- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Toast (NYSE:TOST) Unveils AI-Driven ToastIQ To Revolutionize Restaurant Operations

Reviewed by Simply Wall St

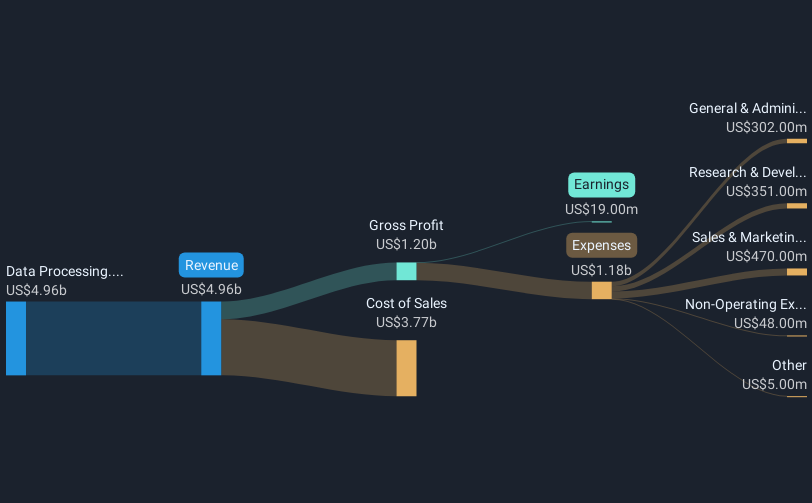

Toast (NYSE:TOST) recently unveiled ToastIQ, an intelligence engine that enhances restaurant operations with innovative features like personalized recommendations and AI-driven workflows. These advancements are integrated across its platform, reflecting the company's commitment to improving service and marketing optimization. Over the last month, the company's share price rose 7.27%, a movement that aligns with the broader market uptrend where major indexes also witnessed gains. Toast's partnership with Dine Brands Global Inc. expanded its technological reach, potentially adding weight to its positive performance, amidst a general market trend buoyed by strong tech sector results.

Find companies with promising cash flow potential yet trading below their fair value.

The introduction of ToastIQ comes at a pivotal moment for Toast as they seek to enhance their platform with AI-driven features. This innovation could bolster the company's efforts in expanding its addressable market, potentially driving revenue and earnings growth. By integrating personalized recommendations and AI-driven workflows, Toast is well-positioned to improve customer satisfaction and gain market share, particularly in enterprise, international, and retail segments. This aligns with Toast's strategy of increasing its platform adoption, which may play a crucial role in meeting analysts' expectations of revenue growth and improved profit margins over time.

Over the past three years, Toast's total shareholder return was 94.85%, reflecting impressive longer-term performance, although this return is extremely high compared to the broader market. Over the past year, Toast exceeded the US market's 9.6% return and the US Diversified Financial industry’s 24.9% return, indicating robust market performance. The recent 7.27% share price increase further narrows the gap with the consensus analyst price target of US$41.03, which is 16.5% above the current price of US$34.18. However, uncertainty remains due to analyst disagreements on future earnings targets and profit margins, highlighting the need for careful consideration of investment assumptions.

Our valuation report unveils the possibility Toast's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Toast, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives