- United States

- /

- Mortgage REITs

- /

- NYSE:RC

Ready Capital (RC): Valuation Insights After Institutional Holders Draw Spotlight on Recent Share Drop

Reviewed by Kshitija Bhandaru

Ready Capital (RC) has drawn fresh attention after a 9.6% drop in its share price, putting the spotlight on its institutional holders. With 68% of shares in institutional hands, investor movements in this group can significantly influence the stock.

See our latest analysis for Ready Capital.

Ready Capital’s sharp downturn follows a tough year, with a year-to-date share price return of -47.53% and a one-year total shareholder return of -42.55%. The recent volatility highlights fading momentum and suggests shifting risk perceptions among major institutional holders.

If wider market trends or changing institutional sentiment have you looking for new opportunities, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a steep discount to analyst targets, investors are left to wonder whether Ready Capital is a bargain in disguise or if the market has already factored in the company's future prospects.

Price-to-Book of 0.3x: Is it justified?

At a price-to-book ratio of 0.3x, Ready Capital’s stock trades notably below both its peer group at 0.4x and the broader US Mortgage REITs industry average at 0.7x. With shares closing at $3.61, this valuation signals a steep market discount relative to the company’s book value.

The price-to-book ratio compares a company’s market price to its net asset value. It offers insight into whether the stock is valued optimistically or pessimistically by investors relative to what its assets are theoretically worth. For a sector reliant on tangible assets like real estate, this multiple is often a primary valuation yardstick.

This low multiple suggests investors remain cautious about Ready Capital’s near-term prospects. This may reflect its unprofitable status and wider sector headwinds. Despite challenges, the company’s valuation stands out against industry benchmarks, raising questions about whether the market is over-discounting risk.

Compared to Mortgage REIT peers, Ready Capital’s price-to-book ratio is sharply lower. This potentially sets the stage for a move if sentiment shifts or fundamentals improve. The discount here is more pronounced than both the immediate peer group and the sector at large.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.3x (UNDERVALUED)

However, persistent negative earnings and sector headwinds remain real risks. These factors could delay any sentiment recovery for Ready Capital in the near term.

Find out about the key risks to this Ready Capital narrative.

Another View: Discounted Cash Flow Perspective

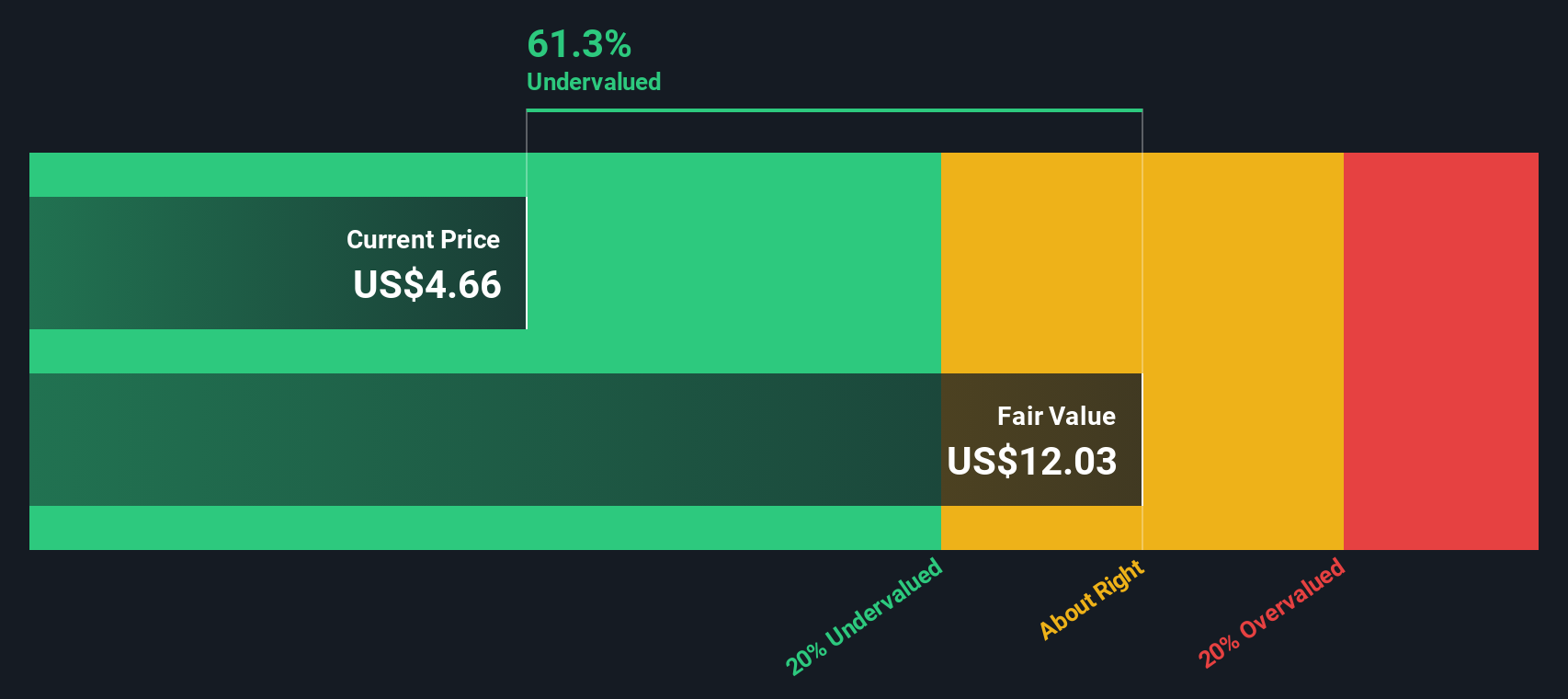

Looking beyond book value multiples, our DCF model provides an additional perspective for valuation. According to the SWS DCF model, Ready Capital’s shares are trading at approximately 28.7% below its estimated fair value. This calculation suggests a deeper undervaluation, but does the cash flow view tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ready Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ready Capital Narrative

If our view does not align with yours or you would rather conduct your own analysis, you can craft your own narrative in just a few minutes, Do it your way

A great starting point for your Ready Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop here? Open up your portfolio’s potential with new investing angles and don't let the next big opportunity pass you by. Try something different today.

- Generate income streams by tapping into steady returns with these 19 dividend stocks with yields > 3% offering yields above 3%.

- Supercharge your strategy with cutting-edge trends and discover what’s possible in these 25 AI penny stocks pushing the boundaries of artificial intelligence.

- Seize bargains in the market by zeroing in on these 891 undervalued stocks based on cash flows that might be trading below their real potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RC

Ready Capital

Operates as a real estate finance company in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives