratio gives a much less optimistic reading. UWM Holdings is currently valued at 98.7 times earnings, which is far above both its industry average of 16.1 and the peer average of 7.9. The fair ratio model suggests 32 would be a more typical valuation for this stock. This means that even with strong growth, the current price may have incorporated a lot of expectations already. Could this premium expose investors to more downside if the narrative shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UWM Holdings Narrative

If these opinions do not match your own or you want to dig deeper into the data, you can craft your own personalized narrative in just a few minutes with Do it your way.

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now is an excellent time to stay ahead of market shifts and uncover opportunities others might miss. Let your next winning idea come from a smarter search.

- Unlock steady portfolio income by exploring these 19 dividend stocks with yields > 3% with attractive yields above 3 percent and proven payout histories.

- Capitalize on emerging tech by considering these 24 AI penny stocks that could benefit as artificial intelligence shapes new industries and business models.

- Find potential bargains by screening these 899 undervalued stocks based on cash flows stocks showing strong cash flow but overlooked by most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives