- United States

- /

- Capital Markets

- /

- NYSE:PJT

Is PJT Partners Still Attractive After Its Big Run And Dealmaking Rebound?

Reviewed by Bailey Pemberton

- Wondering if PJT Partners is still a smart buy after its big run, or if the easy money has already been made? Here is a look at what the current price really implies about its value.

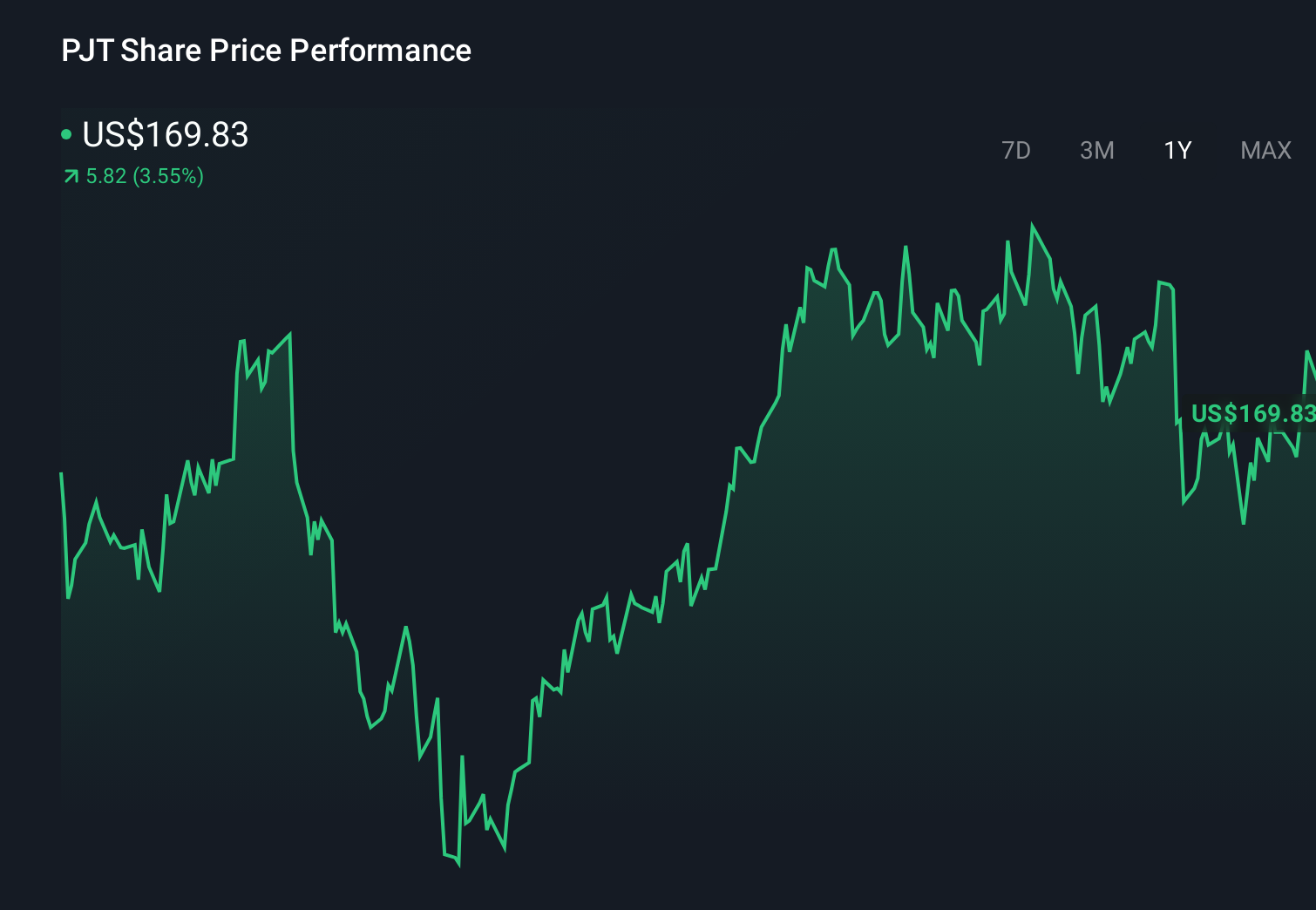

- The stock has cooled slightly in the last week, down 3.5%, but it is still up 1.8% over the last month, 8.5% year to date, and 129.8% over three years.

- Recent headlines have focused on a rebound in dealmaking activity and a healthier pipeline for advisory work across Wall Street. That naturally puts a specialist like PJT in the spotlight. At the same time, sector wide debates about interest rates and financing conditions have kept volatility elevated, making investors more sensitive to what they are paying for that growth.

- On our framework PJT scores just 1 out of 6 on undervaluation checks, which might surprise anyone looking only at its long term returns. Next we unpack why different valuation methods can tell very different stories about PJT, and then finish with a more practical way to think about what the stock may be worth.

PJT Partners scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PJT Partners Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that shareholders reasonably demand, then capitalizes those surplus profits into an intrinsic value per share.

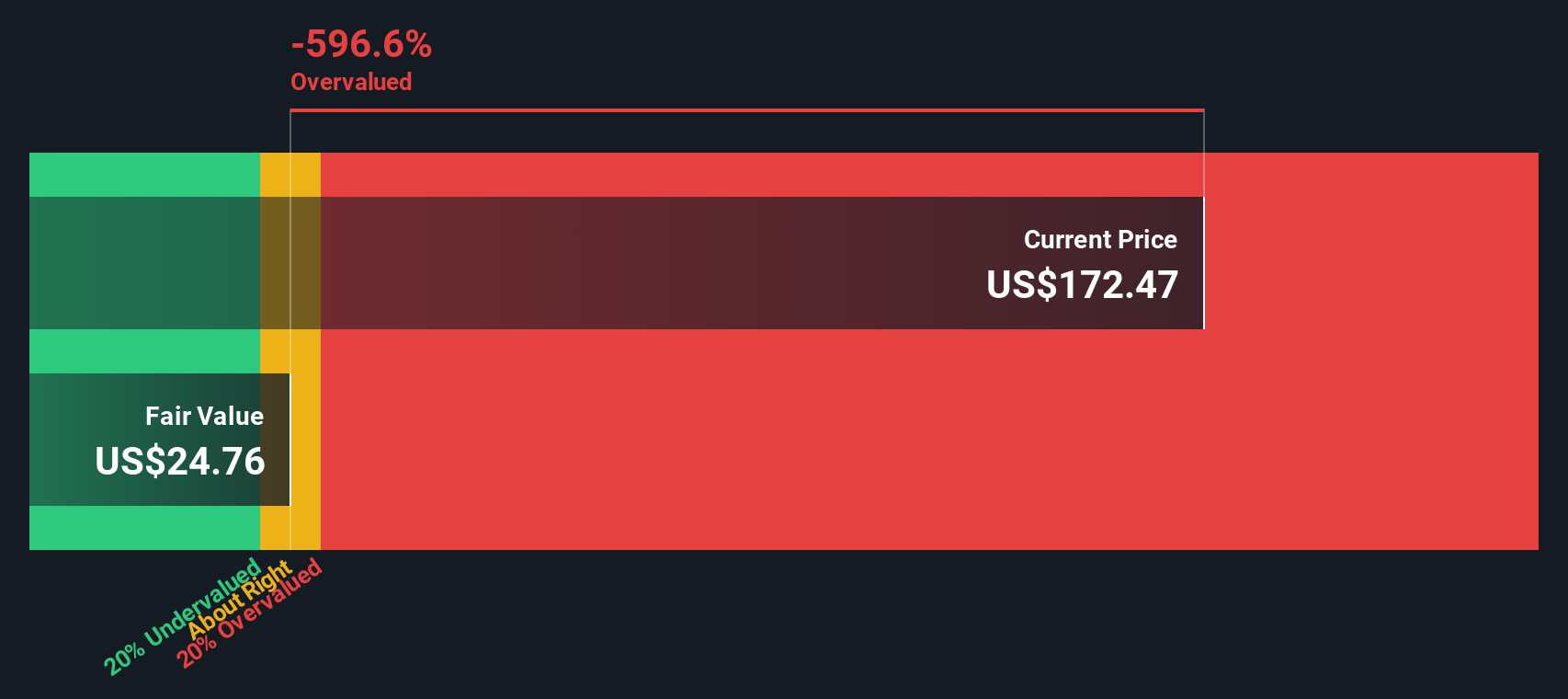

For PJT Partners, the starting point is a Book Value of $9.40 per share and a Stable EPS of $4.76 per share, based on the median return on equity over the past five years. With an Average Return on Equity of 22.07% and a Cost of Equity of $1.78 per share, the model estimates an Excess Return of $2.99 per share. This means PJT is expected to earn well above its required return on capital.

Looking ahead, analysts expect Stable Book Value to reach $21.58 per share, using weighted future book value estimates from two analysts. When these excess returns are projected forward and discounted, the model arrives at an intrinsic value that is roughly 108.2% below the current share price. On this framework, the stock screens as significantly overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests PJT Partners may be overvalued by 108.2%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: PJT Partners Price vs Earnings

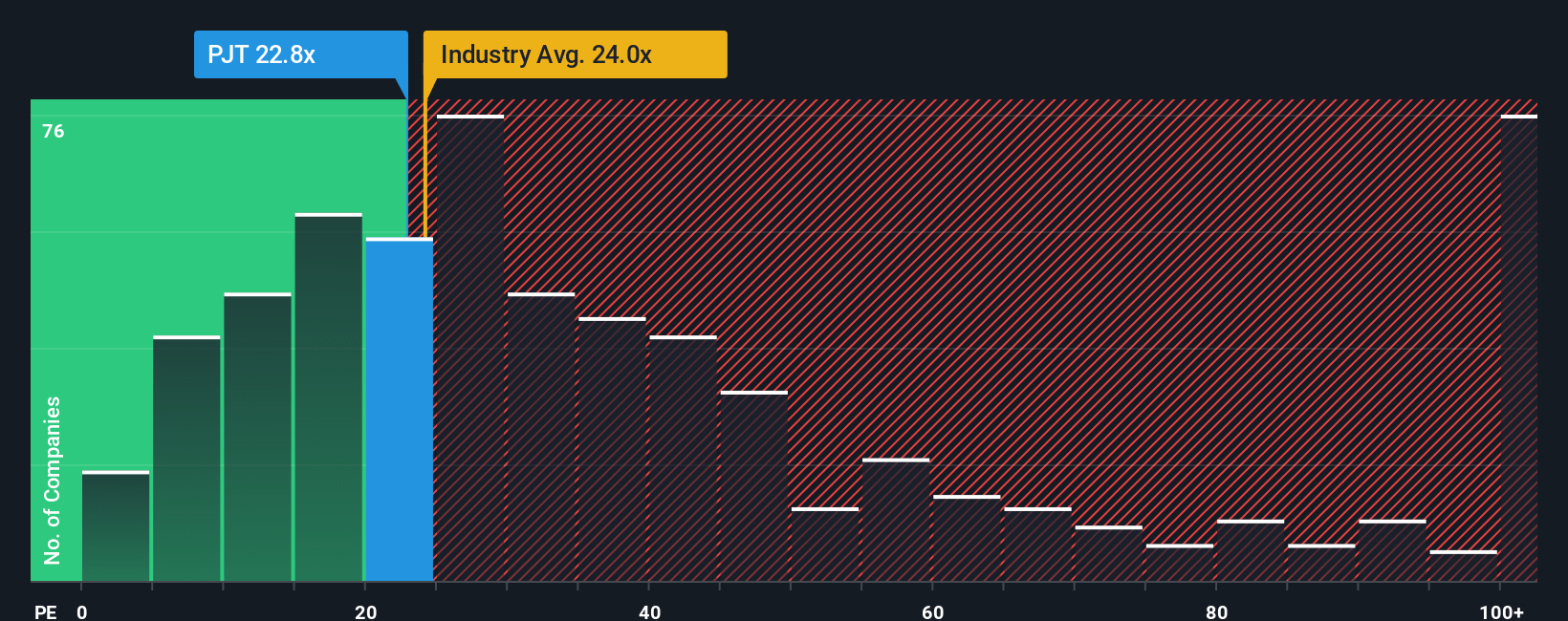

For a profitable advisory firm like PJT Partners, the price to earnings ratio is a sensible way to judge valuation because it links what you pay directly to the cash generating power of the business today. In general, faster and more reliable earnings growth can justify a higher PE ratio, while more cyclical or risky earnings usually warrant a discount.

PJT currently trades on a PE of 23.18x. That is below the broader Capital Markets industry average of about 25.35x, but meaningfully above the peer group average of around 16.41x, suggesting investors are already paying a premium versus similar companies. Simply Wall St also uses a Fair Ratio framework, which estimates what a reasonable PE should be after accounting for PJT’s own earnings growth profile, margins, risk factors, industry positioning and market capitalisation.

This Fair Ratio based view is more tailored than a simple peer or sector comparison because it adjusts for the specific strengths and vulnerabilities in PJT’s business instead of assuming one size fits all. On this basis, PJT’s actual 23.18x multiple screens higher than where the Fair Ratio would sit, pointing to the shares being priced above what fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PJT Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of PJT Partners with the numbers behind it. A Narrative is your story about a company, expressed through assumptions about its future revenue, earnings and margins, which then flow into a financial forecast and, ultimately, a fair value estimate. Instead of relying only on static multiples or models, Narratives on Simply Wall St’s Community page, used by millions of investors, make it easy to build and compare these story driven forecasts. They show how your fair value compares to the current share price, and they automatically update as new information like news or earnings is released. For example, one PJT Partners Narrative might assume slower revenue growth and a lower fair value than another that expects a stronger M and A cycle and a much higher valuation, highlighting how different perspectives can coexist and be tested against the market price.

Do you think there's more to the story for PJT Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)