- United States

- /

- Capital Markets

- /

- NYSE:PIPR

Piper Sandler (PIPR): Assessing Valuation After a Recent Pullback in a Strong Long‑Term Performer

Reviewed by Simply Wall St

Piper Sandler Companies (PIPR) has been quietly rewarding patient shareholders this year, and its recent pullback could have watchful investors asking whether the latest dip offers a more attractive entry point.

See our latest analysis for Piper Sandler Companies.

The latest 1 day share price pullback sits against a solid year to date share price return and a striking multi year total shareholder return. This suggests momentum is cooling in the short term, while the long run compounding story remains firmly intact.

If this kind of compounding performance has your attention, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar growth stories with aligned insiders.

With shares pulling back despite robust multi year returns and trading at a modest discount to analyst targets, the key question now is simple: is Piper Sandler undervalued, or is the market already pricing in its future growth?

Price-to-Earnings of 26.1x: Is it justified?

On a price-to-earnings basis, Piper Sandler currently trades at 26.1 times earnings, putting a premium valuation on the recent share price of $348.32.

The price-to-earnings multiple compares what investors pay today to the company’s current earnings, a key lens for capital markets firms where profitability can be cyclical and deal driven.

In Piper Sandler's case, the market is assigning a richer multiple than both the broader US Capital Markets industry average of 25 times earnings and a much lower peer group average of 7.8 times. This indicates that investors are paying a higher price relative to earnings and also implies expectations that these elevated results can be sustained or built upon rather than reverting quickly.

Compared with peers, that 26.1 times earnings figure looks notably stretched, especially against the 7.8 times peer average. This underscores how much optimism is already embedded in the current price relative to similar businesses.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 26.1x (OVERVALUED)

However, a cyclical deal slowdown or a sharper than expected pullback in advisory fees could expose how much optimism is already embedded in the current valuation.

Find out about the key risks to this Piper Sandler Companies narrative.

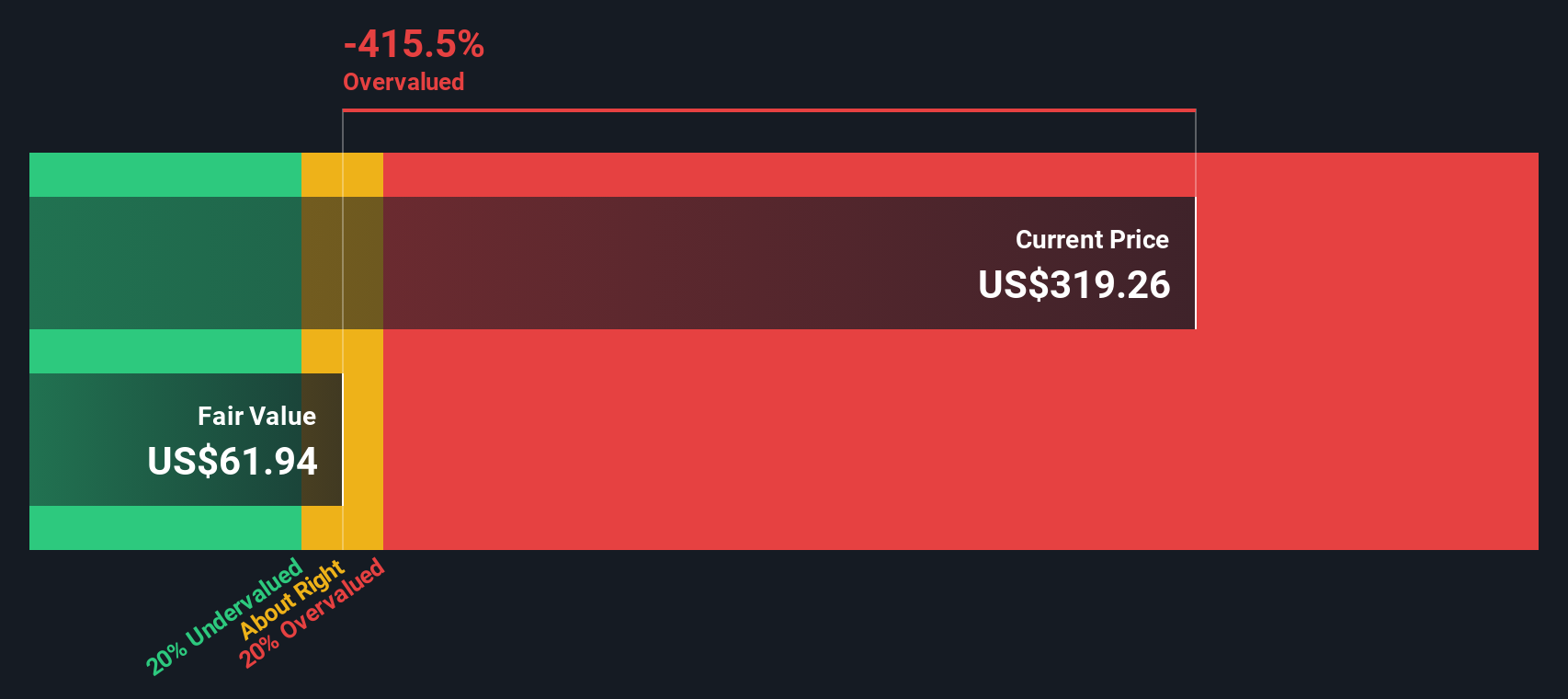

Another View: Our DCF Puts Shares Deep in Overvalued Territory

Our DCF model paints a much starker picture than the earnings multiple, suggesting Piper Sandler is trading far above its estimated fair value of $61.55 at the current $348.32 share price. If the DCF is closer to reality, how much downside risk are investors really taking on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft your own view in just a few minutes: Do it your way

A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas you do not want to miss?

Use the Simply Wall St Screener now to uncover targeted stock ideas tailored to your strategy, so your next move feels deliberate, timely and informed.

- Capture potential bargains early by scanning these 911 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Tap into innovation by focusing on these 25 AI penny stocks positioned to benefit from accelerating demand for intelligent automation and data driven products.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that can help support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PIPR

Piper Sandler Companies

Operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)