- United States

- /

- Consumer Finance

- /

- NYSE:RM

Regional Management Corp. (NYSE:RM) Soars 26% But It's A Story Of Risk Vs Reward

Those holding Regional Management Corp. (NYSE:RM) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.5% in the last twelve months.

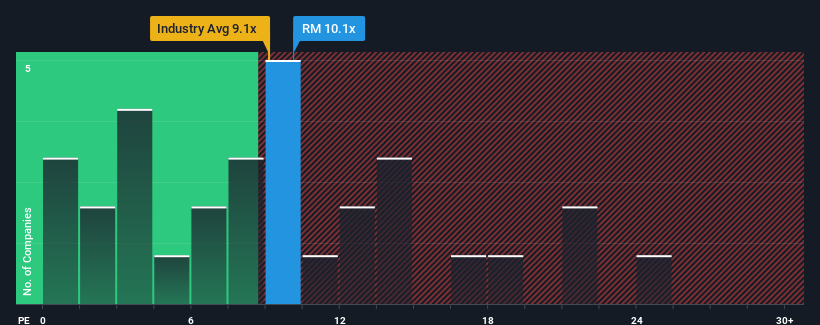

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Regional Management as an attractive investment with its 10.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Regional Management has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Regional Management

Is There Any Growth For Regional Management?

In order to justify its P/E ratio, Regional Management would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 57% during the coming year according to the five analysts following the company. That's shaping up to be materially higher than the 10% growth forecast for the broader market.

In light of this, it's peculiar that Regional Management's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Regional Management's P/E?

Despite Regional Management's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Regional Management's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Regional Management (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on Regional Management, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RM

Regional Management

A diversified consumer finance company, provides various installment loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives