- United States

- /

- Consumer Finance

- /

- NYSE:PRG

Is PROG Holdings Stock Mispriced After Strategy Shift and 32.7% Slide in 2024?

Reviewed by Bailey Pemberton

- If you are wondering whether PROG Holdings is quietly turning into a value opportunity while most investors look the other way, this article will walk through whether the current share price really matches the business underneath.

- Despite being down 26.4% year to date and 32.7% over the last year, the stock has bounced 5.4% in the last week and 10.5% over the last month, all against a backdrop of a still strong 78.6% gain over three years.

- Recent headlines have focused on PROG Holdings sharpening its focus on lease to own and virtual lease offerings via its PROG and Vive segments, alongside ongoing efforts to streamline operations and manage credit risk. Investors are watching how this strategic positioning in non traditional financing might reset expectations around growth, resilience, and long term profitability.

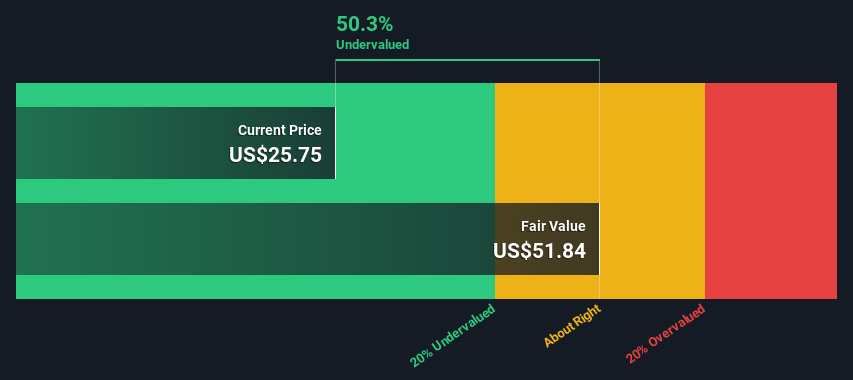

- Based on our checks, PROG Holdings earns a valuation score of 6/6, suggesting it screens as undervalued across every metric we test. Next, we will unpack what traditional valuation approaches say about that score and then finish with a more holistic way to judge whether the market is still mispricing this stock.

Find out why PROG Holdings's -32.7% return over the last year is lagging behind its peers.

Approach 1: PROG Holdings Excess Returns Analysis

The Excess Returns model looks at how efficiently PROG Holdings turns shareholder capital into profits, then compares those returns to the cost of that capital to estimate what the business should be worth today.

PROG Holdings starts with a Book Value of $17.79 per share and a Stable Book Value of $13.55 per share, both grounded in the median balance sheet levels over the past five years. Using an Average Return on Equity of 23.39%, this translates into a Stable EPS of $3.17 per share, according to the same historical median. Compared with a Cost of Equity of $1.22 per share, the company is generating an Excess Return of $1.95 per share, which indicates it is earning more than investors require for the risk they are taking.

When these excess returns are projected forward and discounted, the Excess Returns model indicates an intrinsic value of about $47.47 per share. This suggests the stock is roughly 34.4% undervalued relative to the current market price. In other words, the market does not appear to be fully crediting PROG Holdings for its capital efficiency and earnings power.

Result: UNDERVALUED

Our Excess Returns analysis suggests PROG Holdings is undervalued by 34.4%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: PROG Holdings Price vs Earnings

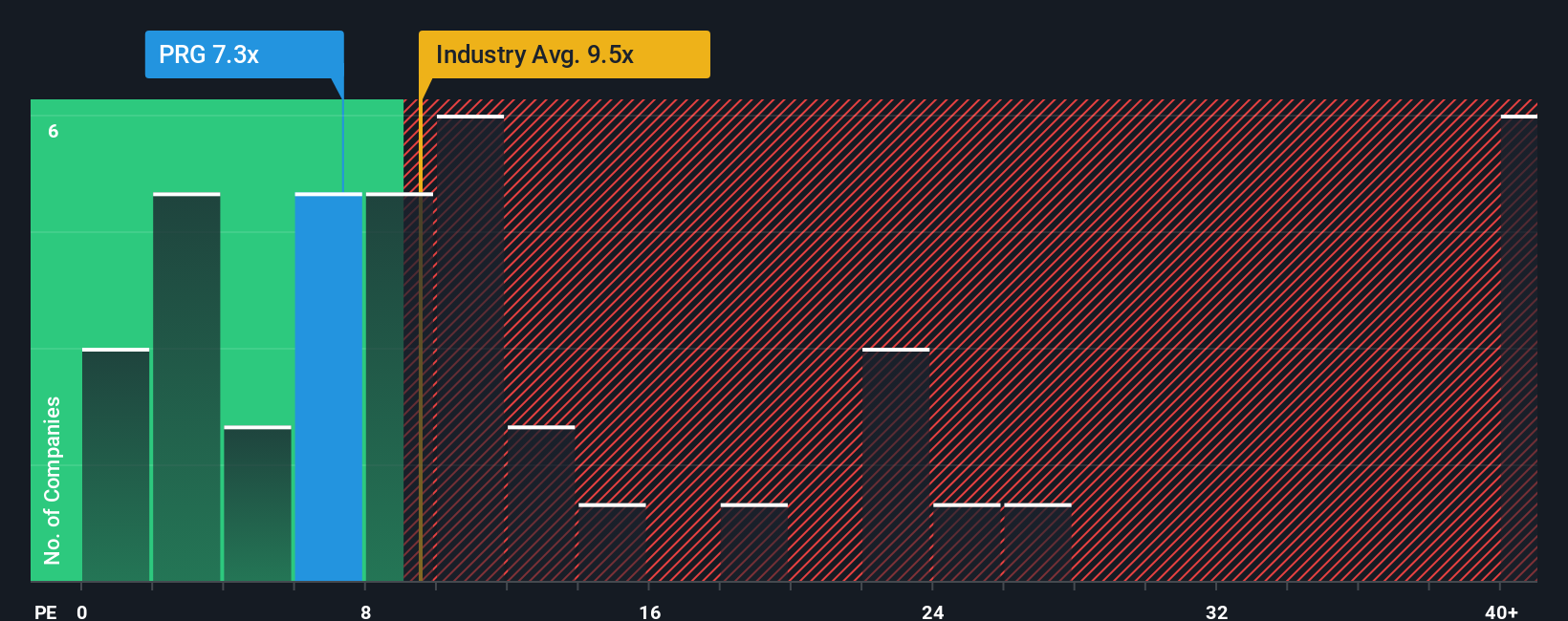

For a consistently profitable business like PROG Holdings, the price to earnings ratio is a straightforward way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing, less risky companies tend to justify higher PE multiples, while slower growth or higher uncertainty should translate into a lower, more conservative PE.

PROG Holdings currently trades at about 7.5x earnings, which is meaningfully below both the Consumer Finance industry average of roughly 9.2x and the peer average of about 9.3x. Simply Wall St goes a step further by estimating a proprietary Fair Ratio of around 13.9x for PROG Holdings, which reflects its specific mix of earnings growth, profitability, risk profile, industry positioning and market capitalization.

Because this Fair Ratio is tailored to the company rather than based on broad peer groups, it is a more nuanced gauge of what investors might reasonably pay for PROG Holdings earnings over a full cycle. With the current PE of 7.5x sitting well below the 13.9x Fair Ratio, the multiple based view aligns with the DCF analysis and suggests the stock may be trading too cheaply relative to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PROG Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect the story you believe about a company with your own forecast for its future revenue, earnings and margins, and then translate that into a fair value you can compare with today’s share price to decide whether to buy, hold or sell.

Instead of only relying on static ratios like PE, a Narrative lets you spell out why you think PROG Holdings will thrive or struggle, link that story to concrete numbers (such as revenue growing a little faster or margins compressing more than expected), and instantly see how that view changes your estimate of fair value relative to the current price.

Because Narratives on the platform are updated automatically when new earnings, news or guidance arrive, different investors can maintain very different PROG Holdings Narratives at the same time. These can range from a more optimistic view that sees the shares worth closer to 45 dollars to a cautious stance that thinks fair value is nearer 27 dollars, and investors can continually refine those positions as reality unfolds.

Do you think there's more to the story for PROG Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRG

PROG Holdings

A financial technology holding company, provides payment options to consumers in the United States.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion