- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Byrna Technologies And Two Other US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results following a recent sell-off, with the Dow Jones Industrial Average barely breaking its longest losing streak in 50 years, investors are keenly observing growth companies that might offer stability and potential upside. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate strong alignment between company leadership and shareholder interests, making them worth considering for those seeking resilient investment opportunities amidst uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.7% | 70.7% |

Underneath we present a selection of stocks filtered out by our screen.

Byrna Technologies (NasdaqCM:BYRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Byrna Technologies Inc. is a company that develops, manufactures, and sells less-lethal self-defense solutions across multiple regions including the United States, South Africa, Europe, South America, Asia, and Canada with a market cap of $592.99 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling $73.42 million.

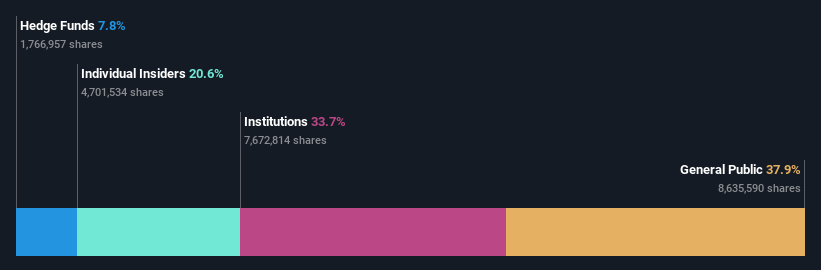

Insider Ownership: 20.9%

Byrna Technologies has demonstrated significant growth potential with its earnings expected to grow at 35.4% annually, surpassing the US market average. Despite high volatility in share price, insider activity shows more buying than selling recently. The company reported a strong revenue increase for Q3 2024 and forecasts record full-year revenue of US$85.8 million. While shareholders experienced dilution last year, Byrna completed a share buyback program worth US$3 million, indicating confidence in its future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Byrna Technologies.

- The valuation report we've compiled suggests that Byrna Technologies' current price could be inflated.

Westrock Coffee (NasdaqGM:WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC operates as an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions both in the United States and internationally with a market cap of approximately $606.57 million.

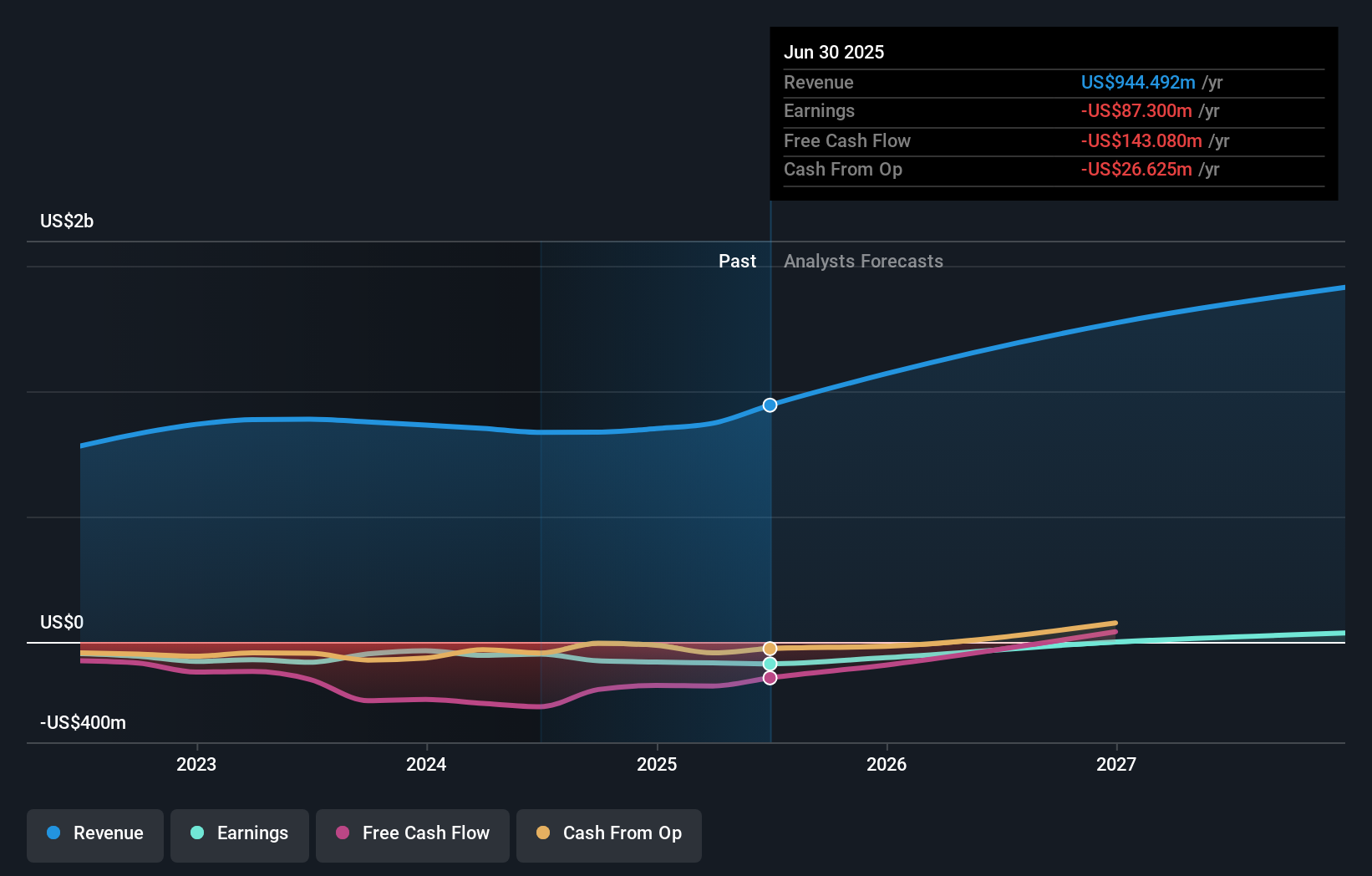

Operations: The company's revenue segments include Beverage Solutions, generating $660.44 million, and Sustainable Sourcing & Traceability, contributing $184.58 million.

Insider Ownership: 13.4%

Westrock Coffee shows potential as a growth company with substantial insider buying in the past three months, indicating confidence from those closest to the company. Despite a challenging financial position with less than one year of cash runway and recent shareholder dilution, analysts expect profitability within three years. Revenue is forecasted to grow at 15.8% annually, outpacing the US market average of 9.1%. Recent earnings revealed a net loss of US$14.26 million for Q3 2024, contrasting with last year's profit.

- Unlock comprehensive insights into our analysis of Westrock Coffee stock in this growth report.

- Our expertly prepared valuation report Westrock Coffee implies its share price may be lower than expected.

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States, with a market cap of approximately $1.44 billion.

Operations: The company's revenue is primarily derived from its asset management segment, totaling $274.50 million.

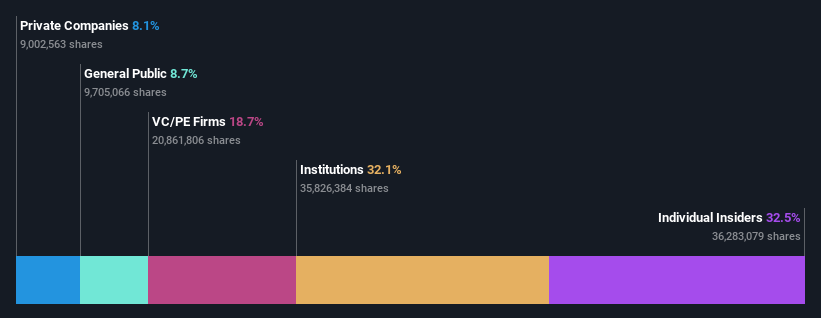

Insider Ownership: 31.6%

P10's growth prospects are underscored by substantial insider ownership, with insiders buying more shares than selling in the last three months. The company has returned to profitability, reporting a net income of US$1.41 million for Q3 2024, compared to a loss last year. However, revenue growth is expected at 7.1% annually, below the market average. Recent strategic leadership changes and share buybacks highlight efforts to strengthen its position despite interest coverage challenges.

- Dive into the specifics of P10 here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that P10 is trading beyond its estimated value.

Make It Happen

- Navigate through the entire inventory of 199 Fast Growing US Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, engages in the development, manufacture, and sale of less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.