- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Toast (TOST): Valuation Check After BNP Paribas Exane Upgrade and AI-Focused Growth Push

Reviewed by Simply Wall St

Toast (TOST) is back in the spotlight after BNP Paribas Exane bumped the stock up to an Outperform rating, just as the company leans into AI driven restaurant tools and steadier margin improvement.

See our latest analysis for Toast.

Even after a choppy few months and a roughly 7 percent year to date share price decline, Toast’s three year total shareholder return of about 96 percent suggests the longer term growth story is still very much intact. Recent AI focused upgrades also hint that momentum could be rebuilding rather than fading.

If Toast’s AI push has your attention, it might be a good moment to see what else is emerging across high growth tech, starting with high growth tech and AI stocks.

Yet with the stock still below consensus price targets but riding a powerful AI and recurring revenue story, are investors looking at an underappreciated compounder, or a name where future growth is already fully priced in?

Most Popular Narrative Narrative: 28.5% Undervalued

With Toast’s fair value estimate sitting well above the last close at $33.83, the dominant narrative leans toward meaningful upside from here.

The consistent increase in ARPU, both through upselling additional modules (inventory, loyalty, marketing, etc.) and innovative fintech solutions like Toast Capital, suggests Toast is successfully scaling its platform ecosystem, boosting net retention rates and high margin recurring revenue streams.

Curious how a recurring revenue engine, rising margins, and a rich future earnings multiple can still line up to a discount today? The narrative unpacks bold growth, profitability, and valuation assumptions that could reframe how you see Toast’s current share price, but the exact numbers and timing might surprise you.

Result: Fair Value of $47.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained marketing spend and hardware cost pressures, combined with softer restaurant sales trends, could quickly challenge the upbeat growth and margin narrative.

Find out about the key risks to this Toast narrative.

Another View: Rich Multiples Signal Caution

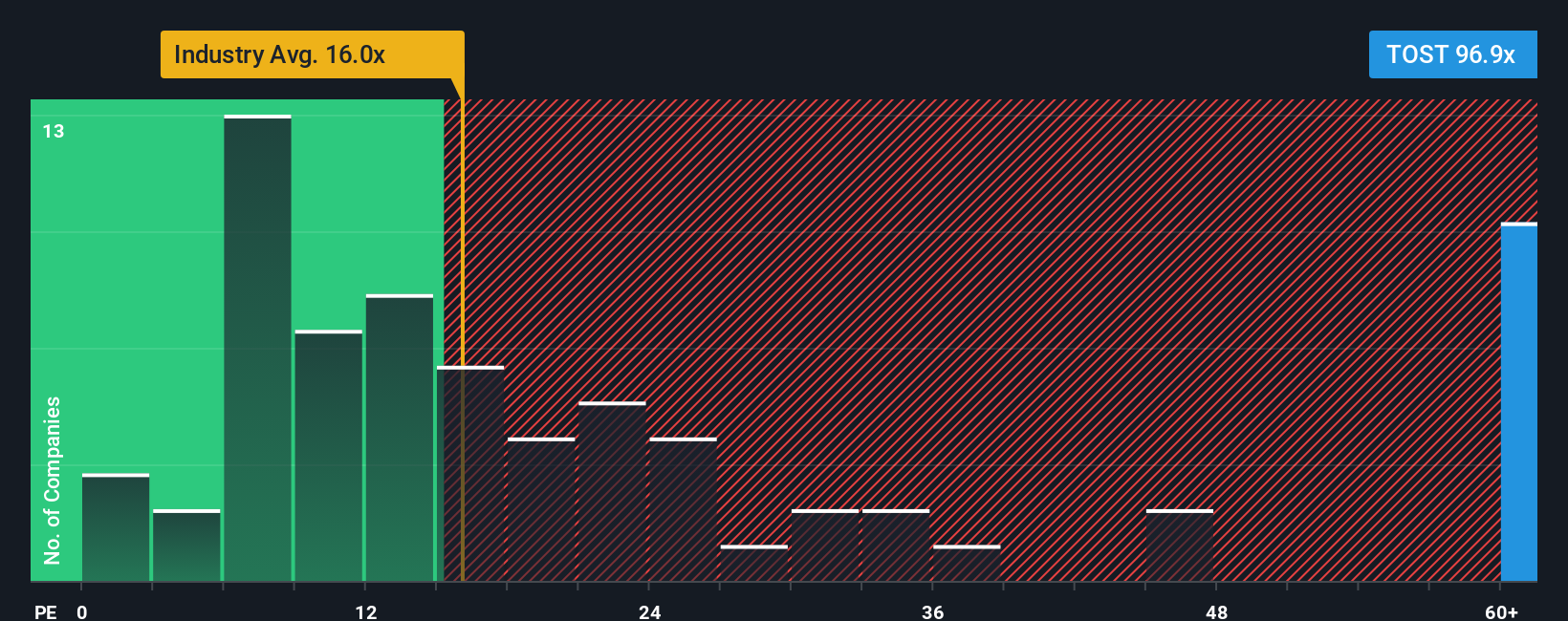

While the narrative model points to upside, the current earnings multiple tells a tougher story. Toast trades at about 72.9 times earnings, far above the US Diversified Financial industry at 13.7 times, peers near 38 times, and even a 22.4 times fair ratio. That gap suggests real valuation risk if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toast Narrative

If you would rather challenge these assumptions or dig into the numbers yourself, you can build a personalized view of Toast in minutes. Get started with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toast.

Ready for more high conviction ideas?

Do not stop at Toast when the market is full of potential. Let the Simply Wall St Screener surface fresh opportunities tailored to how you invest.

- Capture rapid small cap momentum by targeting these 3576 penny stocks with strong financials that already back their story with strengthening balance sheets and improving cash flows.

- Position your portfolio for the next wave of automation by focusing on these 24 AI penny stocks powering breakthroughs in software, data infrastructure, and intelligent tools.

- Lock in income potential while it is still overlooked by zeroing in on these 14 dividend stocks with yields > 3% that combine solid payouts with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026