- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (PMT): Assessing Valuation After Insider Buy and Third-Quarter Dividend Announcement

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 9.2% Undervalued

According to the most widely followed narrative, PennyMac Mortgage Investment Trust shares appear to be undervalued by 9.2 percent compared to their estimated fair value. This narrative is built on a framework of future earnings, profit margins, and sector dynamics that shape analysts’ fair price expectations for the coming years.

"Ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets. This could drive net margin expansion as operational efficiencies scale."

Want to see what is powering this undervaluation? There is a bold growth roadmap at play, with ambitious projections for the company's profits and margins. Which assumptions really drive analysts to say the market is missing out? Discover the forecasted figures and the potential catalysts that could reshape PennyMac’s true worth.

Result: Fair Value of $13.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent interest rate volatility and a dependence on high dividend payouts could quickly undermine this optimism and put pressure on the stock’s value.

Find out about the key risks to this PennyMac Mortgage Investment Trust narrative.Another View

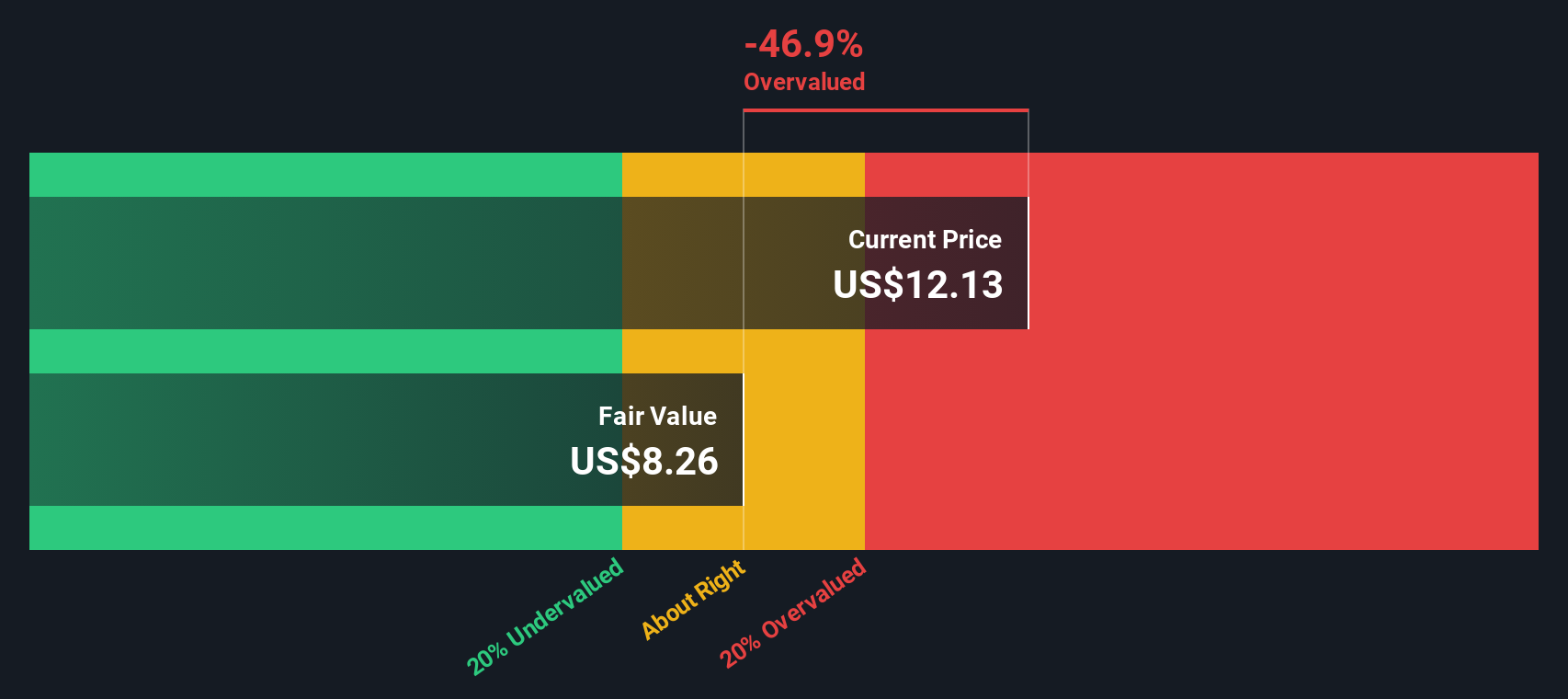

Taking a different angle, our DCF model suggests that PennyMac Mortgage Investment Trust may actually be trading above its estimated fair value. This challenges the notion that the stock is a clear bargain. Which story will the market believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PennyMac Mortgage Investment Trust Narrative

If you see things differently or prefer to dig into the numbers your way, you can craft a unique narrative in just a few minutes with Do it your way.

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop here? Unlock the full potential of your portfolio by acting on powerful trends and niche opportunities you might be missing. Grab your edge now while others hesitate.

- Uncover hidden value plays among businesses strong on cash flows with our selection of undervalued stocks based on cash flows that look primed for growth potential.

- Spot game-changers in healthcare by harnessing healthcare AI stocks to identify innovative companies using artificial intelligence to transform patient care.

- Capture income opportunities you can count on by targeting dividend stocks with yields > 3% and benefit from stocks offering reliable, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives