- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Is Toast Worth a Fresh Look After Strong Annual Growth and Recent Stock Swings?

Reviewed by Bailey Pemberton

Wondering whether to put your money behind Toast? You are definitely not alone. Lately, this stock has been catching eyes with its swings and the promise of big, long-term growth. Toast finished its last session at $36.70, and while its performance in the last week was up by 3.1%, the past month was a little bumpier, with a 9.9% slide. Still, year to date, Toast is hanging in the green at 0.9%. If you zoom out even further, the story gets even more interesting: the stock is up 26.6% over the last year and an impressive 104.8% over three years.

What is behind these moves? The broader market has had its share of volatility thanks to shifting macro trends and renewed interest in digital solutions for restaurants. Toast has benefited from industry enthusiasm about restaurant tech. Some market watchers believe there is increased risk in the sector too, as competition heats up and economic sentiments waver.

For anyone thinking about value, Toast’s valuation score currently sits at 1 out of 6. This is an early signal that the company looks undervalued on just one check, which means the story is still developing from a bargain-hunter’s perspective.

Let’s break down the different valuation methods analysts use to score stocks like Toast, and see where this company stands. We will also uncover why these scores might not tell the whole story about Toast’s future potential.

Toast scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Toast Excess Returns Analysis

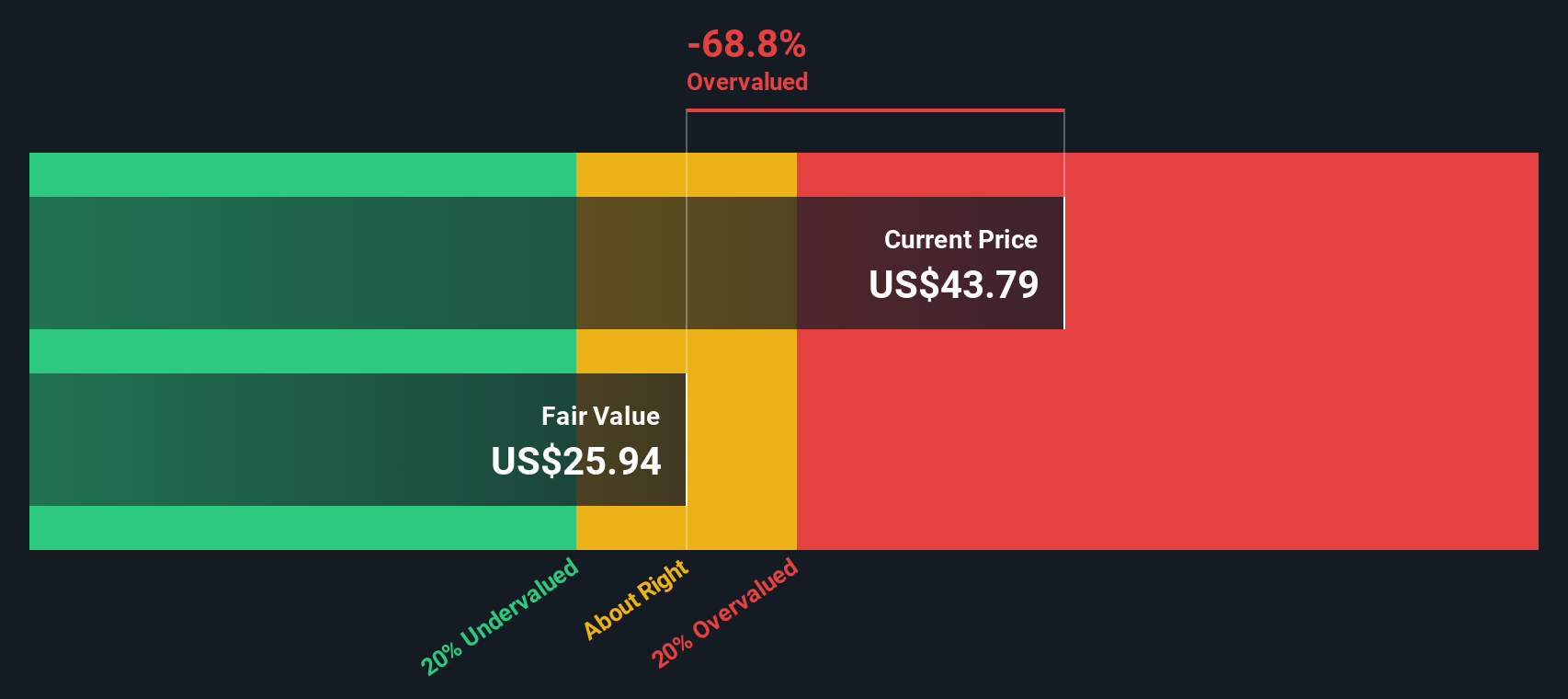

The Excess Returns valuation model evaluates how much profit a company generates above its cost of equity, measured per share. This method looks closely at how effectively Toast is putting its investment capital to work, and estimates future growth potential by factoring in analysts' forecasts for return on equity and book value.

For Toast, the numbers tell an interesting story. The company's book value stands at $3.13 per share, and projected stable earnings per share are $1.31, based on weighted future Return on Equity estimates from eight analysts. The cost of equity is $0.41 per share, leaving Toast with an excess return of $0.90 per share. Toast's average return on equity is calculated at 23.70%, indicating strong profitability relative to its equity base. Furthermore, analysts expect its stable book value to rise to $5.52 per share over time, according to consensus from five analysts.

Using these inputs, the Excess Returns model estimates Toast's intrinsic value at $26.52 per share. With the stock currently trading at $36.70, this implies Toast is about 38.4% overvalued by this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Toast may be overvalued by 38.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Toast Price vs Earnings

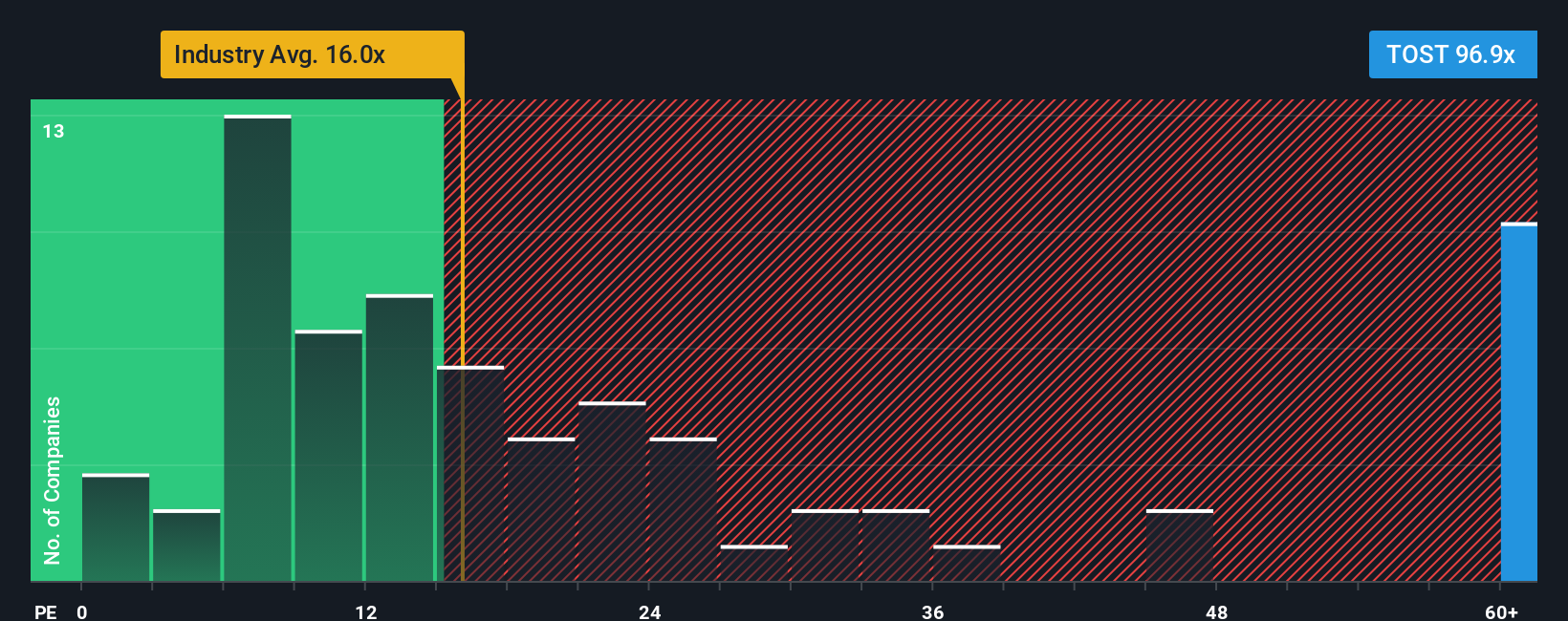

The Price-to-Earnings (PE) ratio is widely accepted as a go-to metric for valuing profitable companies. It allows investors to compare what the market is willing to pay for each dollar of a company’s earnings. In general, a higher PE can be justified when a company is expected to grow rapidly or carries less risk, while a lower PE is common when growth is slower or risks are higher. This means the “right” PE is not fixed and depends heavily on broader expectations around future profits and stability.

Currently, Toast trades at a PE ratio of 95.52x, which is a significant premium compared to the Diversified Financial industry average of 16.71x and a peer average of 18.69x. While at first glance this may raise eyebrows, it is important to consider Toast’s unique growth profile and potential, which can justify a richer valuation in certain cases.

Simply Wall St’s proprietary “Fair Ratio” calculates the preferred multiple for Toast by taking into account factors such as earnings growth, profit margins, risk profile, industry benchmarks, and company size. Unlike conventional comparisons that can overlook key company specifics, the Fair Ratio provides a more tailored benchmark by blending quantitative and qualitative factors. For Toast, the Fair Ratio comes out to 23.18x. Since Toast’s actual PE multiple is much higher than this fair value, the stock appears overvalued using this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toast Narrative

Earlier, we mentioned that there is an even better way to understand a company’s value, so let’s introduce you to Narratives. A Narrative is simply the story an investor believes about a company. It combines your own fair value estimates and future expectations for revenue, earnings, and margins, all set in one place. Narratives connect the dots between Toast’s business drivers and a financial forecast, helping you see how the company’s story unfolds into a fair value number.

Simply Wall St makes this easy through the Narratives tool on the Community page, where you can build, view, and update perspectives that powerfully link the why and how behind your valuation. Narratives are not just static calculations. They update automatically as new news or earnings data becomes available, making sure your story and numbers stay in sync.

When deciding whether to buy or sell, Narratives let you compare your calculated Fair Value to today’s price, giving clear guidance tailored to your viewpoint. For example, one investor might use optimistic revenue assumptions and end up with a $60 price target for Toast, while another, more cautious user may see a fair value closer to $36 given different risk or margin expectations. Narratives put you in control, letting you map your outlook to a target and act when opportunity arises.

Do you think there's more to the story for Toast? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives