- United States

- /

- Media

- /

- NYSE:CCO

Exploring Undervalued Small Caps With Insider Actions In The United States July 2024

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq continue to reach record highs, with notable gains driven by companies like Nvidia, the broader market sentiment appears optimistic. This buoyant atmosphere sets a compelling backdrop for exploring undervalued small-cap stocks, particularly those where insider actions suggest unrecognized potential amidst current economic dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 8.4x | 1.9x | 48.97% | ★★★★★☆ |

| PCB Bancorp | 8.9x | 2.4x | 45.04% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 32.55% | ★★★★★☆ |

| Titan Machinery | 3.7x | 0.1x | 29.66% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 17.34% | ★★★★☆☆ |

| Ramaco Resources | 13.8x | 1.1x | 12.35% | ★★★☆☆☆ |

| Papa John's International | 19.5x | 0.7x | 37.22% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -135.23% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -148.55% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Clear Channel Outdoor Holdings (NYSE:CCO)

Simply Wall St Value Rating: ★★★★★☆

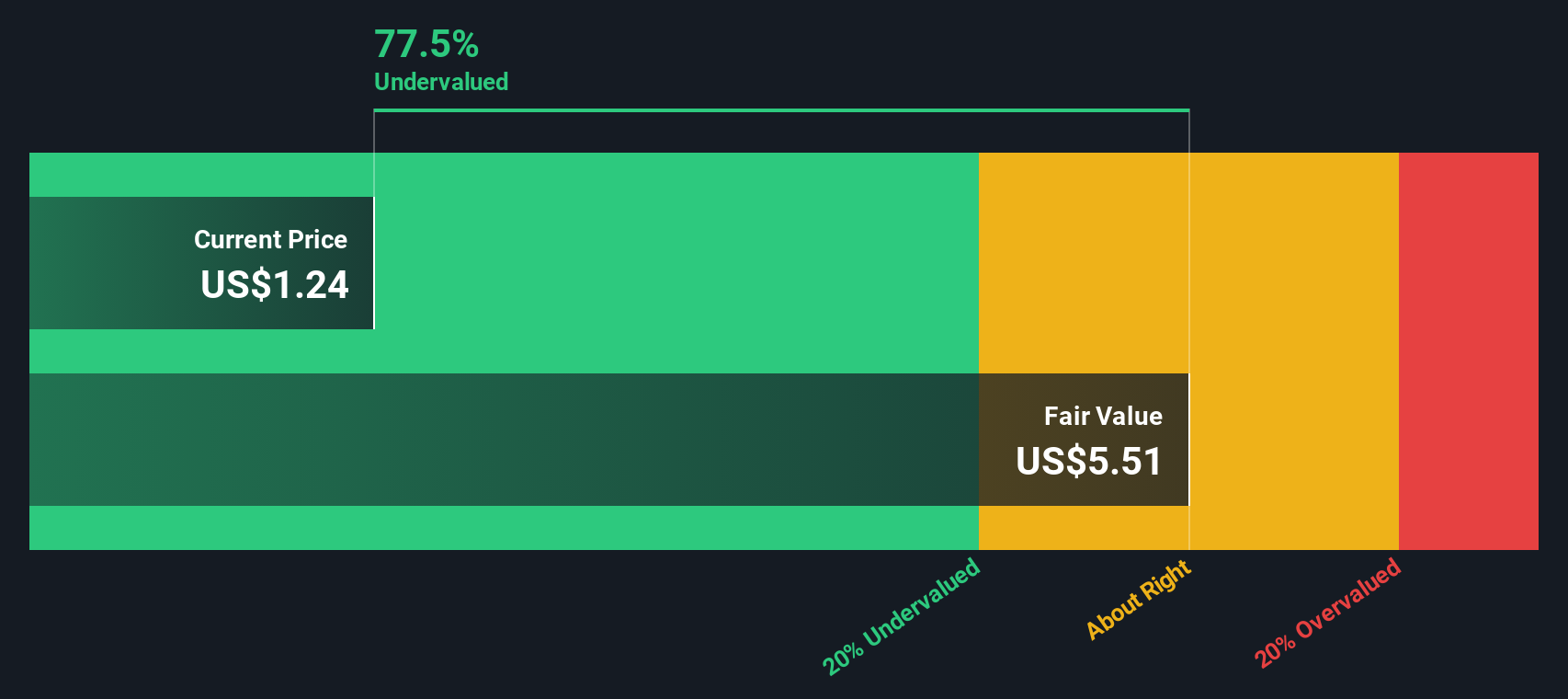

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning billboards, street furniture, and airport displays, with a market capitalization of approximately $0.65 billion.

Operations: The company's revenue streams are diversified across various geographical regions with America (excluding airports) generating $1.11 billion, followed by Europe-north at $0.63 billion, and Airports contributing $0.33 billion. The gross profit margin has shown a trend of fluctuation over the periods analyzed, with a notable decrease from 46% in early years to approximately 44% in more recent terms, reflecting changes in cost of goods sold and operational efficiency.

PE: -4.9x

Recently added to several Russell indices, Clear Channel Outdoor Holdings reflects a growing recognition in the market, potentially hinting at its underappreciated value. Despite current unprofitability and reliance on high-risk external borrowing—as it holds no customer deposits—the company has shown active engagement in the financial community with multiple conference presentations and a significant shelf registration of $64.74 million for common stock. Insider confidence is evident as they have recently purchased shares, aligning their interests with long-term investors. This blend of qualitative engagements and financial maneuvers paints a picture of a company poised for reevaluation by the market.

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

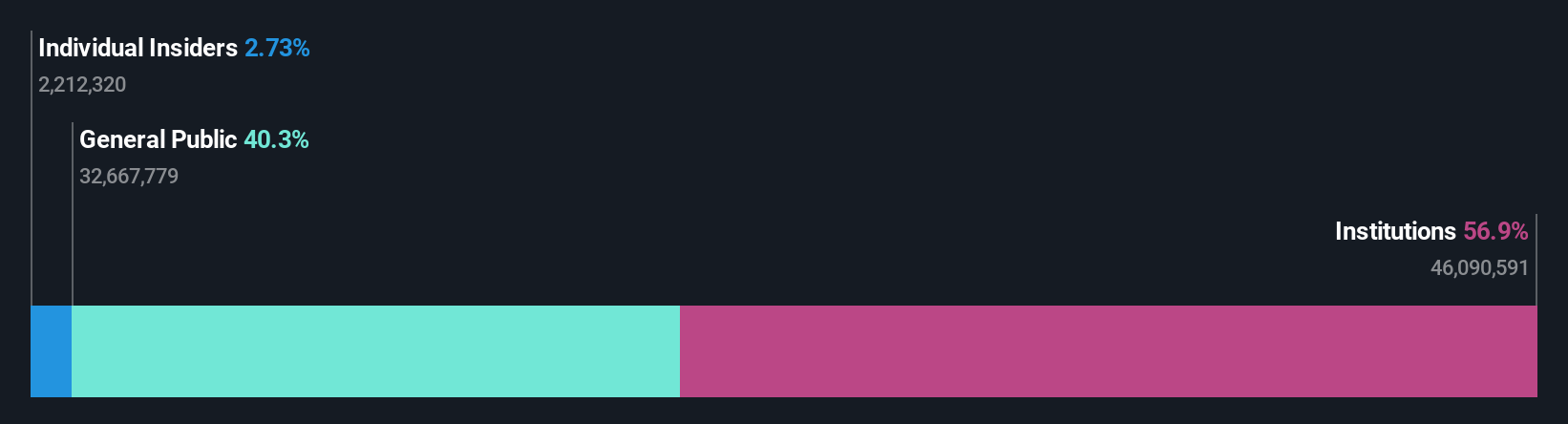

Overview: Chimera Investment operates by investing, on a leveraged basis, in a diversified portfolio of mortgage assets.

Operations: The company generates revenue by investing on a leveraged basis in a diversified portfolio of mortgage assets, with the latest recorded revenue being $291.99 million. Its gross profit margin has shown variability over the years, recently recorded at 89.09% for the last quarter of 2024, reflecting fluctuations in operational efficiency and market conditions.

PE: 8.5x

Chimera Investment, reflecting a blend of challenges and potential, recently increased its quarterly cash dividend to $0.35 per share, signaling financial stability despite a forecasted slight earnings decline over the next three years. Notably, insiders have recently demonstrated confidence through share purchases. With no shares repurchased this quarter but significant past activity under its belt, the firm has completed substantial buybacks since 2020. A recent reverse stock split aims to enhance shareholder value amidst these strategic financial maneuvers.

- Unlock comprehensive insights into our analysis of Chimera Investment stock in this valuation report.

Examine Chimera Investment's past performance report to understand how it has performed in the past.

Ready Capital (NYSE:RC)

Simply Wall St Value Rating: ★★★★★☆

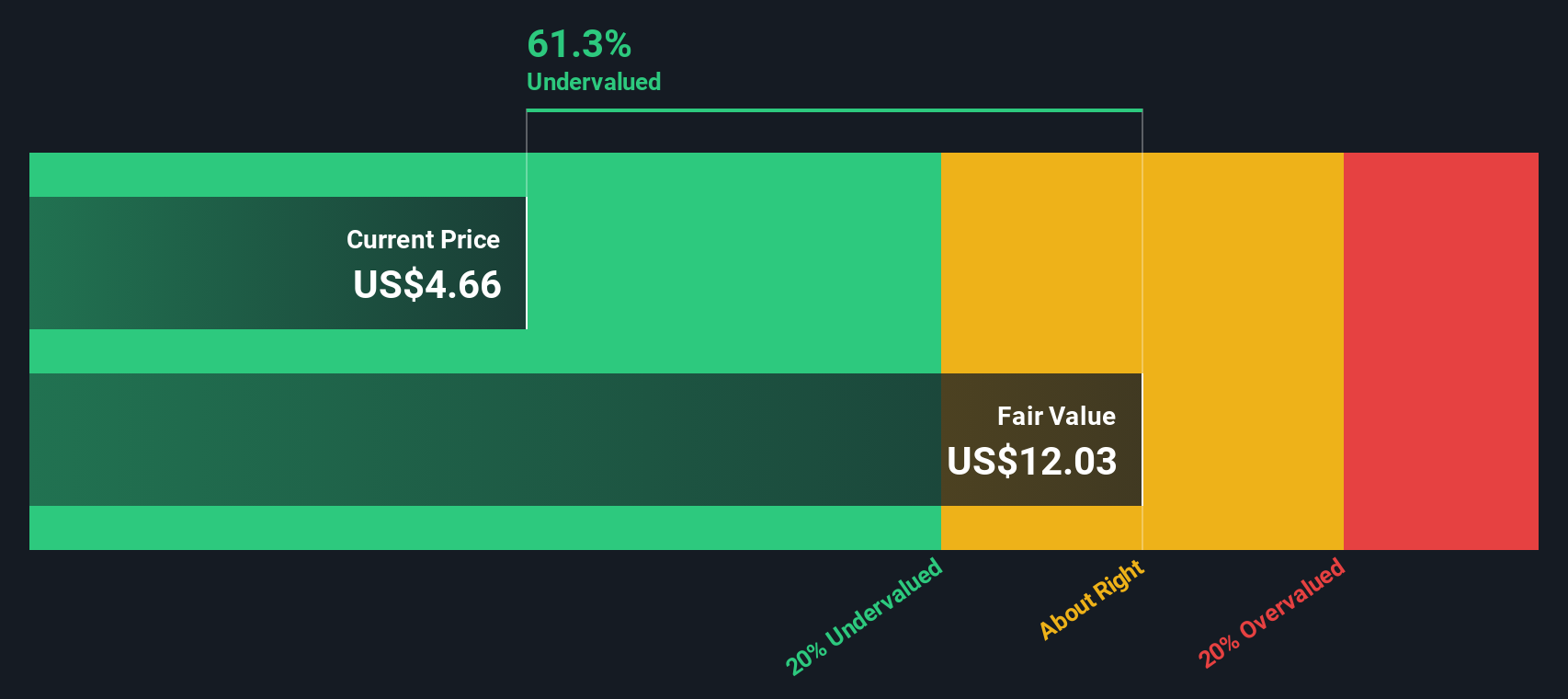

Overview: Ready Capital is a real estate finance company that specializes in small business lending and lower middle market commercial real estate, with a market capitalization of approximately $1.07 billion.

Operations: The company's gross profit margin has shown a significant upward trend, increasing from 9.58% in late 2013 to 85.36% by mid-2024, reflecting an enhanced efficiency in managing the cost of goods sold relative to revenue. Notably, net income has also seen substantial growth, with figures rising from $0.80 million at the end of 2013 to $220.66 million by July 2024, indicating robust profitability over this period.

PE: 6.4x

Recently, Ready Capital showed insider confidence with significant share purchases, affirming belief in its potential despite a challenging quarter where it reported a net loss of US$74.28 million. The firm actively engaged in repurchasing shares, acquiring 3.74 million shares for US$32.72 million earlier this year, signaling strength and commitment to shareholder value. Additionally, consistent dividend declarations underscore its stability and appeal to investors looking for regular income streams from a promising entity within the undervalued segment of the market.

- Delve into the full analysis valuation report here for a deeper understanding of Ready Capital.

Understand Ready Capital's track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 58 Undervalued Small Caps With Insider Buying by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCO

Clear Channel Outdoor Holdings

Operates as an out-of-home advertising company in the United States and Singapore.

Undervalued very low.

Similar Companies

Market Insights

Community Narratives