- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW): Assessing Valuation Following Strong Q3 Growth and Record New Client Accounts

Reviewed by Kshitija Bhandaru

Charles Schwab delivered a clear signal to investors with its third-quarter results, reporting net income of $2.36 billion and strong earnings per share gains compared to last year. Retail investing momentum continued as the company added over one million new brokerage accounts for the fourth straight quarter.

See our latest analysis for Charles Schwab.

The momentum around Charles Schwab has translated into notable gains for long-term shareholders, with a total shareholder return of 34.5% in the past year and 156.9% over five years. While the share price is up an impressive 27.5% year-to-date, recent excitement around record earnings and new product launches signals that investors are still reassessing Schwab’s growth runway in today’s evolving market, even as short-term price moves remain modest.

If robust retail activity and fresh innovations have you looking for what else is out there, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With all this momentum factored in, investors may wonder whether Schwab’s strong results and ambitious expansion are already reflected in the current share price, or if there is still room for a buying opportunity as markets look ahead.

Most Popular Narrative: 14% Undervalued

Charles Schwab’s last close at $94.14 sits well below the fair value set by the most-followed narrative. This gives bulls a fresh reason to look closely at this valuation. The gap between consensus expectations and the current price is drawing renewed attention to the long-term story.

Expanding client base and digital adoption are driving sustained asset growth, deeper client engagement, and increasingly diversified revenue streams. Operational efficiencies, innovative product launches, and industry scale are enhancing margins, competitive position, and long-term earnings resilience.

Want to see what’s fueling this double-digit upside? The forecast rests on major changes to how Schwab grows revenue, cuts costs, and reinvents itself through digital transformation. Curious which future profit and growth assumptions led to this ambitious fair value? The details are where the story really gets interesting.

Result: Fair Value of $109.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from low-cost digital brokers and potential interest rate cuts could quickly challenge Schwab's growth and profit outlook.

Find out about the key risks to this Charles Schwab narrative.

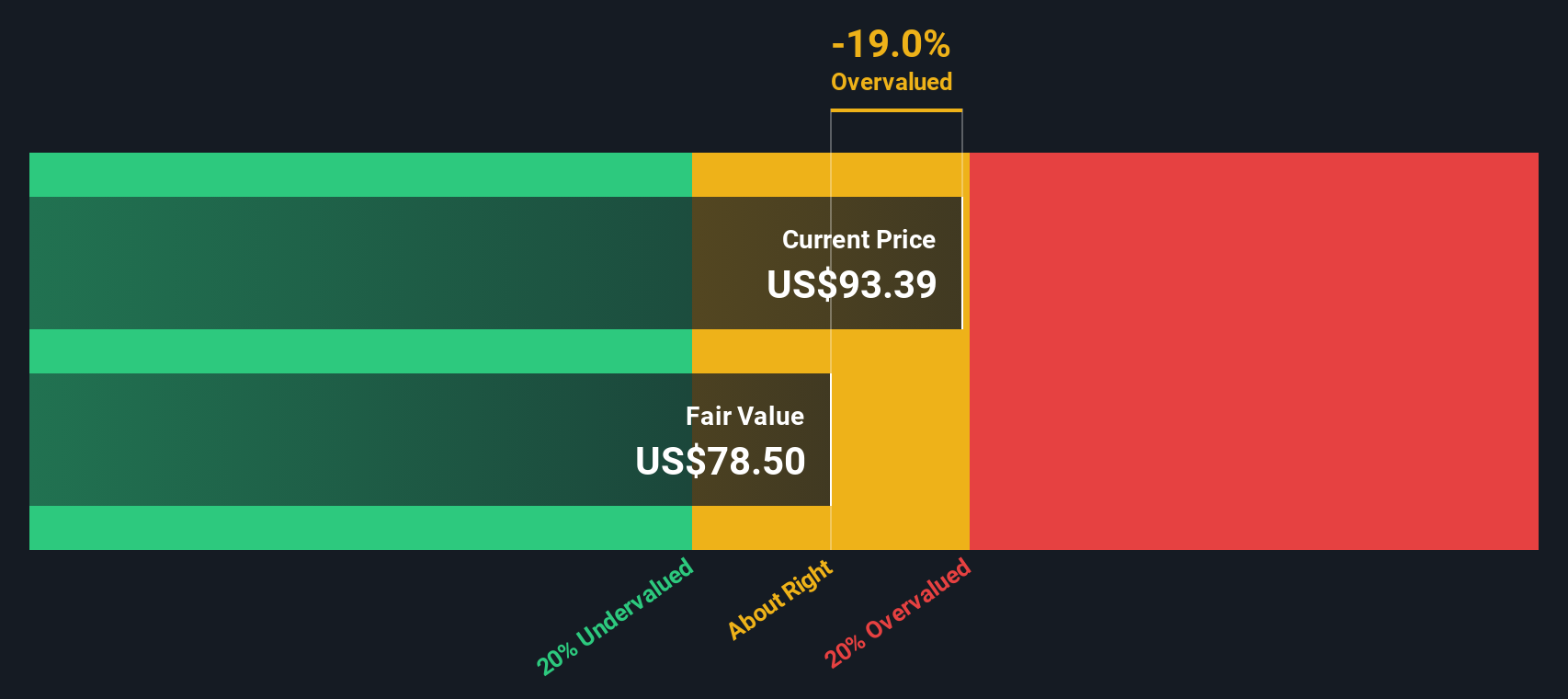

Another View: The DCF Model Tells a Different Story

Looking at our DCF model, Charles Schwab appears less of a bargain today. While analyst consensus points to a 14% undervaluation, the SWS DCF calculation puts SCHW’s fair value at $85.29, meaning the stock is actually trading above it. Could this signal market optimism running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If you think there’s another angle to the Charles Schwab story, dive into the numbers yourself and craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The market keeps moving, and the next big winner rarely waits around. Tap into fresh opportunities beyond Charles Schwab and turn insights into action today.

- Boost your portfolio’s potential by targeting income with these 18 dividend stocks with yields > 3%, which features companies with standout dividend yields over 3%.

- Capitalize on the future of artificial intelligence by assessing the most promising newcomers via these 24 AI penny stocks, setting trends in emerging tech.

- Unlock value opportunities by pursuing these 868 undervalued stocks based on cash flows, focusing on companies priced below their estimated fair value based on cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives