- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (NYSE:RKT) Announces US$0.80 Dividend Acquires Redfin and Amends Company Bylaws

Reviewed by Simply Wall St

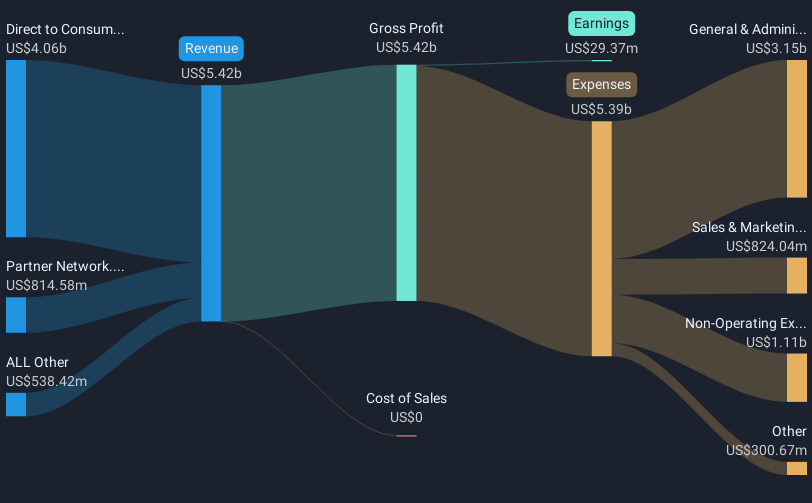

Rocket Companies (NYSE:RKT) has recently made headlines by entering into an agreement to acquire Redfin and announcing a special dividend of $0.80 per share in connection with its governance adjustments. Over the last quarter, the company's stock price moved 6.12%, reflecting investor reactions to these strategic initiatives. This price move occurred amidst a volatile market environment largely affected by geopolitical trade tensions, such as the U.S. imposing higher tariffs on Canadian steel and aluminum, which saw major indices like the Dow Jones Industrial Average and S&P 500 experience declines. However, Rocket's robust earnings report, which highlighted a substantial increase in Q4 2024 revenue and net income, likely contributed positively to investor sentiment despite the broader market's 4.6% drop over the same period. The company’s proactive corporate actions and improved financial performance appear to have provided a counterbalance to external economic pressures.

Dig deeper into the specifics of Rocket Companies here with our thorough analysis report.

Rocket Companies (NYSE:RKT) has delivered a total return of 28.99% over the last three years, which provides a broader context to evaluate recent strategic decisions. In the past year, Rocket's performance met the US market's return of 8.8% but lagged behind the US Diversified Financial industry's 17.2% return. The company's shift to profitability has been a key factor, underscored by the substantial increase in Q4 2024 earnings and revenue. From a governance perspective, Rocket's adjustments, including the Up-C Collapse amendments, have reshaped its corporate framework, likely influencing shareholder perceptions positively.

The company's focus on organic and inorganic growth, notably through planned acquisitions and exploring AI technology opportunities, reflects a forward-looking approach. The significant share buyback, constituting 26.48% of the total announced program until November 2024, demonstrates a commitment to returning value to shareholders. Additionally, Rocket's addition to the S&P Banks Select Industry Index may have solidified its market presence, enhancing investor confidence over the long term.

- Get the full picture of Rocket Companies' valuation metrics and investment prospects—click to explore.

- Discover the key vulnerabilities in Rocket Companies' business with our detailed risk assessment.

- Already own Rocket Companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rocket Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives