- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Where Does Schwab Stand After Its 33.6% Stock Surge This Year?

Reviewed by Bailey Pemberton

Thinking about what to do with Charles Schwab stock? You are not alone. Whether you have been riding its impressive long-term climb or are eyeing a new entry, the recent momentum has definitely caught investors’ attention. Schwab’s share price just closed at $94.14, and if you have been holding on over the past five years, congratulations—you are looking at a remarkable 149.3% gain. Even in the last twelve months, the stock is up 33.6%, outpacing many benchmarks and peers. Within the past month and week, the positive trends have continued, delivering 2.2% and 2.4% returns, respectively.

Part of this steady advance can be traced back to shifts in the broader financial sector, especially as interest rate developments and investor confidence evolved. As a major player in wealth management and retail brokerage, Schwab attracted inflows when markets grew optimistic about continued economic recovery and more stable client activity. That said, valuation always matters, because great businesses are not always great bargains.

On the valuation front, Schwab currently lands a value score of 2 out of 6, meaning it is undervalued on only two of the six checks that analysts often use. Does that mean the stock is pricey, or are those metrics missing something? Next, we will dive deeper into these traditional valuation approaches and see what each one actually tells us about Schwab’s current price tag. Plus, we will reveal an even more insightful way to judge value at the end of the article.

Charles Schwab scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Charles Schwab Excess Returns Analysis

The Excess Returns model estimates the intrinsic value of a stock based on how much return a company is generating over and above its cost of equity. It focuses on whether a firm is creating real value for shareholders by evaluating its average return on equity compared to what equity investors require as compensation for risk.

For Charles Schwab, the Book Value per share stands at $23.53, while the Stable EPS is $5.80 per share. These projections come from a weighted average of future Return on Equity estimates from seven analysts. The company’s equity cost is $2.61 per share, resulting in an excess return of $3.19 per share. Schwab's average Return on Equity is a robust 19.74%, and the Stable Book Value, based on four analysts’ forecasts, is expected to be $29.36 per share.

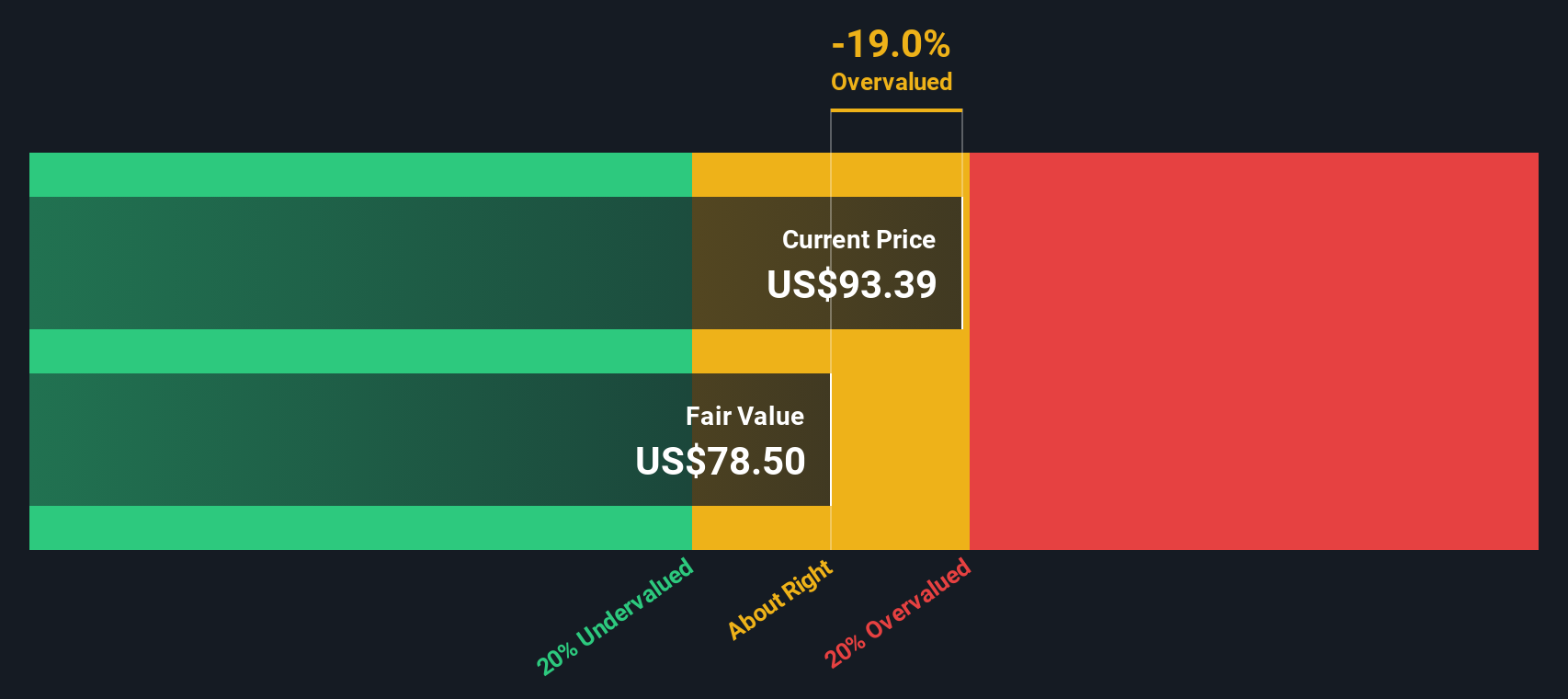

The Excess Returns model arrives at a fair value estimate of $84.21 per share for Charles Schwab. With the current market price at $94.14, the stock is trading at an 11.8% premium relative to this intrinsic value. According to this approach, Schwab shares are overvalued at today’s price point.

Result: OVERVALUED

Our Excess Returns analysis suggests Charles Schwab may be overvalued by 11.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Charles Schwab Price vs Earnings

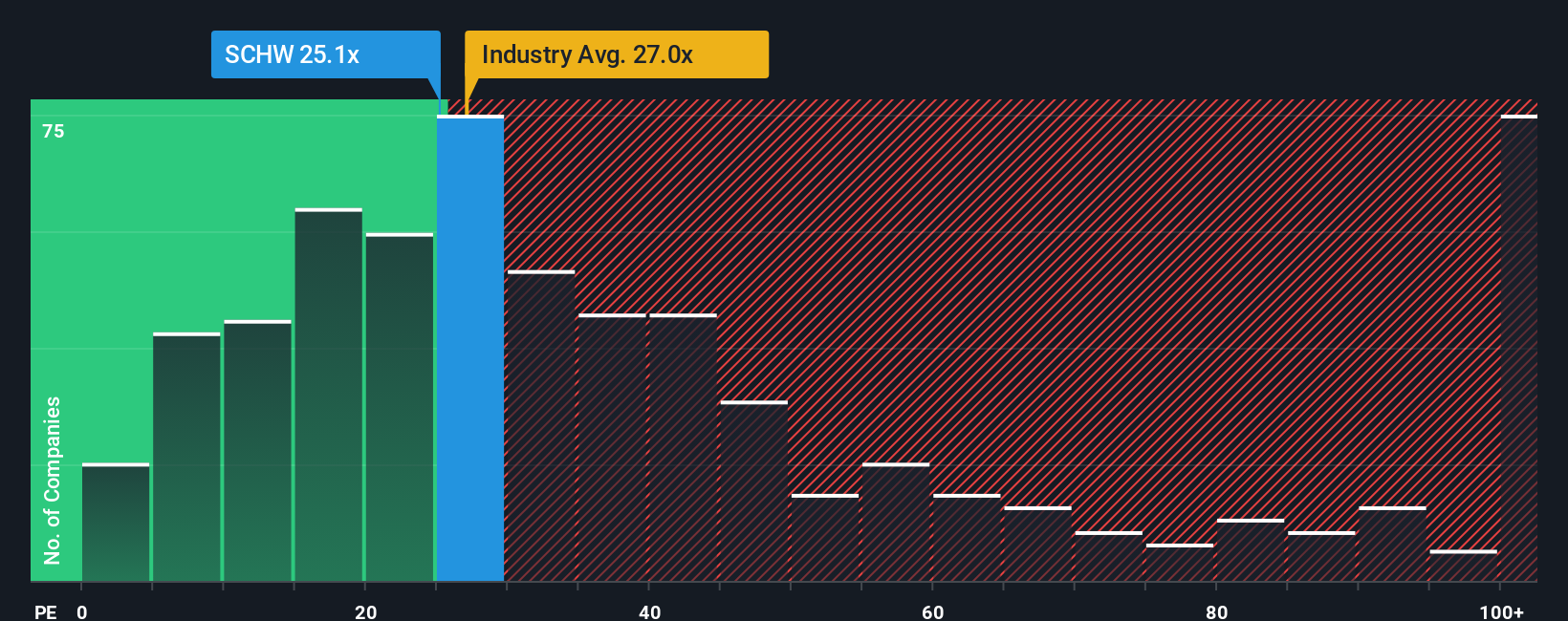

For profitable companies like Charles Schwab, the price-to-earnings (PE) ratio is often the go-to valuation metric. It reflects how much investors are willing to pay for a dollar of earnings, making it especially useful when a business has steady or growing profits.

While a higher PE ratio can signal the market expects robust growth, it can also mean greater risk is being priced in. Conversely, a lower PE may indicate concerns about future prospects or company-specific challenges. What is considered a "normal" or "fair" PE ratio depends on the company’s growth outlook, risk profile, and how those compare to others in the same industry.

Charles Schwab currently trades at a PE ratio of 22x. This is below the Capital Markets industry average of 25.95x and under the peer group average of 32x. However, Simply Wall St’s proprietary "Fair Ratio" for Schwab is 20.97x. The Fair Ratio provides more insight than a simple comparison to peers or the industry because it adjusts for Schwab’s earnings growth, profit margins, size, and risk factors, giving a holistic view of what the multiple should ideally be.

Comparing the current PE ratio to the Fair Ratio, Schwab’s 22x is just slightly above the 20.97x level. The difference is minor and falls within a reasonable range, suggesting the stock’s price is about right based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charles Schwab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your investment story: a set of expectations you believe about a company’s future, such as what you think will happen to its revenue, profit margins, and fair value. Rather than just relying on a single metric or one-size-fits-all estimate, Narratives let you tie a company’s story directly to your assumptions, forming a clear path from business outlook to financial forecast and then to a fair value estimate. This means you can decide what you think matters most and see how your perspective measures up against the market price.

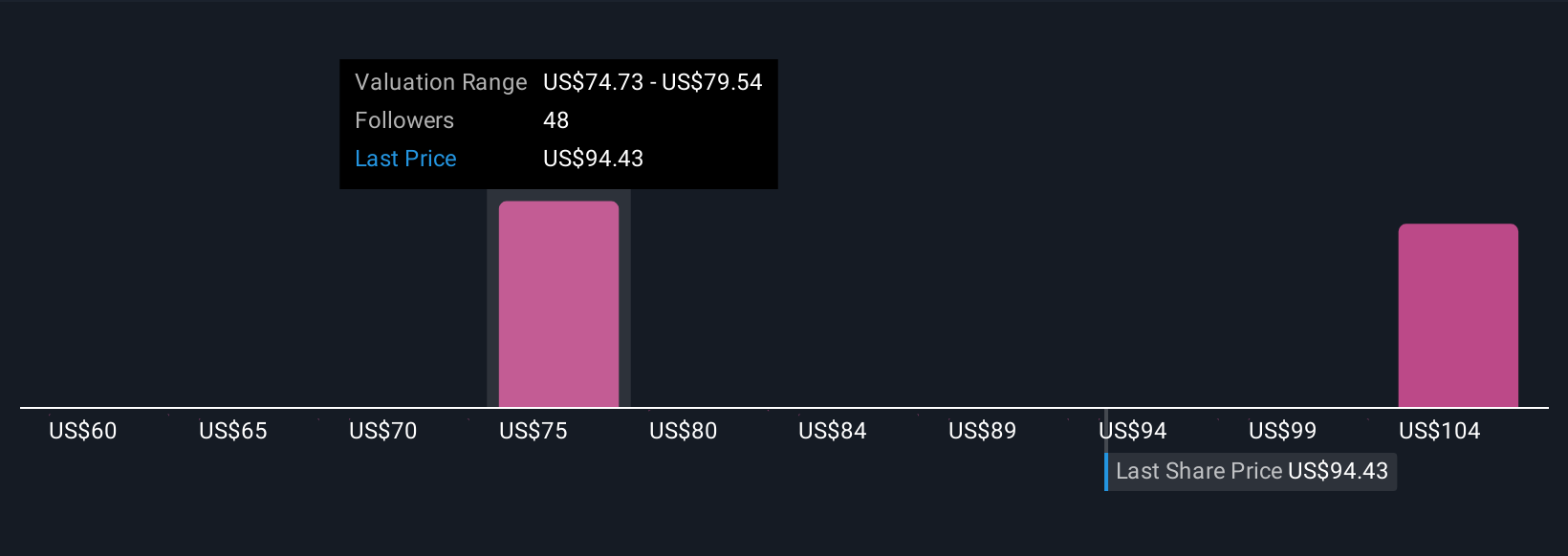

On Simply Wall St’s Community page, millions of investors build and update Narratives that reflect their thinking, making the process accessible and interactive. When news breaks or earnings are released, Narratives update dynamically, helping you adapt your decisions in real time. For example, the most bullish investors in Charles Schwab currently see a fair value as high as $131.0 per share, while the most cautious see it as low as $84.0. These differences are based on varying expectations about growth, margins, and risks. By exploring Narratives, you can better understand which story best fits your own outlook and make smarter decisions about whether to buy, hold, or sell.

Do you think there's more to the story for Charles Schwab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives