- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (NYSE:RKT) Declares US$0.80 Special Dividend

Reviewed by Simply Wall St

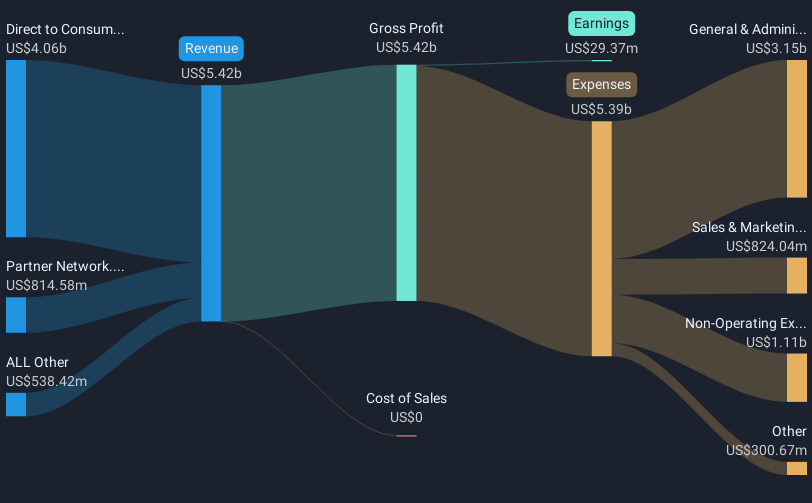

Rocket Companies (NYSE:RKT) is focusing on growth through its planned acquisition of Mr. Cooper Group Inc., which aligns with its strategy to bolster its presence in the mortgage industry. This strategic direction comes in the wake of the company's fourth-quarter earnings announcement, showing a significant year-over-year revenue increase to $1,769 million and a swing to a net profit. Furthermore, the declaration of a special dividend of $0.80 per share could have bolstered investor confidence. Against a backdrop where the market has recently climbed 5.4%, Rocket's 14.2% price move suggests these initiatives added weight to its broader upward momentum.

Rocket Companies has 1 possible red flag we think you should know about.

The recent acquisition of Mr. Cooper Group Inc. by Rocket Companies is likely to reinforce its growth narrative by increasing its foothold in the mortgage sector. This strategic move may influence future revenue and earnings forecasts, as the integration of Mr. Cooper's resources could lead to enhanced operational efficiency and potential gains in market share. However, these efficiencies might be countered by high marketing expenses, as Rocket Companies has invested heavily in branding efforts, such as a Super Bowl advertisement.

Over the past three years, Rocket Companies' total shareholder return, including both share price and dividends, was 33.92%. Comparatively, over the last year, Rocket has underperformed both the US Market, which returned 3.6%, and the US Diversified Financial industry, which returned 17.6%. This suggests that, while long-term returns have been strong, recent performance may not have met broader market expectations.

The company's current share price stands at US$15.77, reflecting a discount to the consensus analyst price target of US$13.71. This suggests that while analysts see potential for underlying business improvement, the market's current expectations might be too optimistic. The acquisition and ongoing investments in AI and brand strategies aim to bolster revenue growth and improve net margins. However, if these efforts do not drive a commensurate increase in earnings, the pressure on Rocket's valuation could persist, impacting future share price movements. It is essential for investors to weigh these factors carefully in light of Rocket's strategic initiatives and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rocket Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives